February 1 is one of the most interesting days in India. The announcement of the union Budget on this day decides the trajectory and plans for the upcoming financial years. Moreover, several financial, regulatory, social, political, technical, etc., factors affect the Budget. Eventually, it affects the financial market before, during and after the Budget announcement.

Explore the basics: What is a Budget – A beginner’s guide

A few weeks before the Budget, investors start anticipating potential actions to benefit from the market movement post-Budget. Even during the Budget, the announcements drive positive and negative sentiments for the stock of particular sectors in the announcement. Post Budget, some investors are positive about the reforms while some bet for opposite results. Eventually, it works as a zero-sum game.

Therefore, the relationship between the Union Budget and the stock market is quite tangled. Recently, the Budget 2025 was announced, and the investor’s confidence in the market, government and the economy is reflected in stock price movements. Let’s explore in detail about the market before, during and after the Budget 2025.

Market Before the Budget 2025

The Budget mainly announces financial performance in the ongoing financial year (FY), expected performance in the upcoming FY, tax rates, capital expenditures, specific reforms, etc. In anticipation of such emphasis in the announcements, investors take positions in the concerned sectors.

Historically, the Budget optimism is reflected in the market rally before the Budget announcement. However, in recent years, investors’ caution about market volatility has been reflected in the market before the Budget. Companies from sectors like defence, infrastructure, financial services, public sector units, power, renewable energy, etc., experienced a significant impact during this period.

This table indicates the 1-month returns for the key indices in light of the Budget announcements: NIFTY 50, BSE Sensex, NIFTY PSU Bank, NIFTY Infra, and NIFTY Financial Services.

| Particulars | Before Union Budget 2025 | Before Union Budget 2024 |

| NIFTY 50 | (0.57%) | 4.28% |

| BSE Sensex | (0.81%) | 4.26% |

| NIFTY PSU Bank | (3.41%) | (0.84%) |

| NIFTY Infra | (1.35%) | 3.06% |

| NIFTY Financial Services | (1.24%) | 2.76% |

Source: National Stock Exchange

The stock market before the Budget is highly speculative and uncertain. Market players carefully examine all available data to make well-informed judgements regarding the Budget’s potential effects on the financial markets and the economy.

Market During the Budget 2025

The financial markets see a period of tremendous activity and quick responses when India’s Budget is announced. A Budget presentation is a much-awaited event that influences market patterns, investor mood, and the forecast for the economy.

The Union Budget is announced at 11:00 A.M. in India, and usually, the announcement date is February 1, 2025 (except for the election year). Therefore, on February 1, 2025, when the Budget announcement started, heavy volatility was observed in the market.

The way traders react to shifts in government spending plans, revenue estimates, and fiscal policy is another way that traders actively impact currency markets. Reactions from a particular sector are prevalent during the Budget release. Tax, incentives, and policy changes immediately impacting an industry’s operations are met with varying responses.

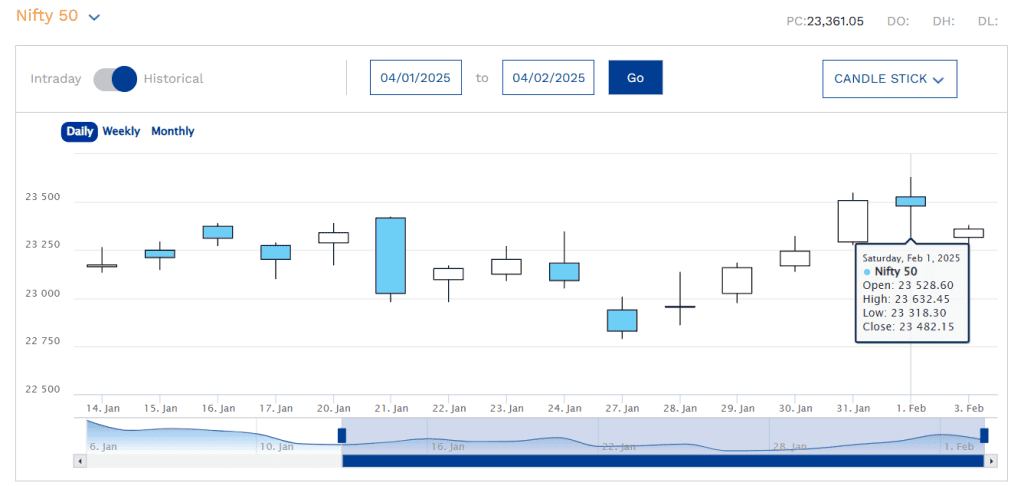

On February 1, 2025, a special session was organised on Saturday due to the Budget announcement. NIFTY 50 opened is green. Despite a positive and consumption-driven Budget, factors like slowed economic growth, increased interest expense, geo-political pressure, etc., the index closed with just a 0.20% uptick.

Source: National Stock Exchange

Budget being a significant event for the financial markets, traders, investors, and companies swiftly modify their positions in response to the direct consequences of the government’s fiscal policies during the Budget. Short-term market patterns are greatly influenced by the responses that occur within this time.

Revise the Budget 2024: How the 2024 Budget will transform the economy and stock market – Key Insights!

Market After the Budget 2025

Post-Budget, the trajectory for the upcoming financial year starts getting clarified. Moreover, investor’s perspectives regarding potential sectors for investment shifted with this clarification, and stocks from those sectors experienced significant volatility in the period. Moreover, the global setup also plays a crucial role in setting the tone for the market.

For example, Indian stock markets after the Budget 2025, crashed on February 3, 2025. It was due to multiple factors like strict tariff rules imposed by the United States on China, Mexico and Canada, along with internal domestic pressure after the Budget. The NIFTY 50 was down by 1.1%, and the Sensex fell by 0.96%.

The longer-term effects on the economy are considered after the Budget. Important elements impacting market mood include the government’s capacity to carry out its fiscal plans, the implementation of budgetary measures, and economic changes. In general, the post-budget market environment shows that market players are responding to the new fiscal framework that the government has imposed through a phase of adaptation and recalibration.

Also, read Railway Stocks Drop After Budget: RVNL, IRFC and More

Final Thoughts

The Budget is one of the most interesting annual events. It decides the plan for the next fiscal year by reflecting upon the previous year’s performance and potential aspects for improvement. The impact of Budget announcements on the stock market is evident in its volatility. The stock market before the Budget 2025, during the announcement and after the Budget was also significantly affected. Understanding this impact can help investors make their investment decisions.

Check this out! Union Budget 2025 Highlights

FAQs

Immediately after the Budget, the market experiences pressure and the volatility affects the stocks from specific sectors. After Budget 2025, the market was down as of February 3, 2025, due to global pressure and impending clarification regarding fiscal policies.

If an investor is specific about some announcements, he/she can take the potential position in the market before the Budget. In case of positive announcements, the stock may earn potential returns. However, investors should also hedge their positions to avoid adverse market conditions.

The market may experience volatility immediately after the Budget. The Budget 2025 has been positive in many aspects, such as taxation. Therefore, volatility may be low, but global pressure is affecting the market negatively.

Stocks related to sectors like financial services, infrastructure, railways, energy, renewable energy, public sector unit banks, etc., are most affected by the Budget volatility.

NIFTY 50 opened on a positive note before the start of the Budget and also picked up momentum during significant announcements such as taxation relief.