The fundamental worth of an options contract is referred to as moneyness. A way of classifying options into three categories—in the money, at the money, and out of the money—is known as the moneyness of an option contract. The categorisation helps the trader select which strike to trade when faced with a particular market situation.

When you are starting on the topic of options trading, it is crucial that you grasp the concept of “moneyness.” Before we go into the details of each type of moneyness in options trading, let’s briefly examine what moneyness is.

You may also like: Futures vs. Options: Differences every investor must know!

Explaining option moneyness

The term “moneyness” can be described as the connection between the latest market price of an asset and the option’s strike price. In simpler terms, moneyness indicates the inherent worth of an option in its present condition.

Traders separate options into mainly three categories:

- At-the-money (ATM)

- Out-of-the-money (OTM)

- In-the-money (ITM)

The categories specify the moneyness of an option. When you engage in trading options, it’s critical to understand these categories and what they include. All options strategies will employ these terminologies, and beginners may get overwhelmed if they don’t understand them.

Types of Options Contracts

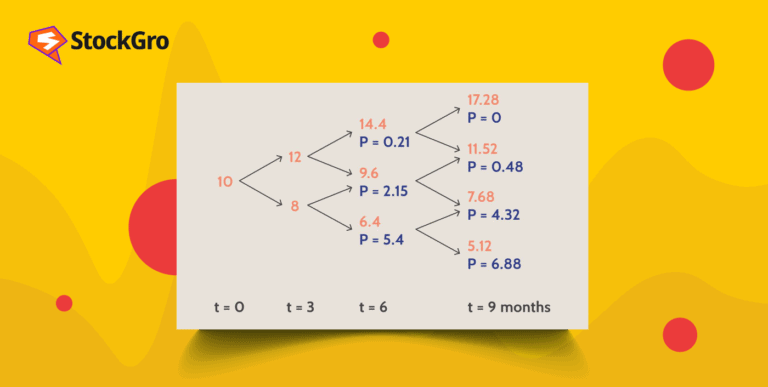

Following the concept of “moneyness,” options contracts fall into three groups. When deciding whether to execute an option contract right away, option moneyness helps a trader make a profitable decision.

At the money (ATM)

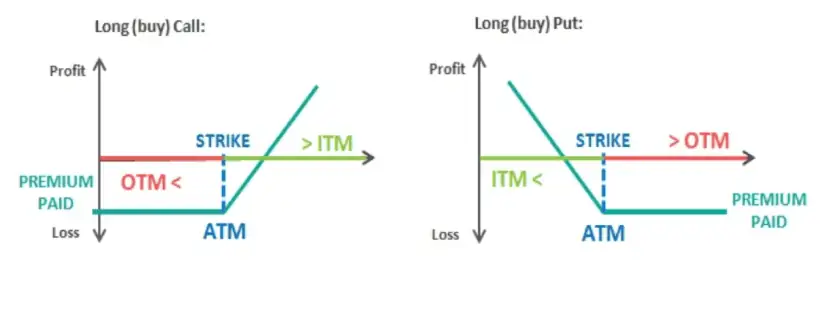

Both long calls and long puts are considered ATMs in the stock market when the strike price and the market price of the shares are equivalent. Keep in mind that due to the options’ expense, ATM options will still lose money when they expire. We’ll look into the at-the-money option in detail later in the article.

Out of the money (OTM)

We refer to an option contract as being out-of-the-money (OTM) if its intrinsic value is zero. The strike price is greater than the spot price in an OTM call option. And, in an OTM put option, it’s vice versa. It indicates that there will be no benefit for the investor if the option is exercised.

Because the premium on OTM options primarily consists of time value, they are less expensive than ITM options. OTM is a better option if you anticipate a rise in the value of the currency because it requires a smaller investment upfront.

In the money (ITM)

The term “in the money” refers to an option contract that holds intrinsic value. The spot price of an ITM call option would be more than the strike price. Conversely, the spot price of an ITM put option would be less than the strike price. ITM options usually have a higher premium than OTM and ATM options. However, because the premium is made up of both time and intrinsic value, there is a good chance that the estimated profits will be noticed.

| Option type | In-the-money | At-the-money | Out-the-money |

| Call option | Spot price > Strike price | Spot price = Strike price | Spot price < Strike price |

| Put option | Spot price < Strike price | Spot price = Strike price | Spot price > Strike price |

Also read: How to trade in options and maximise your profit?

Understanding at-the-money (ATM) in options trading

The term “at the money” designates a scenario in which the option’s strike price and the current market value of the asset that is being traded are the same.

Consider the example of an ATM with a strike price of ₹5,000, and the market price of the security is also ₹5,000.

Compared to OTM and ITM, ATM options have a significant premium to pay. Still because they only have time value and not intrinsic value, the chance of achieving the predicted gains is reasonable.

Most options traders view things within a few points as ATM since it is unusual to find options with the same strike price as the stock price. In a nutshell, it’s the “tipping point” that separates an option’s OTM and ITM values.

Even though ATM options are not positioned to benefit if exercised, they still hold value because they have time left before expiring and might be invested in the money.

The strike price of a call option is deducted from the current price of the underlying securities to determine its intrinsic value. In contrast, the intrinsic value of a put option is determined by deducting the strike price from the actual value of the asset that is being considered.

At-the-money call option vs. at-the-money put option

When the strike price of a call option is nearly identical to the spot price of the underlying assets, it is referred to as an at-the-money call option. The spot and strike prices are nearly equal.

On the other hand, at-the-money put options are the ones where the strike price is nearly the same as the current market price. There is simply time value associated with an at-the-money put option; it has no intrinsic value.

Differences between ATM, OTM, and ITM

The standard practice is to treat one option strike price as being at the money and all other strike prices to be in two ways: out of the money or in the money. An in-the-money option is distinguished from an out-of-the-money option by its intrinsic value, which indicates that exercising the option now would provide a profit.

When a call is in the money, the strike price is less than the value of the stock. A striking price for a put option is deemed to be in the money if it is more than the price of the stock.

Out-of-the-money options are the reverse. In addition to having no inherent value, options that expire worthless are those that are out of the money.

Also read: Stock options – The beginner’s guide to the options market

Conclusion

Since the option pricing is equal to the option’s market price when using the at-the-money approach, it also simplifies the investor’s decision-making process. The differences between these can be better understood by using brokerage accounts. You may keep learning by using an options platform for trading that offers learning resources.