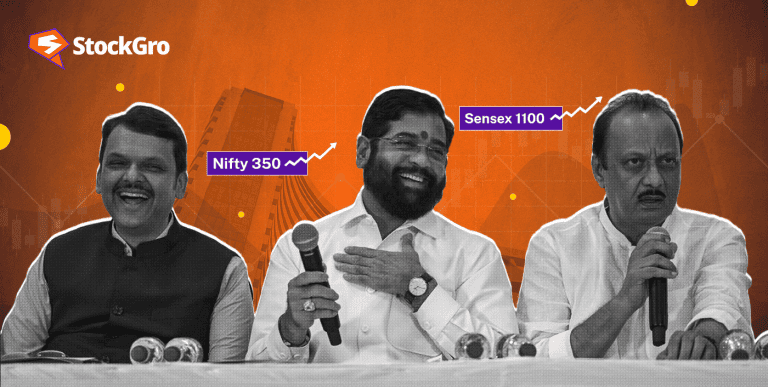

Nifty surges after BJP’s Mahayuti victory in MaharashtraA market rally or political win? Let’s find out why Nifty surged post BJP’s victory in Maharashtra!

Introduction: The market’s jubilant response The financial markets lit up like Diwali lamps on Monday, driven by the political win of BJP’s Mahayuti alliance...