Section 80GG of the Income Tax Act, 1961, provides a sigh of relief for individuals who do not receive house rent allowances (HRA) from their employers and yet incur rental expenses.

This section offers taxpayers the opportunity to claim deductions on the rent they pay for their accommodations, helping ease the tax burden for those who are not entitled to HRA benefits.

Understanding the provisions and conditions of Section 80GG can significantly benefit taxpayers seeking to maximise their tax savings while navigating the complexities of the Indian taxation system.

What is 80GG?

Section 80GG helps you reduce your taxable income if you are not eligible for House Rent Allowance (HRA). If you are paying rent for your home and it is not owned by you, your spouse, or your minor child, you can claim a deduction.

This deduction is for the rent you pay that is more than 10% of your total income, up to a maximum of ₹5,000 per month or 25% of your total income, whichever is lower. However, this deduction does not apply if you own a house at your usual place of residence or if the value of your other owned accommodation is determined under certain sections of the Income Tax Act.

Section 80GG of the Income Tax Act, 1961, is like a financial breather for individuals who pay rent for their homes and are not given House Rent Allowance (HRA) by their employers.

You may also like: Overview of section 80C deduction and its sub-sections in income tax

Eligibility to claim 80GG

To make use of the provision of Section 80GG and reduce your tax liability, you need to meet certain conditions, and those are:

- This benefit is for individuals and Hindu Undivided Families (HUFs) only. Businesses cannot use it.

- You must have some income to be eligible. If you have zero income, sorry, this will not work for you.

- Fill out Form 10BA and submit it. This form declares you do not have a self-occupied property elsewhere.

- If salary includes the House Rent Allowance (HRA), you cannot claim this benefit.

- If your yearly rent goes above ₹ 1 lakh, provide your landlord’s PAN card copy.

- You cannot have claimed HRA at any point in the fiscal year you are applying for.

- You can claim the deduction if you live on your parents’ property. Just make a rental agreement, and remember, your parents will need to pay taxes on the rent you show.

- NRIs paying rent in India can also apply.

So, remember, if you meet these conditions, you can enjoy some tax savings with Section 80GG.

Calculation of deduction

The deduction you can claim under section 80GG is based on the smallest of these three amounts:

1. The actual rent you paid during that is more than 10% of your total income.

2. A maximum of ₹5,000 per month.

3. 25% of your total income before taking any other deductions into account.

Let us understand through an example-

Raj knows about the 80GG deduction, which can help him reduce his taxable income when he’s renting a property and not receiving House Rent Allowance (HRA) from his employer. Let’s calculate how this deduction works for him.

Calculation of 80GG Deduction:

- Rent Paid: Raj’s annual rent is ₹20,000 per month * 12 months = ₹2,40,000.

- Annual Salary: Raj earns ₹8,00,000 annually.

- A minimum of the following three is deductible:

- 25% of Annual Income: 25% of ₹8,00,000 = ₹2,00,000

- Actual Rent Paid Minus 10% of Income: (₹2,40,000 – (10% of ₹8,00,000)) = ₹1,60,000

- ₹5,000 per month: 12 months * ₹5,000 = ₹60,000

- Calculating the Deduction: Raj can claim the minimum of these three amounts, which is ₹60,000.

When Raj files his income tax return, he can reduce his taxable income by ₹60,000 using the 80GG deduction. This means he will pay less income tax on his ₹8,00,000 salary, helping him save money while living in a rented apartment.

It is important to know that this section does not apply if you owned a house during the year or received a House Rent Allowance from your employer. It is not possible to claim the section 80GG deduction under certain circumstances.

Also Read: What is TDS? A complete overview of TDS in income tax

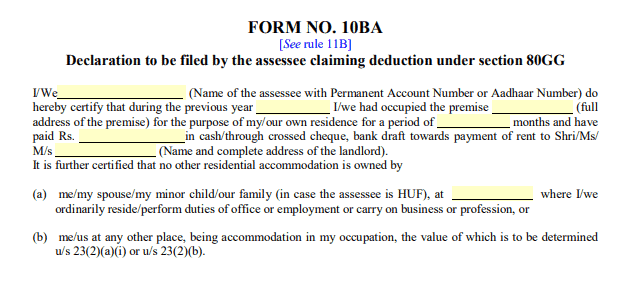

Form 10BA and why is it required?

Form 10BA is a tax form in India used to report deductions under Section 80GG of the Income Tax Act. This section allows you to claim deductions for the rent you pay on your home if you do not own a house or if your house is not available for your use. You need to fill out this form and submit it along with your income tax return to claim these deductions.

Source: Department of IncomeTax

How to fill form 10BA correctly?

- Go to the Income Tax website and log in using your User ID, PAN, or TAN, and password to access your account.

- On the dashboard, click on “e-file” and then select “Income Tax Forms.”

- Find “Form 10BA” by searching for it under “Person not reliant on any Source of Income.”

- After choosing the relevant assessment year, click “File Now.”

- Click on the button that states “Let’s Get Started” on the next screen.

- Provide details for each option as required.

- Select “House Property Details.”

- Enter information like the rental property’s address, the landlord’s name and address, the rent amount paid, and so on. Then, click “Save.”

Finally, choose “Declaration,” tick the box, and click “Save.”

Documents required to claim the deduction

- Agreement of rent

- PAN details of the landlord

- Copy of salary slip mentioning HRA

- Details of house property

Also Read: Tax saving scheme in India 2023 [Explained]

Limitations of the provision of section 80GG

- Individuals only: Only individual taxpayers can claim this deduction; it does not apply to Hindu Undivided Families (HUFs).

- No HRA required: Taxpayer gets to claim if he is not receiving House Rent Allowance from the employer.

- 25% cap: The maximum deduction you can get is 25% of your total income before taking any other deductions into account.

- No house ownership: If you owned any residential property during the year, you cannot claim this deduction.

Bottomline

Section 80GG is like a helping hand from the government for those who cannot enjoy the House Rent Allowance (HRA) benefit. It helps to lower your tax bill if you are the one to pay rent for your home.

It is good to save money on taxes. So, if you are someone who pays rent, remember that Section 80GG might just be your ticket to lower taxes.

Make data-driven decisions with in-depth technical stock market analysis app. Master market trends with StockGro app now!