Angel investors are perhaps some of the most important people in the economy’s entrepreneurial landscape. Although their contributions and participation often goes unnoticed, they’re pivotal in shaping young startups in their early stages of development.

In this article, we’re going to understand what angel investing is, who angel investors are, and why they do what they do. We’re also going to dive into how their investments into early-age startups help not only their partners but also themselves.

What is angel investing?

Angel investors are people who provide startups with the money they need in their early stages. This is usually in exchange for equity in the company. Such investments are solicited when companies don’t have enough revenue or sales numbers to justify their valuations.

More often than not, these high net-worth individuals are the only ones who consider investing in these startups that early, hence the term ‘angel’ investing.

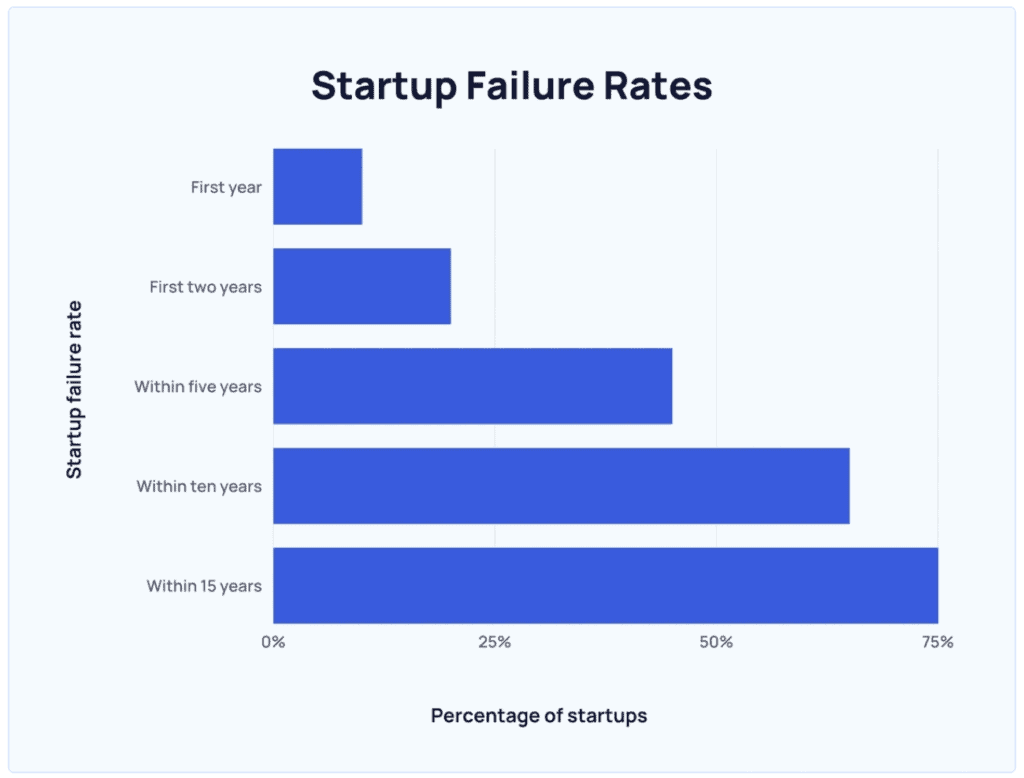

As you might have guessed already, these early-age companies are not exactly what you’d call ‘safe’ investments.

More than 80% of all startups never become successful or profitable, and the investors who have equity in these companies never see their money again. However, with great risk comes great reward, too.

Since angel investors get in on the ground floor with most startups, they’re able to negotiate very lucrative deals. Subsequent investors always have to pay a higher price for a successful company in upcoming rounds, which makes their initial stake skyrocket.

You may also like: Diving into FDI: What it means for investors and countries

Why do angel investors take on such high risk?

Most angel investors do what they do for one (or both) of the following reasons:

- Fostering innovation – Angel investors are usually successful founders, executives, or entrepreneurs themselves. With their life experience building and supporting businesses, angel investors have a lot to offer to startups than just money.

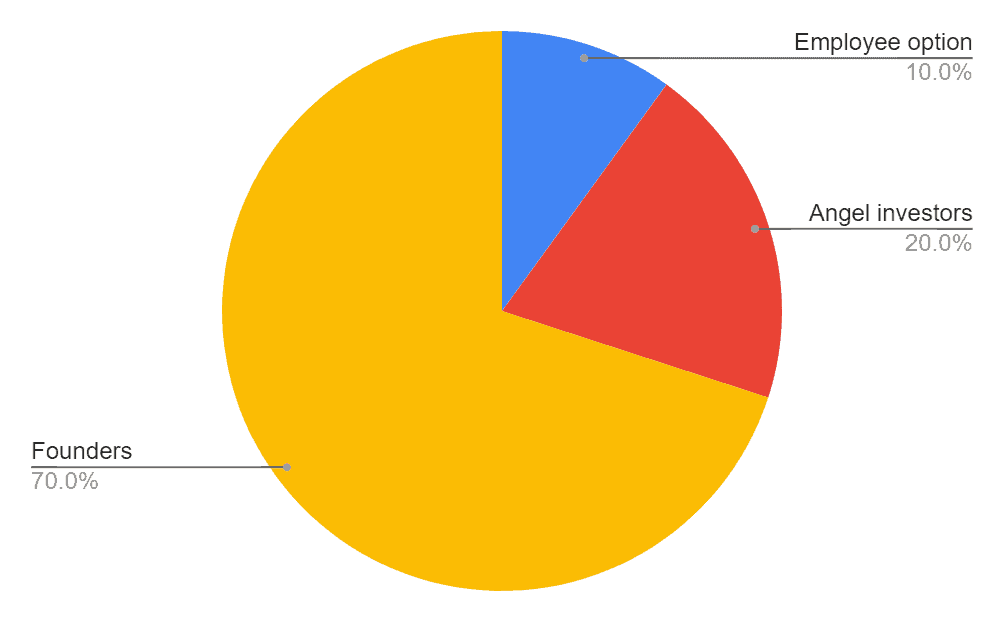

Mentorship, access to networks, credibility, and a long-term partnership help innovative ideas grow. - Potential for colossal returns – Equity investors usually demand a large equity ownership in early-age startups in return for their mentorship and their capital.

While they do not control how the company operates, they look for enough equity to make sure that their exit can justify their investment. Generally, investors seek 20-25% equity in a startup.

What do angel investors look for?

Obviously, not every company is worth investing in. There could be a hundred things wrong with a startup – they could be targeting an already saturated market with the wrong strategy, they could have a ridiculously high valuation, the founders could be complacent, etc.

Hence, an angel investor has to look for early green flags to make sure they’re making the right bet.

Here are some of them:

- Return on investment – Investing is not charity. Angel investors, just like any other investor, deploy their capital in the hope that they’ll make more money. That’s why ROI is one of the most important metrics that an angel investor will consider before investing in a startup.

- Reliable founders and management – The leadership of the company is very important. Investors have to make sure that the founders have the skills, experience, and the right attitude to take the company to the finish line.

Both the professional and personal values of founders are usually on display when seeking angel investments. - A solid strategy – Successful businesses are seldom run on whims. Angel investors look for founders who know exactly what they want to do, how they want to do it, and why.

Having solid, time-based business plans in place along with processes that detail the journey to success are very helpful to angel investor pitches.

Also Read: Why do financial services companies invest in each other?

How long do angels wait for profits?

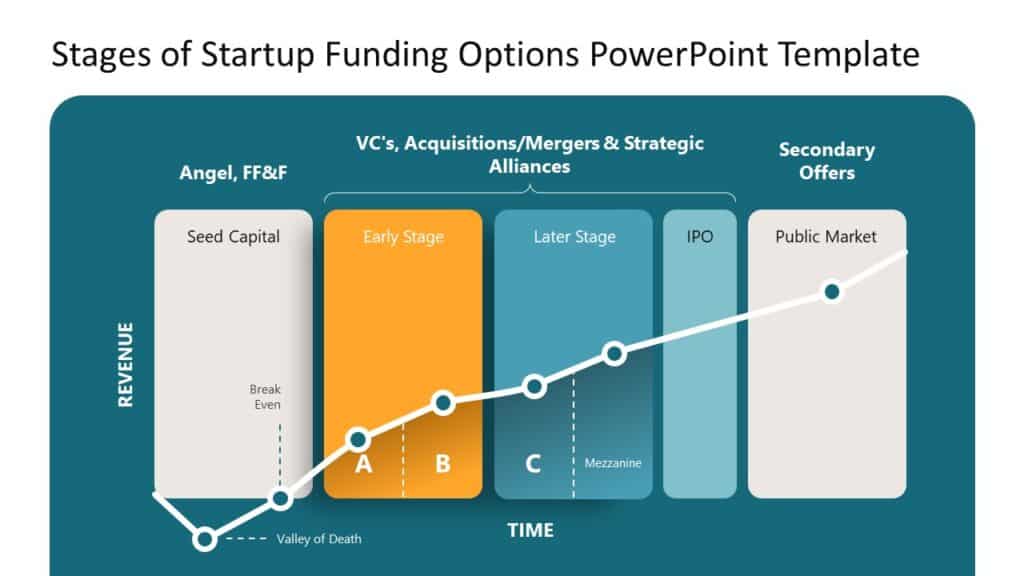

Angel investors typically make money when their investments exit – meaning when the company they’ve invested in either goes public or gets acquired by another, usually larger, company.

There’s no template for such an exit; strategies are closely tied to every company’s individual growth trajectory.

For instance, if the company experiences rapid and significant growth, it becomes more attractive to potential acquirers or investors in the public markets, resulting in a higher valuation and increased returns for angel investors.

The timing of the exit is crucial, too; if it occurs too early, investors may not realise the full potential of their investment. That’s the reason why angel investors rely on their experience and market insights to gauge when the optimal exit point is, considering both their returns and the company’s growth.

Becoming an angel investor

Let us tell you right off the bat – it’s not for everyone. That’s because angel investing is not just about writing checks to people who need money – it’s about nurturing startups who really want to succeed and contributing to their growth.

Angel investors, first off, need a lot of money they’re willing to lose. That’s because this is a very high-risk game. Every time you make an investment as an angel investor, you have to be able to afford to lose that money. Because the odds say you will.

That’s just the first step, though. You also need a skillset that will be helpful in not only identifying good investment opportunities but also in making sure you’re contributing to their success in some way.

This could be in the form of enhanced networking, industry knowledge, mentorship guidance and portfolio management. Consider investing in sectors that you can navigate.

Also Read: Foreign portfolio investments – Overview, types and benefits

As an angel investor, you also have to think about your profits. Creating a winning exit strategy keeping in mind your risk tolerance, the country’s tax implications, personal ethical considerations, and due diligence sounds like a handful. And it is.

Conclusion

The companies that have an impact on our everyday lives today were all startups once. Angel investors help identify the next generation of ideas and companies that could improve our lives and give them a shot.

Angel investing, whether or not it’s profitable, is certainly something that’s helping a lot of people succeed and create an impact in the economy that they wouldn’t have otherwise been able to.