Your credit score, a three-digit number summarising your credit history, is an important part of your financial well-being. Your score is often the gatekeeper to key opportunities and decisions you have to make as an adult – obtaining loans, securing affordable insurance, even renting an apartment.

The credit score in India is also called the credit score. In this article, we’re going to learn about the importance of credit scores and what you could do to repair yours if it’s low.

The importance of credit scores

Most people have heard of credit scores before, but know little to nothing of use about them. They’re actually a very important part of your financial journey, especially when you’re making big spending decisions like buying a house, car, or getting a student loan.

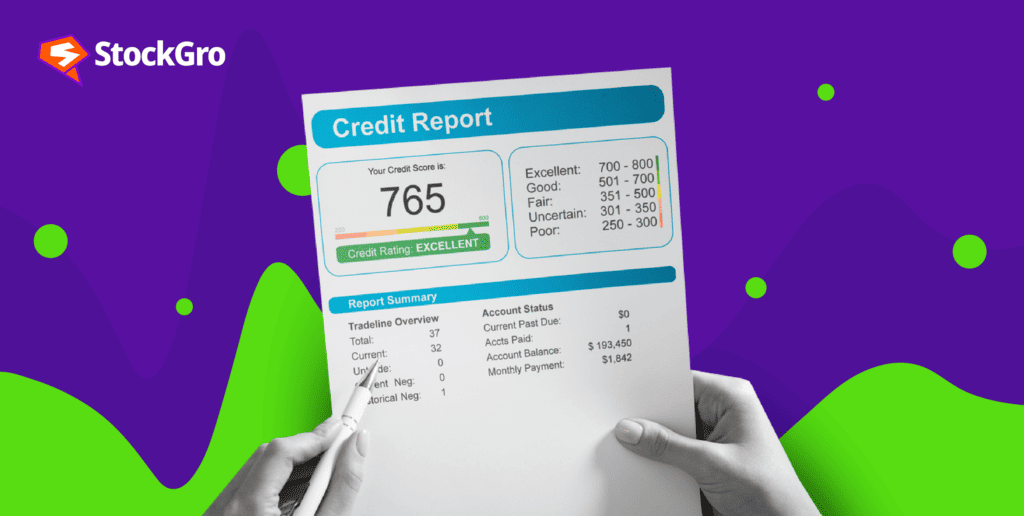

The CIBIL score is a three-digit number, ranging from 300 to 900, that summarises your credit history and predicts your likelihood of repaying debt responsibly. It’s calculated based on information in your credit reports, including your payment history, debt levels, credit mix, length of credit history, and recent credit inquiries.

You may also like: Credit history: What is it and why it matters?

Think of it as a financial reputation score, impacting everything from loan approvals and interest rates to insurance premiums and even rental applications.

While having a high credit score might not automatically make your life better, having a bad one can make it worse. Here are some reasons why you should care about getting a better credit score:

- Lower interest rates, bigger savings: A good credit score translates to lower interest rates on loans, from mortgages to car payments. This translates directly to thousands of dollars saved over time. On the other hand, a poor score means higher interest rates, making borrowing more expensive and hindering your ability to save.

- Beyond loans: Landlords often use CIBIL scores to assess potential tenants, and insurance companies might set your car or home insurance premiums based on it. Utility companies might require larger security deposits, and some employers even consider credit scores during the hiring process.

- Negotiation leverage: A strong credit score empowers you to negotiate better terms on loans, credit cards, and even utility bills. You become a desirable borrower, giving you bargaining power for more favourable rates and conditions.

However, your score isn’t fixed and changes every single time you take out a new loan, max out your credit card, or forget to make your payments. It takes years to build a good score and have the discipline to pay your bills on time, but it takes only a couple missed payments to go back to square one.

Also Read: Understanding credit cards: What are they, and how do they work?

How to repair a bad CIBIL score

A good CIBIl score is anything above 750. An average CIBIL score could be anything from 650 to 750. However, if you happen to have a bad credit score (below 650) and need to repair it, here are a few things you can do to start with:

Dispute errors

The first thing you need to do is get a credit report for your credit cards and your loans and make sure that all your charges, even those that are marked paid, are correct. If there are some deductions that you don’t recognise, contact your issuer or bank to figure out what they are and dispute them to get your money back.

Prioritise on-time payments

Payment history is the biggest factor that affects your CIBIL score, almost 35%. Make sure that you’re not only paying your bills on time but also making it a habit to do so. Set up automatic payments or calendar reminders to avoid slipping up. Even catching up on past-due accounts demonstrates your commitment to responsible credit management.

Also Read: Everything you need to know about credit ratings

Reduce your debt utilisation

Another factor that hurts your credit score is the utility ratio. If you consistently max out your credit cards, your score still gets hurt even though you pay your bills on time; that’s because your utilisation ratio is very high. Aim to keep your utilisation below 30% – even lower is better. Develop a debt repayment plan, prioritising high-interest cards first.

Get a secured card

If you have a really bad score and still want access to some credit, you could get a secured card from your bank. This means that you deposit some money with your bank and they issue you a card with a ‘credit’ limit equal to your deposit. Even though you’re not technically securing credit, your bank will treat it like credit and boost your score if you make your payments on time.

Conclusion

Repairing your credit score to a really good one is often achievable. Most times, all you need to do is pay more attention to your debt, whether or not you’re paying it off on time, and how you can sustain your lifestyle without using up all the credit that’s offered to you. We hope the tips help. Good luck!