So, you’ve got your investments in place, but how do you know if you’re on the winning side? That’s where benchmarks swoop in to save the day!

These nifty tools, just like how your parents compare you with Sharma Ji ka beta, help in judging the success of your investments. They are called benchmark portfolios, and they provide a reference point for evaluating your investment performance.

Let’s dive deeper into the world of benchmark portfolios and how they evaluate a portfolio manager’s performance.

What is the benchmark?

In the world of investing, a benchmark is like a measuring stick that helps you evaluate the performance of your investments. Think of it as a target your fund aims to hit. Another example could be wanting to score the same marks as the top student in your class.

Benchmark portfolios are usually indices that measure the overall performance of a stock or mutual fund. A benchmark gives you an idea of how much your investment should have earned, allowing you to compare it with the actual earnings.

You may also like: Startup success: Swiggy turns profitable almost 9 years after inception

What is a benchmark index?

Just like different students have their own report cards, each asset class has its own benchmark index to evaluate its behaviour in the market.

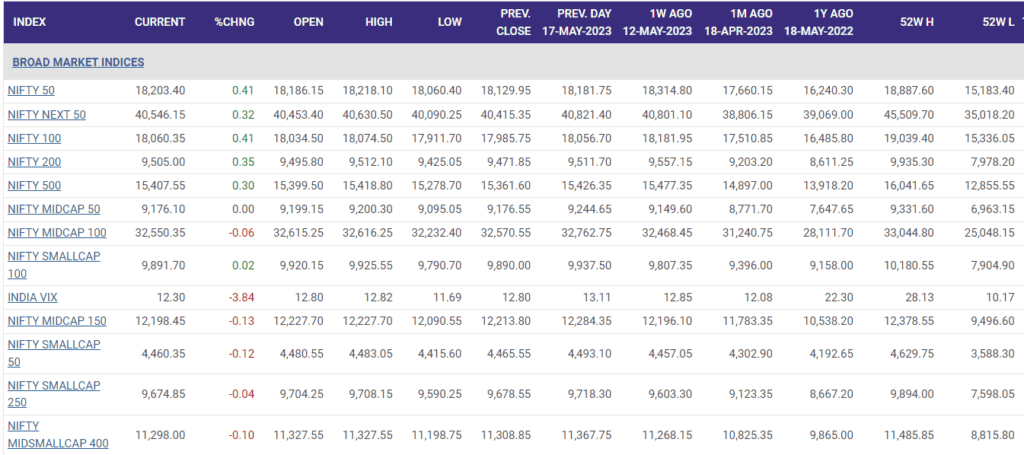

Benchmark indices, also known as stock market indices, track and compare the overall performance of the stock market or specific sectors within it. In India, there are various benchmark indices for different types of investment options.

For example, CNX Midcap and Smallcap are used as benchmarks for mid-cap and small-cap funds. Nifty 50 is the benchmark for the top 50 stocks by market capitalization. Sectors like Pharma, Energy, FMCG, Financial Services, and Infrastructure also have their dedicated benchmarks.

And let’s not forget Nifty Fixed Income indices, which serve as benchmarks for fixed-income instruments like bonds and Government securities.

Importance of benchmarking

Now that you are familiar with benchmarking, let’s take a closer look at why it matters and what it tells us about our investments and their management.

1. Performance comparison: Mutual Funds’ performance can vary due to market fluctuations. Benchmarking provides a platform to compare returns. For example, if an equity fund is benchmarked against the Sensex, its return can be compared with the Sensex’s performance.

2. Outperformance and underperformance: Outperforming funds deliver returns higher than the benchmark while underperforming funds fall short. Benchmarking helps assess whether a fund is exceeding expectations or lagging behind.

3. Factors for benchmark selection: Fund houses select benchmark indices based on factors like investment strategies, sectoral focus, and market capitalisation. Large-cap funds suit investors with lower risk appetites, while small and mid-cap funds appeal to risk-tolerant individuals.

4. Ideal investment tenure: Investments should ideally be benchmarked for at least a year. This timeframe allows for risk assessment, fund allocation evaluation, and measuring returns.

5. Tracking error: The performance of your individual investment portfolio compared to its benchmark is what we call a tracking error. This little number tells us whether our investments have soared above expectations or fallen short of the mark.

Using appropriate benchmarking ensures effective portfolio management.

Also Read: The 20% TCS buzz and its impact on international credit cards

How to measure mutual fund performance against the benchmark?

Now that we know what and why benchmarking matters. How to gauge the performance of your Mutual Funds? Here are some ways to measure how your funds stack up against their benchmarks.

NAV and benchmark changes:

- Monitoring the Net Asset Value (NAV) and benchmark index over time provides performance insights. If the NAV falls at a lower percentage than the benchmark, it indicates that the fund has outperformed.

Alpha:

- Alpha is a handy formula used to measure the difference between the expected and actual return of a Mutual Fund. It reflects the additional return generated by the investment after considering its risk.

- A higher Alpha indicates a fund manager’s ability to add value and consistently beat the benchmark, even in diverse market conditions.

Beta:

- Beta ratios help gauge the risk associated with a fund in relation to its benchmark.

- A Beta ratio of more than one suggests higher volatility, while a ratio of less than one indicates relatively lower risk compared to the benchmark.

- Beta ratios can vary based on the investment’s size, such as large, small, or mid-cap funds.

R-squared:

- R-squared measures the correlation between a fund’s performance and its benchmark.

- Represented on a scale of 0 to 100, a lower percentage indicates a weaker correlation, while 100 represents an exact match with the benchmark.

- A higher R-squared value implies a stronger alignment with the benchmark.

Also Read: Mutual funds or stocks: Which is a better investment?

Benchmark error

Sometimes, investors end up with benchmarks that don’t accurately reflect their portfolio’s holdings. It’s like using a ruler to measure the height of a giraffe—sure, it’s a measuring tool, but it’s not quite suited for the job. Here’s why benchmark errors happen:

The mix of assets in a portfolio can create substantial benchmark errors. If the reference standard doesn’t align with the portfolio’s holdings, it’s like trying to compare apples to oranges. This leads to overestimating or underestimating how well your portfolio is doing.

Understand the unique characteristics of your investment portfolio and select a benchmark that aligns with its risk-return profile. It’s like finding the perfect match for your investment journey.

Today, investors have a treasure trove of benchmarks to choose from. They come in all shapes and sizes, catering to different investment types. Let’s check some of the benchmarks available in the financial world.

Types of benchmarks

- Fundamental benchmarks focus on market capitalization and other factors like book value or revenue to filter stocks. They are commonly used for passively managed funds, attracting investors seeking exposure to stocks with strong fundamental characteristics.

- Thematic benchmarks are customised benchmarks created by fund managers based on specific themes or sectors. For example, if a fund invests in the ESG theme, the benchmark would be a thematic index like the Nifty 100 ESG Index.

- It caters to investors interested in investing in a particular theme, such as housing or ESG, rather than representing the overall market.

The best stock benchmark is an index that matches your portfolio or holdings the closest. So, next time you venture into the investment market, remember how benchmarking can help you in setting realistic and logical expectations.