The Credit Linked Capital Subsidy Scheme, or CLCSS MSME scheme as it is more commonly referred to, is a hot topic in India’s Micro, Small, and Medium Enterprises (MSME) industry.

This scheme is more than just a mouthful of acronyms. It’s a huge deal for MSMEs, providing them a rescue rope in their fight for expansion and market dominance.

Envision yourself eligible for a subsidy that allows you to invest in cutting-edge tech, allowing your business to reach new heights! With the MSME CLCSS scheme, that is exactly what is offered.

Understanding CLCSS

The Ministry of Micro, Small, and Medium Enterprises in India is the driving force behind the CLCSS scheme. The MSME Development Commissioner (DC) works tirelessly to make this scheme a reality. By offering an upfront capital subsidy, the DC of MSME CLCSS aims to help MSMEs upgrade their technology.

Reducing production costs for the MSME sector and making it more competitive is the main goal of the scheme. Incorporating cutting-edge technology into MSMEs’ plants and machinery is one of its primary goals.

Some of the sectors under the CLCSS scheme of MSMEs are

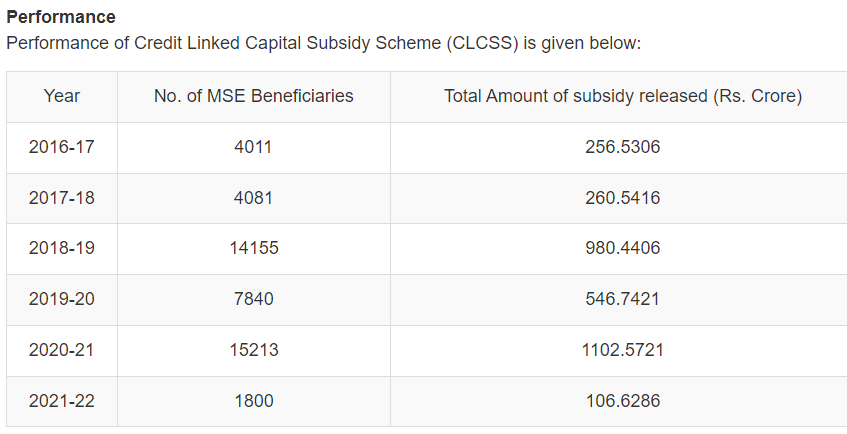

Over the years, this scheme has helped a lot of MSMEs. The Ministry of Micro, Small, and Medium Enterprises (MSME) has released the following list of performance metrics:

Benefits of CLCSS

There are several advantages of this scheme, some of which are:

Substantial subsidy: The CLCSS scheme’s 15% subsidy on the purchase of advanced technology is a major perk. Your investment in cutting-edge machinery and equipment is made possible significantly reducing your small business loan obligations.

Increased efficiency, and decreased expenses: By embracing modern technology, you can increase productivity while decreasing production costs. As a result, cutting costs without sacrificing quality is possible.

International competitiveness: The dominance of large corporations is rapidly fading in today’s interconnected world. With the help of the CLCSS scheme, MSMEs can manufacture goods of a high enough quality to meet international standards, opening doors for their businesses to grow internationally.

Boosting rural industries: Beyond specific companies, this scheme has a positive impact. Jobs are created and living standards are raised as a result of the expansion of rural industries. Your technology upgrade has far-reaching consequences.

Simplified application process: There is no fuss when applying for the CLCSS scheme. Submitting your application and accessing the required information is a breeze.

Also read: What is the Efficient Market Hypothesis?

Continuation of CLCSS MSME:

The CLCSS for MSMEs is an ongoing scheme. The continuation of the CLCSS has been confirmed by the MSME Secretary, contrary to reports speculating otherwise. This means that MSMEs can keep using the scheme to their advantage, increasing their technological capabilities and competitiveness.

Application process

Let’s talk about how micro, small, and medium-sized enterprises (MSMEs) can apply for the Credit Linked Capital Subsidy Scheme (CLCSS)

Initiate application with a recognised financial institution: The CLCSS application process starts with a financial institution recognised by the scheme.

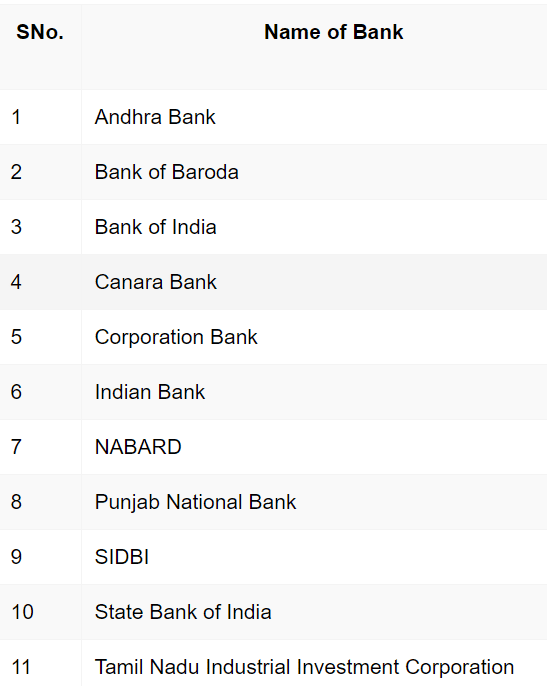

Among the listed financial institutions are:

Access MSME’s official portal: After submitting the initial application request to the selected financial institution, the applicant must log in to the official MSME website with their login credentials.

Navigate to ‘apply for subsidy’: Once the applicant has successfully logged in, they need to find the “Apply for Subsidy” option in the user task menu and click on it.

Fill in the required information: Filling out the form completely, including any specifics regarding the machinery or equipment, is the next step.

Review and finalise the application: Once the applicant has double-checked all the details, they can proceed to submit the form.

Also read: The best banks in India: Leading the way in finance

Role of Primary Lending Institutions (PLIs) in the application process

When applying for the CLCSS, Primary Lending Institutions (PLIs) play an essential role. Those interested in the scheme’s subsidies must submit their applications to the PLIs directly; it is from these institutions that the MSME will obtain the term loan.

Once the PLI has uploaded the application, it is directed to the Nodal Agency. On top of that, the Nodal Agency recommends that the Office of DC (MSME) receive the subsidy.

Funds are released to Nodal Agencies after the application has been processed and, if there are sufficient funds, after the Competent Authority has given its approval, with the concurrence of the Internal Finance Wing.

After that, the Nodal Agencies send money to the PLIs, who manage the MSME’s account.

Subsidies under the CLCSS scheme

In addition to the 15% upfront capital subsidy, the CLCSS scheme offers a plethora of other subsidies designed to boost your MSME business. Here are a few of the most important ones:

Zero Defect Zero Effect Scheme (ZED): Promoting environmentally conscious outputs and ZED production processes, the government has developed this scheme. Using cutting-edge methods and tools, it hopes to boost production efficiency, reduce waste, and encourage market expansion.

Assistance for entrepreneurial and managerial development of MSMEs via incubators: To encourage innovation and the adoption of cutting-edge technology, this CLCSS subsidy is offered to MSMEs. Technology is crucial in empowering entrepreneurs to strategise and implement business plans, facilitating their growth.

Digital MSME: This subsidy provides MSMEs with cloud-based services specifically designed to help them adapt to the digital age.

Intellectual Property Rights (IPR): The country’s long-term economic growth and technological advancement are aided by this subsidy’s promotion of an entrepreneurial ecosystem.

Lean manufacturing: MSMEs can adopt lean manufacturing practices and overcome competitiveness challenges with the help of this subsidy. Cutting costs and increasing productivity and overall competitiveness are both helped by this approach.

Design: To solve design-related problems, this subsidy allows businesses to consult with experts in the US manufacturing and design communities. Existing and new products undergo value-adding processes and continuous improvement as a result.

These CLCSS subsidy schemes aim to support micro, small, and medium-sized enterprises, encourage innovation, and boost the economy as a whole. Thus, you should seize the opportunities they offer to help your company achieve new levels of success.

Further reading: Unlocking prosperity: The transformative power of financial literacy

Bottomline

Loan Linked Capital Subsidy Scheme (CLCSS) is more than just a grant programme; it aids MSMEs in the journey of growth and enhancement. It inspires new ideas, pushes for better technology, and helps the MSME sector expand—it’s a change agent.

By taking advantage of the CLCSS, MSMEs in India can boost their competitiveness and aid the country’s economic development.