Financial literacy is a topic gaining increasing attention today. It is essential for economic development as it helps reduce poverty and unemployment. The first step towards financial literacy among individuals is to decode the basic concepts of personal finance, along with the different components involved in financial planning.

Today’s article discusses the different components involved in financial planning, both for individuals and businesses.

Financial planning

Financial planning is the process of analysing one’s current financial position and future financial goals, along with formulating suitable strategies to achieve such goals.

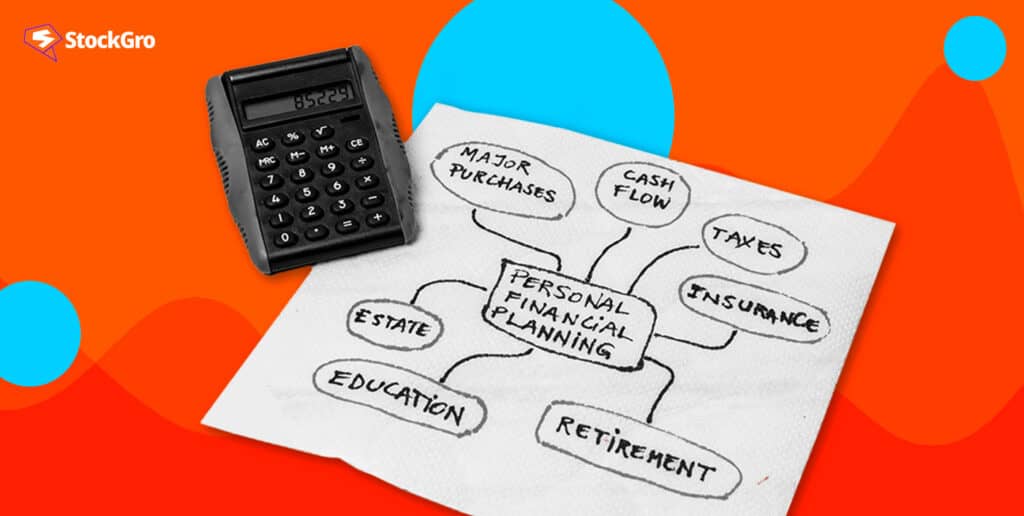

Personal financial planning

Personal financial planning revolves around an individual’s income, savings, investments, insurance, retirement planning, tax planning, etc. It comprises all financial aspects of an individual from earning income to investing it in the right avenues to grow wealth.

Financial planning for business

Similar to personal finance planning, businesses need financial planning, too. It revolves around assessing the business’s current standpoint and future financial objectives. It involves various financial statements like the balance sheet, profit and loss account, cash flow statements, etc., to assess the financial position and plan future strategies.

What are the components of a financial plan?

Understanding the different components involved in financial planning is the first step to forming a robust financial plan. An ideal financial plan must be comprehensive and cover multiple components, from everyday budgets to retirement planning.

Budgeting

Budgeting is the process of estimating expected income and expenses for a future period. Preparing a budget and following it helps overcome uncertainties and be financially aware. With a budget, one is more prepared to meet their financial obligations without shocks or surprises.

Cash flow is a vital aspect of a budget. Ascertaining the different sources and approximate amounts of cash inflow helps prioritise expenses accordingly. While factoring in cash outflows, a budget must include regular and one-time expenses.

A budget helps recognise recurring expenses and areas where too much money is spent. Identifying these is the first step to cut down on unnecessary costs. So, a budget plays a significant role in avoiding disturbances while achieving a financial goal.

A basic budget thumb rule that most people follow is the 50:30:20 rule. It suggests making a budget that sets aside 50% of the income towards needs, 30% towards wants and 20% towards savings and investments.

Also read: Are you changing your career? Here is how to manage finances during a career change

Investment planning

Saving money is essential to meet sudden requirements. But, another aspect, as essential as saving, is to invest money. While saving provides liquidity and a backup to rely on, investments help in increasing the value of one’s wealth. Hence, savings and investments must be two separate aspects of a budget. A portion of the budget must be allocated towards profitable investments.

Various investments are providing different levels of returns at different risk rates. Each investment avenue offers a unique financial benefit, suiting the different financial objectives of investors. Hence, individuals must go through the available options, assess the risk-return factors and choose the best avenue that aligns with their goals.

Generally, stocks are the preferred option by growth aspiring investors with high-risk appetite. Conversely, bonds are suitable for those wanting lower exposure to risk and more stability in their investments. Mutual funds can be an ideal option for investors looking at a mix of both. Investors having large amounts of funds for investment can try their luck at real estate options. Hence, there is an option for every investor in the financial market.

A simple rule of thumb for beginners is to invest 10% of their income and increase it by 10% every year.

Insurance

Every well-made financial plan must include insurance as one of the primary components. Without insurance, the burden of sudden financial commitments during a mishap increases. The absence of insurance may lead to debts, which can even push people into debt traps. Owning insurance gives individuals a feeling of security and protection at all times.

Whether through employers or privately, individuals must own at least the three basic insurance policies – life, medical and vehicle insurance. Setting aside a portion of the budget to pay for insurance premiums is essential, especially when the policy is privately held.

Taxes

Sometimes, people wonder why they are unable to save sufficiently despite earning well. One of the reasons for this, besides excessive spending, is tax payments. As the income increases, the amount of tax payable to the government increases, leading to a reduction in disposable income at hand.

Hence, tax planning is crucial. Individuals can save taxes in legal ways through the different exemptions and deductions mentioned in the Income Tax Act. Professional guidance from auditors and chartered accountants can help reduce tax liabilities, increasing the spendable income.

Retirement planning

Most companies in India consider 60 years as the retirement age. Some companies extend it, depending on their policies. Irrespective of the company’s policy, an individual must start planning for retirement from the beginning of the career, to be able to save maximum and reap the benefits of compounding.

Planning for retirement and arranging a source of income in the form of interest on deposits, rent, etc., gives a feeling of security and peace of mind. It allows individuals to be independent without relying on their children or others after retirement.

As a simple thumb rule, some planners suggest having a retirement fund that has 15 to 20 times the amount of annual salary. An ideal start for beginners can be to set aside 10-15% every period towards retirement.

Also read: Financial literacy for senior citizens: Crossing retirement hurdles

Estate planning

This component of financial planning is not discussed often, but it is as essential as the other aspects. Estate planning refers to planning the management of one’s financial assets after death.

Generally, financial assets pass on to legal heirs after death. However, a lack of planning can lead to disputes and disagreements among family members. Hence, the ideal way to do this is to prepare a will stating how the assets will be divided after the individual passes away.

Components of a financial plan for businesses

Similar to personal financial planning, business financial planning involves different components, too.

Analysing the company’s balance sheet and other financial statements helps ascertain the current situation. The management then prepares a forecast of the expected revenue and expenses, along with planning strategies to achieve the desired sales.

Understanding the firm’s break-even point and formulating growth strategies post-break-even is an integral part of business financial planning.

Bottomline

Financial planning may seem like a complex and tedious task to many. But, breaking it down into smaller parts can simplify the process. Hence, understanding the components of the financial planning process is crucial. It is the first step towards making money work in your favour.