“Convertible debentures” may sound complex, but they offer a unique and flexible investment opportunity worth exploring. These financial instruments, blending elements of debt and equity, have gained popularity among seasoned investors and newcomers to the financial world.

Whether you seek growth, diversification, or a mix of both, understanding convertible debentures can be a valuable addition to your investment knowledge; scroll till the end to know more.

Also read: Debt instruments in India: Understanding your investment options

What are convertible debentures?

A convertible debenture is a hybrid financial instrument issued by a corporation or government entity. Initially, it functions as a regular bond, paying periodic interest to bondholders.

However, what sets it apart is its convertibility feature. At a predetermined time or under specific conditions, the holder has the option to convert the debenture into a predetermined number of the issuing company’s common shares.

Conversion of debentures into equity shares refers to the process where holders of convertible debentures can exchange their debt securities for a predetermined number of company shares.

This conversion offers investors the chance to engage in potential stock value increases, rendering convertible debentures an appealing choice for individuals aiming to combine a steady income stream with the prospect of capital growth.

Convertible debentures example

Let’s consider your own convertible debentures worth ₹ 500,000, carrying an annual interest rate of 4%. These debentures provide the opportunity for conversion into equity upon maturity at a 1:10 ratio. In simpler terms, for every debenture with a denomination of ₹ 5,000, you can exchange it for 10 equity shares.

It’s crucial to understand that the conversion ratio is determined by the issuer during the initial debenture issuance. As a holder, you retain the right to either convert the debenture into equity or hold it until maturity without converting.

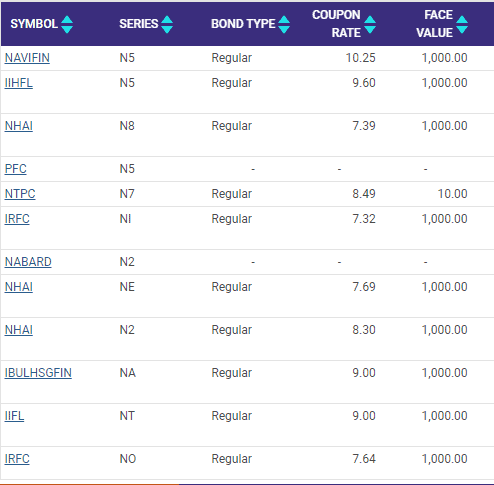

Debentures are considered convertible unless mentioned otherwise, and below is the list showcasing some of them currently listed on NSE.

Indian Railway Finance Corporation Ltd., Navi Finserv Ltd., IIFL Home Finance Ltd., National Highways Authority of India and Power Finance Corporation Ltd. have listed their debentures for public issue.

Source: NSE India

Also read: Government bonds in India – Meaning, types and features

How to buy debentures?

Given below are the steps to buy debentures in India:

- Open a Demat account: Investors should establish a Demat account with an accredited depository participant.

- Select debentures: Choose the debentures you want to buy after researching their terms.

- Initiate the account setup: The subsequent action involves establishing an account with a stockbroker authorised by the government.

- Fund trading account: Deposit funds into your trading account for the debenture purchase.

- Place your order: With your account, place an order specifying quantity and price.

- Payment: Once your order is executed, funds get debited from your trading account.

- Confirmation: Receive a contract note as proof and see debentures in your demat account.

Types of convertible debentures

- Optionally convertible debentures (OCDs):

Optionally convertible debentures, as the name suggests, provide the investor with the choice to convert the debenture into equity shares or retain it as a regular debt instrument.

Investors benefit from the flexibility to assess market conditions and the issuer’s performance before deciding to convert.

This can be advantageous when uncertainty exists regarding the company’s future prospects. Companies issue OCDs to attract capital with the promise of potential equity participation. They offer lower interest rates compared to non-convertible debentures.

- Fully convertible debentures (FCDs):

Fully convertible debentures are financial instruments where conversion into equity shares is obligatory within a specified timeframe, generally at a predetermined conversion ratio. Investors of FCDs do not have the option to retain them as debt.

The conversion is mandatory when the conditions outlined in the debenture agreement are met. FCDs are popular among companies looking to raise funds for growth and expansion, as they provide a clear path to transitioning investors into equity stakeholders.

- Partially convertible debentures (PCDs):

Partially convertible debentures have a unique structure where only a portion of the debenture is convertible into equity shares while the remaining portion remains as debt. Investors have the choice to convert a specified percentage of their PCD holdings into equity shares, often at predetermined conversion prices.

PCDs offer a balance between fixed-income stability and equity participation, appealing to investors seeking income while maintaining some exposure to potential capital gains.

Also read: Non-Convertible Debentures decoded: Steady returns, zero complications

Convertible debentures advantages and disadvantages

| Advantages | Disadvantages |

| Investors benefit from a diversified portfolio as convertible debentures combine fixed-income characteristics with the potential for equity appreciation. | The hybrid nature of convertible debentures makes them more complex to understand compared to traditional debt or equity securities. |

| Holders can participate in stock price gains by converting debentures into equity when favourable market conditions arise. | Compared to non-convertible bonds, the interest rates on convertible debentures are often lower, potentially reducing income for investors. |

| Convertible debentures offer a consistent income stream through interest payments, ensuring stability during market fluctuations. | For existing shareholders, the conversion of debentures into equity may lead to dilution of ownership, affecting their voting rights and share value. |

| Companies often issue convertible debentures at lower interest rates than traditional bonds, reducing borrowing costs. | The conversion value is tied to the issuer’s stock price, subjecting investors to market volatility and fluctuations. |

| Investors can strategically choose when to convert to equity, aligning with market dynamics and their investment goals. | Convertible debenture returns depend on stock performance. If the stock underperforms, investors may receive lower returns than expected. |

| Convertible debenture holders retain a fixed-income security in adverse market scenarios, limiting potential losses if they opt not to convert. | Convertible debenture holders have no direct influence over the issuer’s management decisions or corporate governance. |

| Start-up companies find convertible debentures appealing for capital raising as they can attract investors without immediately giving up ownership control. | Choosing when to convert requires market timing skills, and making the wrong decision can lead to missed opportunities or losses. |

| Convertible debentures trade on secondary markets, which provides liquidity. | Investors seeking higher fixed income may find convertible debenture yields less attractive. |

Bottomline

Convertible debentures offer investors a multifaceted investment avenue, blending fixed-income stability with the allure of equity participation.

Their advantages, such as diversification, make them a good choice. To wield convertible debentures effectively, investors must grasp their intricacies and align their strategies with market conditions.