Credit ratings aren’t just for investments – they’re very versatile tools used everywhere in the market. They can be used to assess the creditworthiness of individuals, corporations, or governments. Most credit ratings are assigned and made public by special credit rating agencies, which are independent organisations that are responsible for evaluating and providing opinions on the ability of these entities to meet their debt obligations.

In this article, we’re going to dive deeper into credit ratings, the agencies that give these ratings, and why they’re so important.

What are credit ratings?

Credit ratings are like your credit score, but for corporations and other large entities. Credit agencies, which are specially-created independent bodies, assess the creditworthiness of individuals and companies alike and give them a score on how likely they are to pay off their debts. The most popular credit agencies are S&P Global, Moody’s, and Fitch Ratings.

Credit agencies, hence, play a very crucial role in the financial landscape of every economy. By providing an unbiased and informed view of the debtor, they caution investors from investing in particularly risky assets that might look good on the surface, but really aren’t.

You may also like: Bond voyage: Unraveling the intrigue of Bonds

How are credit ratings given?

Credit rating agencies evaluate the financial health and ability of entities to repay their debts. This evaluation includes an analysis of financial statements, economic conditions, etc. A high credit rating after assessment means that, in the agency’s opinion, a bond issuer is likely to repay their debts to investors without much difficulty.

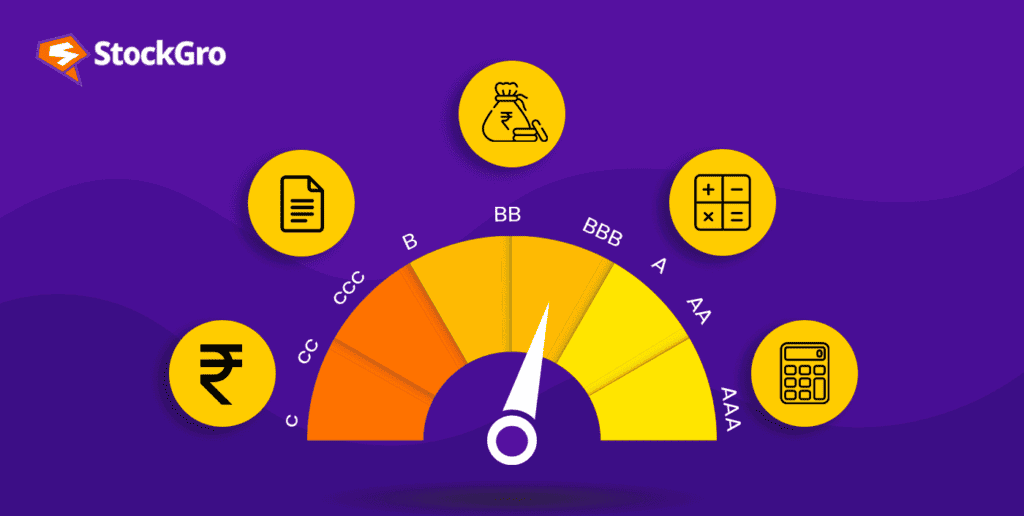

The scale

Credit rating agencies typically assign credit ratings using a scale that includes letter grades or symbols. The specific scale may vary slightly among agencies, but a general scale looks like this:

- AAA or Aaa: The highest rating that can be given to a bond issuer, indicating the lowest risk for the investor. Only two companies in the United States today hold the pristine AAA ratings for their corporate bonds – Microsoft, and Johnson & Johnson.

- AA or Aa: This is also a great score but they’re slightly more risky compared to AAA. U.S. Treasury bonds are currently rated AA+. This means that Fitch, the agency that gave Treasuries that rating, believes that there’s a very low chance that the U.S. will default on its debt.

- A: Upper-medium credit quality

- BBB or Baa: Medium credit risk, but still considered investment grade.

These ratings are all called ‘investment grade’ ratings. Below them are:

- BB or Ba: Speculative or ‘junk’ status, indicating a higher level of credit risk.

- CCC or Caa: Highly speculative with significant risk of default.

- D: In default or likely to be in default soon.

Also Read: Credit history: What is it and why it matters?

Factors that are considered

A combination of qualitative and quantitative factors are considered by credit agencies when attributing a credit rating to a bond.

Quantitative attributes include financial metrics, cash flow, historical performance, debt profile, industry and economic conditions, and liquidity. This is done to ensure that the issuer has the ability to generate sufficient cash flow to meet debt obligations when the time comes. Stable and strong cash flow is viewed favourably. Historical performance that indicates high growth and prudent financial risk management can also boost the ratings higher.

Qualitative attributes include management quality, the regulatory environment, competitive position of the company, its legal structure, and a wide host of economic factors. Market conditions like investor sentiment and interest rates are also usually taken into account in various degrees during the due diligence process.

The story behind the U.S. Treasuries downgrade

It is worth noting that the U.S. Treasuries, which are American government bonds, are generally granted the highest possible credit rating. However, one of the biggest credit agencies in the world, Fitch Global, in August 2023 downgraded the credit rating for the United States, moving it from AAA down to AA+. They cited reasons that stemmed from the country’s fiscal condition in the next three years, mostly owing to the country’s political climate.

This downgrade can have several economic and financial repercussions in the long-term, including an increased risk perception amongst investors, higher interest rates, market volatility, and a negative impact on the U.S. Dollar.

Also Read: How does the US Fed’s interest rate pause impact global markets and India?

Interpreting credit ratings in personal finance

Credit ratings usually have a large impact on investors’ portfolios, like they should. Since these ratings are usually given after years of consideration, due diligence, and research, they are generally considered to be reliable. Using this information to diversify your portfolio and assessing your investment goals is a good idea.

Make sure that if you don’t have a high risk-appetite, you’re not investing in anything that’s rated below a BBB. Stay informed about updates on the news, consider the yields that you’re getting, and keep a finger on the market pulse to make sure that you’re getting all the information you want to make the best investments. Also remember, a credit rating is only an indication of the credit worthiness but not a guarantee!