India’s employee provident fund (EPF) is a crucial pension scheme for those who earn monthly salaries. It helps workers accumulate money to be used in their later years.

Among various forms related to EPF, Form 10C is used for claiming EPF withdrawal benefits or obtain a scheme certificate. Understanding how to file this Form and check its status is essential for employees seeking to access their funds.

What is EPF Form 10C?

For pension withdrawal, it is necessary to fill in Form 10C. From your EPF account, 8.33% out of the total 12% goes into the pension fund, which is the EPS (employee pension scheme) account.

This amount meant for employees’ retirement can still be withdrawn when emergencies like two or more months of unemployment or medical emergency, among other things, come up.

Therefore, this way, an employee who wishes to retain his membership with the Employee Pension Fund (EPF) while enjoying its benefits files Form 10C.

Must read: The concept of EPF – All you need to know about this tax-saving fund

Types of benefits and eligibility to apply EPF withdrawal Form 10C

- Withdrawal benefit: Those members who have not completed ten years of service can apply for withdrawal benefits from the amount of money saved in terms of pension.

- Scheme certificate: This certificate enables those members below 58 years but with a minimum period of 10 years to be able to shift their benefits to another employment. In case they fall between fifty and fifty-eight years old. However, they may choose partial payment through Form 10D instead of a Scheme Certificate.

- Family/heir benefits: If a member dies after reaching the age of 58 but before attaining ten years of service, then his/her family/nominee/legal heir is entitled to claim withdrawal benefits.

- Disability pension: Any member who resigns due to total permanent disability, irrespective of his/her age or length of service, is eligible for a monthly disability pension, and such member should submit Form No.10-D.

You may also like: Top financial strategies for individuals with disabilities | StockGro

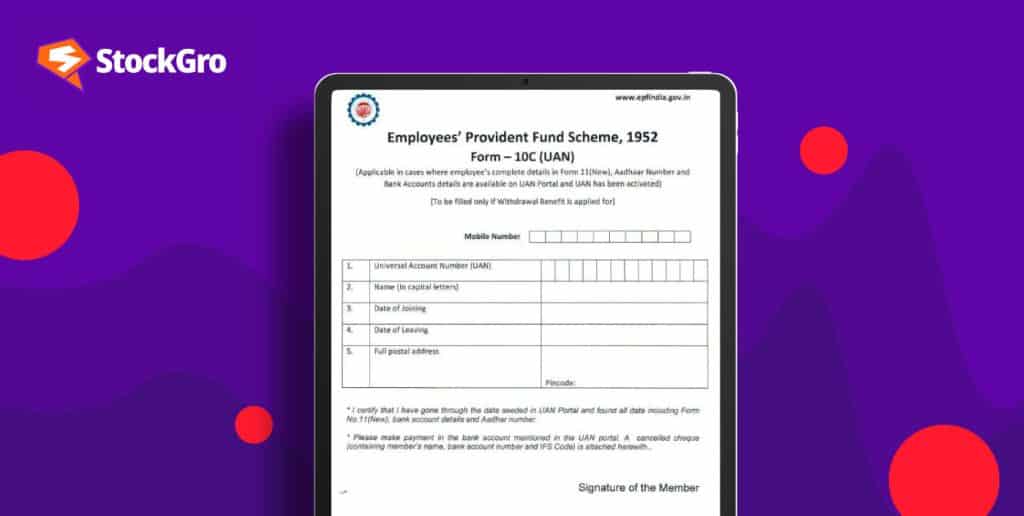

Contents of sample EPF withdrawal form 10C

Form 10C of the EPF is used to claim withdrawal benefits and scheme certificates; it consists of the following:

- Name of claimant: The full name of the person who made the application for this benefit.

- Date of birth: The date on which the applicant was born.

- Father’s name: His or her father’s name.

- Husband’s name: If any exist, his or her husband’s name.

- Previous employer details: Address and company name where member last worked before retirement.

- Employment details: Encompassing region code, establishment code for a previous company, plus individual PF account number.

- Joining date: When the claimant joined that previous place of work.

- Service termination details: Reason and date left service.

- Claimant’s address: Full address details of the person applying for the benefit

- Scheme certificate option: An affirmation showing if an applicant would rather receive a scheme certificate instead of withdrawal benefits;

- Family details: Information about spouse (if any), children (if any), legal heir or nominee;

- Details in case of deceased member: Such information as death date, applicant name, their relationship with the dead member;

- Mode of remittance: This implies the way preferred for receiving payment, such as postal money order, cheque, or electronic payment.

Step-by-Step Guide to Filing EPF 10C Withdrawal Form

- To access the EPFO website, go to the EPFO member portal.

- To log in, use your UAN and password. If you are not registered, please do so.

- Choose “Online Services” to access services.

- Click on “Claim Form (Form-31, 19, 10C & 10D)” to select Claim Form 10C.

- You need to confirm your personal details and bank details.

- The four digits of your bank account should be entered for bank account verification.

- Now, accept the terms and conditions.

- Choose “Only Pension Withdrawal (Form 10C)” to select pension withdrawal.

- Submit your full address while entering your address information.

- Aadhaar OTP shall be sent to your registered mobile number.

- Please enter OTP and submit. Confirmation will be given.

- EPFO will process this request and transfer funds into a bank account.

If you go offline, then download the Form by going to the EPFO website with an EPF form 10C download option. Ensure that all particulars are accurate so that it becomes easier for you.

Further reading: Personal Loan vs EPF Advance

Bottomline

EPF Form 10C is a critical resource in assisting employees to handle their pension savings during retirement and seek funding from it whenever there is a need. If one knows its application process thoroughly and appreciates the advantages that come with it, then one would have positioned himself/herself better in terms of future financial stability through his/her EPF contributions, supporting him/her at times when things become difficult.

FAQs

- How do I check the status of my Form 10C claim?

One can check the status of his Form 10C claim by visiting an EPFO member portal and logging in with a UAN (Universal Account Number) and password. You should click on “Online Services” after that and then go to “Track Claim Status.” This is where you will find the current position for your claim as well as any updates or pending actions. Otherwise, you may wish to consider checking through the UMANG app, where you will need to choose “EPFO” followed by “Track Claim.”

- What happens if 10C is rejected?

Once your Form 10C claim has been dismissed by the EPFO, they usually inform you about what caused it. Reasons like incomplete or wrong information, inconsistency in personal details, and problems in bank accounts given are common. To rectify, look through the rejection commentaries, noting errors so that new entries can be made before re-submitting the document. Alternatively, any help concerning EPFO’s office on why it was not accepted at all will also be attended to by calling them for clarification on how to fix it.

- Can I claim both Form 19 and 10C?

Yes, both Form 19 and Form 10c can be claimed. When one retires from employment or quits a job he/she has had for quite some time, he/she should use Form 19 as it allows the person to withdraw his/her Employee Provident Fund (EPF). However, if you have worked in an organisation for less than ten years after which you leave voluntarily, retire, or resign on health grounds, applying for a pension via Form No 10 C under the EPS scheme is worth undertaking, as well as opting for a scheme certificate when entitled.

- Can I withdraw my 100% PF amount?

Certain conditions apply to withdrawing up to 100% of the PF amount. You can take out all PF balances if you retire at an age above fifty-eight years, stay unemployed for more than two months, or permanently shift abroad. In addition, some withdrawals may be partial, for instance, for medical reasons, higher education dwelling house constructions, etc. Consequently, ensure that all preconditions are met and necessary documents are submitted concerning the withdrawal process initiation process.

- Will PF interest stop after three years?

Yes, the interest on your PF account will stop at three years of inactivity. This usually occurs when one resigns from employment and fails to withdraw or transfer his/her PF balance. However, such a loss can be avoided by withdrawing the PF amount or promptly transferring it to your new employer’s PF account.