Factor markets are where businesses buy inputs for their production. These inputs could be anything from labour to land. One important difference to note between factor markets and traditional markets is that the former are not very well known, but are just as important as the latter.

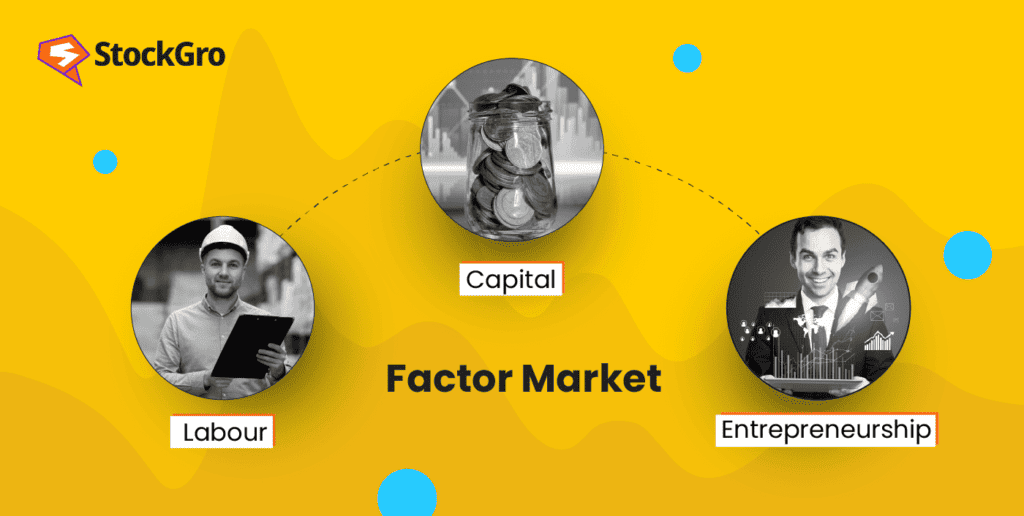

What is a factor market?

Regular markets facilitate the exchange of goods between consumers and producers. Factor markets, however, are where the factors of production – capital, labour, land and entrepreneurship – are bought and sold.

Unlike traditional markets, the commodities in factor markets are not final products; they are the essential components used in the production process.

You may also like: What is Capital Market – an engaging guide for beginners

Why are factor markets important?

Factor markets might seem like they’re not too significant for investors like you and me who don’t run businesses. However, these are markets that impact the cost of production for the businesses that you’re investing in; that affects profitability, which hits their income statement, which is the first thing fundamental investors look at when they’re stock-picking.

All businesses need some input to make products. For instance, a food company would need to buy raw materials, and a real estate company would need agents and property. These inputs would be sourced from factor markets, where a cost change could affect the business’ bottom line.

The global labour force is estimated to reach 3.5 billion people in 2023, showcasing the immense scale of labour market transactions. In 2022, the total value of the global capital market was estimated to be over $200 trillion!

Aspects that affect factor markets

Government policies and regulations

Labour markets are famously impacted by minimum wage laws, workplace safety standards, and labour union regulations, which can in turn affect wages and employment levels. This forces businesses to change their bylaws and regulations, which can very well cause disruptions in the supply chain and production processes.

Similarly, government policies concerning interest rates, fiscal policies, and monetary policies significantly influence borrowing costs and credit availability, which can make or break expansion projects or infrastructure development.

Also Read: Beat the market: Your ultimate guide for fundamental analysis tools.

Global macroeconomic conditions

Several metrics like growth rates, inflation levels, currency fluctuations, job stability data, and capital availability can affect how expensive it is for businesses to borrow.

For instance, at the time of writing of this article, the Fed is aggressively raising interest rates to curb inflation. This is causing a global slowdown in equity and private markets since the risk-free rate for money is rapidly increasing as well.

Demographic factors

Changes in population demographics greatly influence factor markets. Ageing populations in developing and developed nations like Japan and China can lead to labour shortages, affecting wages and productivity. In factor markets, demographic shifts can influence savings rates, investment patterns, and the demand for various financial products and services.

Tech advancements

Technological innovations have always affected how factor markets work. Automation in key business processes using artificial intelligence have shaped labour markets, which have in turn altered job demands and the standard of skill requirements. Hiring entry-level executives, for instance, has been becoming harder. Tech innovations also enable founders to get more access to capital, making funding their growth easier.

Understanding these multifaceted factors is crucial for investors and policymakers. They need to anticipate and respond to the changes in factor markets to make informed decisions and formulate appropriate strategies.

Monopoly in a factor economy

A monopoly exists when there is only a single producer and many buyers, while a monopsony is when there are many producers and few buyers. When universal input factors like labour and real estate become monopolised by certain individual companies, buyers usually lose.

In a free market, producers compete amongst each other to have their share of buyers. In the process, they lower their prices until their offer matches the buyers’ bid. Since there’s no competition in a monopolised factor market, buyers have to pay higher prices because they have no substitutes.

Consequently, monopolies in a factor market can have disastrous impacts – since they have no competition to force or incentivise them to cut prices, innovate, or even excel.

Also Read: What is spot market?

Competitive markets

In competitive factor markets, both buyers and sellers don’t control prices. Prices are determined by changes and movements in supply and demand. Firms can sell products at these equilibrium prices. This enables small businesses to adjust their profitability and price to fit the market’s current standards, rather than have to cope with an ever-expensive monopoly.

Conclusion

Factor markets are the backbone of economic transactions, and provide several vital components for production. For investors, understanding how these markets work is essential for making informed decisions and predicting market trends. By keeping a close eye on the dynamics of factor markets, you can be better suited to navigate the ever-evolving economic landscape with more confidence and precision.