Form 15G is a crucial document in the realm of taxation, offering a valuable tool for taxpayers in India. It serves as a shield against the deduction of Tax Deducted at Source (TDS) on interest income, ensuring that individuals and small investors can enjoy tax benefits on their earnings.

Understanding Form 15G can empower taxpayers to make informed financial decisions and optimise their tax liability.

What is form 15G?

Form 15G is like a tax-saving tool for individuals in India. When you receive income, such as bank interest, and your total earnings remain below the taxable threshold, you can complete Form 15G.

This form serves as a declaration to the bank, indicating that your income is not substantial enough to warrant taxation and therefore, no tax deductions should be made. Essentially, it is a method to retain a larger portion of your income when you are not subject to significant tax liabilities. How to get a personal loan income tax exemption in India? This article explains the details of the personal loan tax exemption for salaried people.

The due date to file form 15G is the end of each financial year, which is March 31. Failing, you will have to face an additional penalty for a late submission.

The Employees Provident Fund Organisation (EPFO) introduced Form 15G for PF withdrawal. This form lets PF members withdraw their PF online without a TDS deduction.

You may also like: How much tax do you pay on stock market gains?

Who is Eligible for Form 15G

It is vital to understand the eligibility criteria for submitting this form and the potential consequences of providing false information.

- Only a person with a valid PAN ( Permanent Account Number) can file this form.

- Only individuals, not firms or companies, can use Form 15G.

- The taxpayer should be a resident of India or part of a Hindu Undivided Family (HUF).

- The individual’s age should be 60 years or younger.

- To file Form 15G the age criteria is younger than 60 years, and for Form 15H the age criteria is above 60 years.

- The total income, including the PF withdrawal, should result in no tax liability for the financial year.

- All information on the form must be accurate, truthful, and complete to avoid penalties, including fines and potential imprisonment.

How to fill form 15G?

- To access the income tax website, visit incometaxindia.gov.in.

- Navigate to the ‘Forms/Downloads’ section and select ‘Income Tax Forms’ given in the menu below.

- Scroll down to locate Form 15G H. You have the option to download either the PDF format or the fillable form from there.

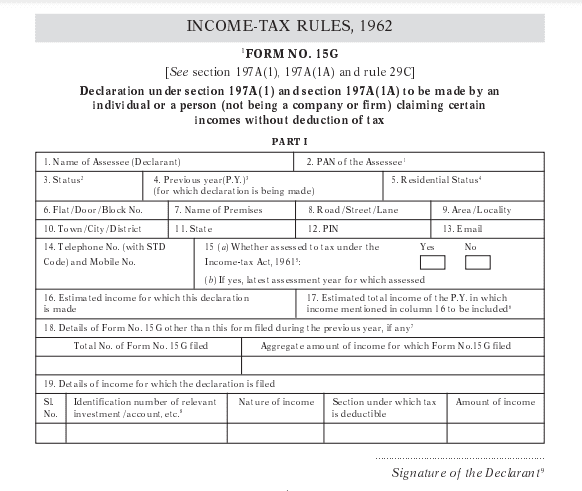

Part-1 of Form 15G: This section is for taxpayers who want to claim certain incomes without having tax deducted at the source.

Part-2 of Form 15G: This section is for the individual who pays the income to the taxpayer who is submitting Part-1 of Form 15G.

- Name of the declarant (assessee): Write your name exactly as is mentioned on your tax records.

- PAN (Permanent Account Number) of the assessee: Fill in your PAN card number as written on your PAN card and tax records. Providing an incorrect PAN will invalidate the declaration.

- Taxpayer status: Indicate whether you are an individual or HUF (Hindu Undivided Family).

- Previous year: Specify the financial year for which your form is being uploaded.

- Residential status: The form can be submitted by residents of India. Specify your residential status according to the Income Tax Act, 1961, Section 6.

- Permanent address details: Provide your complete permanent address, including flat/door/block number, premises name, road/street/lane, area/locality, town/city/district, state, and PIN code.

- Email address: Include your email address, ensuring it matches the one in your income tax records.

- Telephone number: Enter your phone number, ensuring it matches your income tax records for communication purposes.

- Tax assessment: If your income exceeded the limit in any of the past six years, select “Yes” for “whether assessed to tax under the Income Tax Act, 1961.” If yes, upload details of the latest assessment year in which the income exceeded the exemption limit.

Below is the form 15G format

Source: Income Tax India

Also read: Capital gains tax – overview, types, and current rates

Process to file form 15G for PF withdrawal online

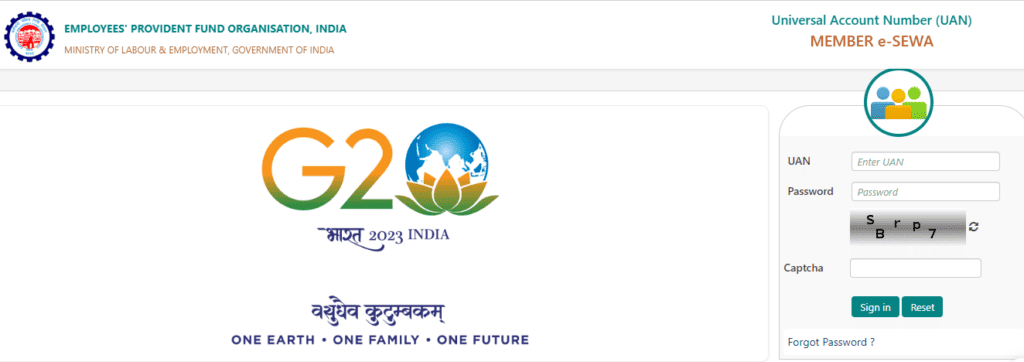

Below are the steps to file form 15G for PF withdrawal online:

Source: EPFO portal

- Login to the EPFO UAN portal.

- Click on ‘Online Services’ and then ‘Claim’.

- Click ‘Verify’, to verify your bank account details.

- Then click on ‘Upload Form 15G’.

Penalties for non-submission

Providing incorrect details on Form 15G to evade TDS can lead to severe charges and fines under Section 277 of the Income Tax Act, 1961. The penalties are as follows:

- Imprisonment ranging from six months to seven years for false declarations aimed at evading tax exceeding ₹25 Lakh.

- The bracket for Imprisonment is from three months to three years with a fine for other cases of false declarations.

Also Read: Old vs. New – Which income tax regime is better for FY 2023-24?

Is form 15G mandatory for PF withdrawal?

Form 15G is not always mandatory for PF withdrawal but becomes crucial in certain cases. It is specifically required when an individual’s total income for the financial year is below the taxable threshold and they want to avoid Tax Deducted at Source (TDS) on their PF withdrawal.

According to the income tax rules, if the withdrawal amount exceeds ₹50,000 and the PF has been held for less than five years, TDS will be deducted unless Form 15G is submitted.

The purpose of submitting Form 15G is to declare that your total income is below the taxable limit, thereby avoiding the TDS deduction on your PF withdrawal.

However, if your income is above the threshold, or if you have completed five years of continuous service, the submission of Form 15G is not required, and no TDS will be deducted. It’s important to ensure that you fill the form accurately to prevent any tax or legal complications later.

How to cancel form 15G?

It is necessary to cancel for 15G if you realise that you no longer meet the eligibility criteria, or if you have mistakenly submitted it. The income tax portal doesn’t provide a direct process to cancel form 15G. If you want to cancel the form, you should immediately inform the institution where you submitted the form.

You can contact them with a formal letter or email explaining that you need to withdraw the declaration due to ineligibility or any other valid reason. If TDS has already been avoided due to the submission, we advice you to adjust it while filing your income tax return to avoid any penalties or legal action for providing incorrect information.

Make sure that the communication is documented for your records. In cases of discrepancies, rectifying the submission in a timely manner will help you avoid severe penalties under the Income Tax Act, 1961.

How to generate UIN for form 15G?

A Unique Identification Number (UIN) is generated when you submit form 15G to the Income Tax Department. Banks and financial institutions are responsible for generating and reporting this UIN when they process the form.

When you submit form 15G to avoid TDS on interest income or PF withdrawals, the institution will generate the UIN and file it with the tax authorities as part of their quarterly TDS returns.

You will be notified once the form has been successfully processed. The UIN is important for tracking and ensuring the form is valid for the financial year in which it was submitted.

It is stored in the system for audit purposes and ensures that individuals are not filing multiple 15G forms to avoid TDS unlawfully. Make sure to follow up with your bank or the institution if you do not receive confirmation of the UIN after submitting the form.

Bottomline

In conclusion, Form 15G can be a valuable tool for taxpayers, especially those with incomes below the taxable threshold. It allows you to prevent unnecessary TDS deductions and preserve your cash flow.

However, it is important to know the criteria for eligibility and provide accurate information. Any false declarations can lead to penalties and legal consequences.

So, when used correctly, Form 15G empowers you to enjoy the benefits of your income without the hassle of extra tax deductions, making it an essential component of your financial planning toolkit. Remember, responsible and accurate filing is the key to harnessing its advantages. Explore the tax implications of share trading and F&O, including simplified turnover calculations and loss reporting.