Form 16 and Form 16A are key documents with distinct roles in the Indian taxation system. Each is tied to a specific source of earnings, and understanding their differences is essential for accurate returns. Overlooking these variations can lead to costly mistakes. Curious to know which one applies to your situation? Let’s clarify the details and their implications for your taxes.

Form 16

Form 16 serves as an official certificate provided by your company, verifying that the necessary TDS– tax deducted at source– from your earnings and credited to the government u/s 203 of Income Tax Act-1961. If your income surpasses ₹2.5 lakhs in a given year, you’ll receive this important document. It provides a clear record of how much has been withheld on your behalf, ensuring transparency in the taxation process.

Issued yearly once by mid-June of the following fiscal year, Form 16 is crucial for filing your returns. This certificate not only plays a role in tax reporting but can also be essential when applying for services, such as loans or visas.

Also read: What is TDS? A complete overview of TDS in income tax

Form 16 components

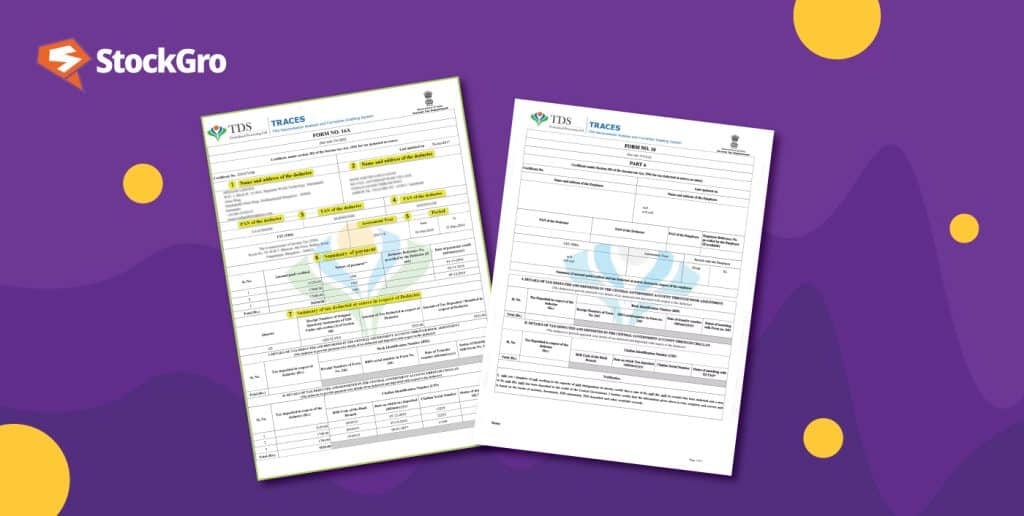

Form 16 is divided into two sections, each delivering crucial information about your salary and the taxes withheld.

Part A: Identification and tax overview

Part A primarily captures identification and transaction information. It sets the context by providing essential background.

- Identity markers: This section includes the names and addresses of both parties involved—employee and company. It also provides critical numbers like the employee’s PAN/ Permanent Account Number and the employer’s TAN, i.e, Tax Deduction and Collection Account Number, ensuring traceability.

- Employment timeline: Specifies the duration of your work with the organisation for the fiscal year, essential for calculating tax liabilities.

- Tax transactions: Lists the quarterly figures, indicating the amounts withheld from your income and transferred to the government.

Part B: Income and adjustments

Part B dives into the specifics of what you’ve earned and the applicable adjustments.

- Income breakdown: This part itemises your earnings into categories such as base pay, benefits, and additional perks. It covers everything from Section 17-related components like bonuses and other gains.

- Allowances and rebates: Highlights the portions of your income that qualify for relief, such as housing or travel allowances, falling under Section 10.

- Reductions: Investments, medical expenses, and similar items that reduce your taxable amount are outlined here, falling under Sections like 80C and 80D.

- Final calculation: After applying all reductions and reliefs, the document shows the amount of income that is subject to tax.

Also read: Section 206AB of the Income Tax Act – TDS for Taxpayers Not Filing of ITRs

Form 16A

Form 16A certifies the TDS on income that isn’t tied to employment. It applies to various financial gains—like interest on savings, rent, or commissions from insurance—where tax is deducted at the point of payment.

Issued by the entity responsible for the deduction, be it a bank or a payer. For example, imagine a person who rents out her flat for ₹30,000 per month. His/ her tenant deducts 10% from the rent each month. Every quarter, the person receives Form 16A from the tenant, outlining the deducted amount and verifying that it was deposited with the authorities.

Form 16A components

Deductor details

It begins with the deductor’s information, including their name, location, PAN, and TAN, ensuring traceability of the tax source.

Recipient information

Next, the recipient’s name, PAN, and address are listed, linking the tax deduction to the correct individual.

Financial specifics

The form details the total payment made, the amount withheld as tax, and the date of deposit into the government’s account.

Challan reference

The challan number acts as proof that the deducted tax has been deposited, adding accountability.

Income type

It also identifies the nature of the income—whether from interest, rent, or other sources—helping to categorise earnings properly.

Difference between Form 16 and 16A

| Aspect | Form 16 | Form 16A |

| Purpose | A certificate that reflects TDS on salary, issued by an employer to an employee. | Document showing TDS on non-salary income, such as interest, rent, or professional fees. |

| Recipients | Specifically for salaried individuals employed by a company. | Given to individuals or entities receiving payments from sources other than salary, such as banks, landlords, or consultants. |

| Income type | Pertains solely to earnings from employment. | Covers diverse earnings, including interest, rental income, commission, and professional payments. |

| Issuance frequency | Distributed annually after the close of the financial year, typically by mid-June. | Generated quarterly, following the timeline for non-salary TDS deposits. |

| Key information | Includes salary figures, tax deducted, and identifiers like PAN and TAN of both the employer and the employee. | Lists the total amount paid, the tax withheld, along with the deductor’s and recipient’s PAN and TAN, and deposit references. |

| Validation | Can be verified online via the tax department’s portal, ensuring accuracy of salary-related deductions. | Also verifiable online, this form allows cross-checking for deductions on other income streams. |

| Legal framework | Governed by Section 203 of the Income Tax Act, which deals with employment income and tax obligations. | Similarly rooted in Section 203, but aimed at tax deductions from non-salaried sources of revenue. |

You may also like: TDS vs TCS: Clearing the blur between these two indirect taxes

Bottomline

Form 16 and Form 16A serve distinct purposes in the Indian tax system. While Form 16 applies to TDS on salary, Form 16A covers non-salary income. Understanding their differences is essential for accurate tax filing, ensuring that all deductions are properly documented and verified for compliance.

FAQs

- Who is eligible for 16A?

Form 16A is for people who earn income outside of a regular salary. If you get interest from a bank, rent from tenants, or commissions from business, you’re eligible. It’s issued when tax is deducted from these payments. It applies to freelancers, landlords, and even small business owners.

- What is 16 and 16A?

Form 16 is for salaried employees. It shows the TDS your company took from your pay. It helps when you file your taxes. Form 16A is different. It covers tax deducted on income like rent or interest. Freelancers or people with side incomes get this one. Both forms are important for tax filing.

- What is the advantage of form 16A?

Form 16A helps you keep track of tax deducted from your non-salary income. It proves that tax has been paid on things like rent, interest, or commissions. It’s useful when you file taxes. You can match it with your Form 26AS to avoid errors. It makes the tax process smoother and keeps everything clear.

- What is form 16 form 16A and form 16B?

Form 16 is for salaried employees. It shows tax deducted from your pay. Form 16A deals with tax on non-salary income, like rent or interest. Form 16B is different. It’s for when you sell property and tax is deducted by the buyer. Each form covers specific situations to help with your taxes. They ensure everything is tracked and reported correctly.

- Is form 16 and salary slip different?

Yes, they are different. A salary slip shows what you earned, like your basic pay, allowances, and deductions, for a specific month. Form 16 is an annual document. It shows the total tax your employer deducted from your salary over the whole year. The salary slip helps you understand your monthly income. Form 16 helps with filing taxes.