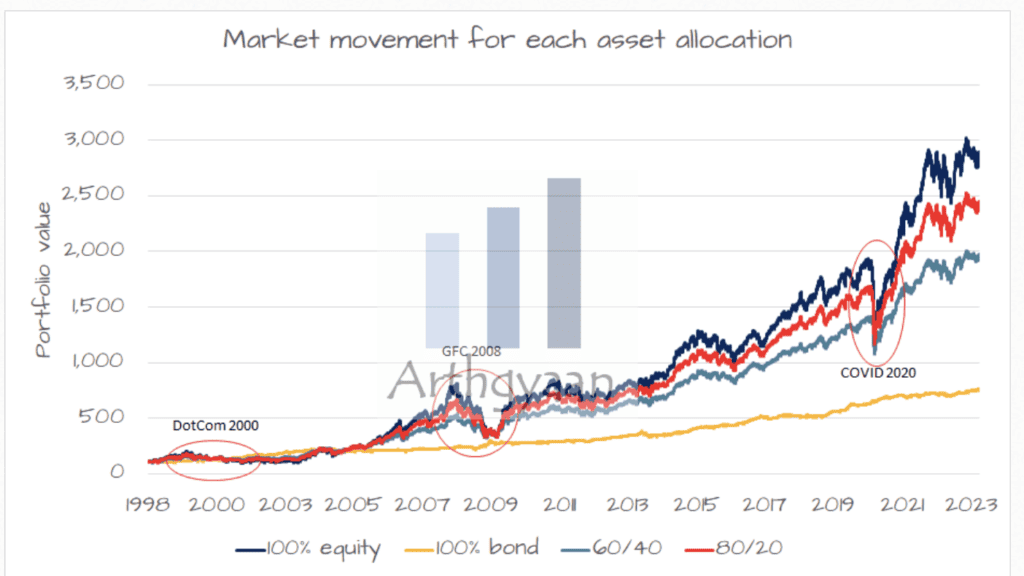

In a world of financial uncertainty where markets can be super volatile, government dated bonds are considered to be pretty stable and secure investments.

Often considered as one of the most dependable financial anchors, government dated bonds add a touch of predictability to an otherwise dynamic investment environment.

In this article, we’re going to understand what these bonds are, how they work, and whether they should find a place in your portfolio.

You may also like: Debt instruments in India: Understanding your investment options

What are government bonds?

Government bonds are debt instruments. This essentially means that you’re lending the money you’re investing to the government. This money is returned to you along with some interest. The Central and State governments in India issue several forms of these dated bonds including treasury bills, municipal bonds, etc.

Governments always need money to fund domestic projects. If taxes aren’t enough (like they frequently aren’t), the government needs to borrow money. This is primarily done through these bonds. When you invest in these government instruments, you are liable to receive interest on your investment regularly throughout the pre-specified term.

Since these bonds are backed by governments and involve central banks, they’re considered very safe and stable. These assets are not very volatile either.

Investing in dated government securities

Government bonds like these are issued for a varying range of tenures – anywhere from 5 to 40 years. These securities are called ‘dated’ because they have their date of maturity explicitly mentioned on them. Interest rates, calculated and decided by the RBI, might also be mentioned.

The ‘coupon rate’ as it’s called, is intimated to investors for each financial year in a range – for instance, 3.55% to 6.95%. For the financial year 2020-21, the interest rate ranged from 3.79% to 7.19% for securities issued by the Central Government with weighted average interest rate of 5.80%, and for the SDLs issued by the State Governments, the interest rate ranged from 4.15% to 8.96% with weighted average interest rate of 6.55%.

You don’t have to hold onto a government security till its maturity date once you purchase it. There are also secondary bond markets where you could trade them over-the-counter (OTC), etc.

Also Read: Government bonds in India – Meaning, types and features

Types of government dated bonds

Here are several types of dated bonds you could consider investing in:

- Savings bonds – These are non-transferable, non-negotiable, and issued in the name of the bondholder. Interest rates and tenure may vary.

- Fixed-rate bonds – These bonds offer fixed interest rates and are usually available in a 7-year tenure with the option of premature withdrawal.

- Floating rate bonds – Depending on the RBI’s repo rate, these bonds have variable interest rates. They are periodically revised and applied to investments.

- Inflation-indexed bonds – The government of India also offers bonds that are designed to protect investors’ money from inflation. The returns are adjusted to the Consumer Price Index (CPI).

- RBI sSavings bonds – These are non-tradable bonds issued by the RBI, meaning they can’t be bought or sold in secondary markets. They offer a fixed interest rate and have a lock-in period.

- Municipal bonds – Although these are not directly issued by the central government, municipal bonds are issued by local municipalities and are considered a form of government debt. They can vary from state to state.

- Government securities – These are highly tradable debt instruments issued by the central government and come in various tenures and have fixed interest rates. They are actively traded in the bond market and can be bought and sold by investors.

When should you consider investing in government bonds?

To extract the full benefit of government dated bond investments, you have to be a certain type of investor. Go through the characteristics below and observe if they apply to you:

- Safety, stability, and savings – Since government bonds are generally considered low-risk investments because they are backed by the government, they can be great investments if your primary concern is capital preservation and stability.

This is also true if you’re saving up money for a big future payment like a down payment. Since you’re basically guaranteed your money back, bonds can be a way of beating inflation in the meantime. - Tax efficiency – Bond investing also comes with tax advantages. Under Section 80CCF of the Income Tax Act, individuals can claim a deduction of Rs. 20,000 on tax-saving bonds owned by them.

This means that an investor reduces his taxable income by Rs. 20,000 in a year.

Note: Since tax laws are highly subjective, we encourage you to do your own research when it comes to filing your taxes. - Retirement planning or capital preservation – If you have a large sum of money that you want to protect from market volatility and ensure that it’s available when you need it, government bonds are the way to go.

Also Read: What are financial securities? Examples, types, and importance

Conclusion

It’s important to note that government bonds, while generally safe, may not offer high returns compared to assets like stocks or corporate bonds. Your returns also depend on which specific instruments you’re choosing to invest in and the rate that’s applicable to you.

Make sure that you research your investments and understand your risk appetite so you don’t lose out on better returns elsewhere. Good luck!