The goods and services tax, fondly known as GST, entered the Indian tax scene in June 2017. This revolutionary tax reform swept away the complexity of multiple indirect taxes, making life simpler for businesses and consumers alike.

This radical reform merged multiple indirect tax laws into one, creating a uniform tax system that benefited various sectors.

Since its inception, the GST Council has fine-tuned the rates several times. The 50th GST Council Meeting unveiled the latest moves on 1st July 2023.

What are GST rates?

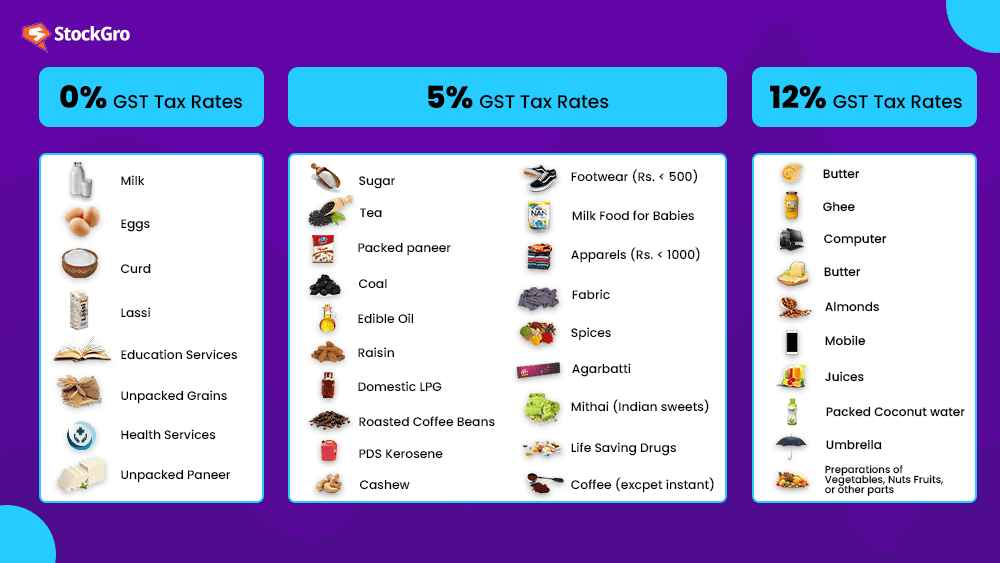

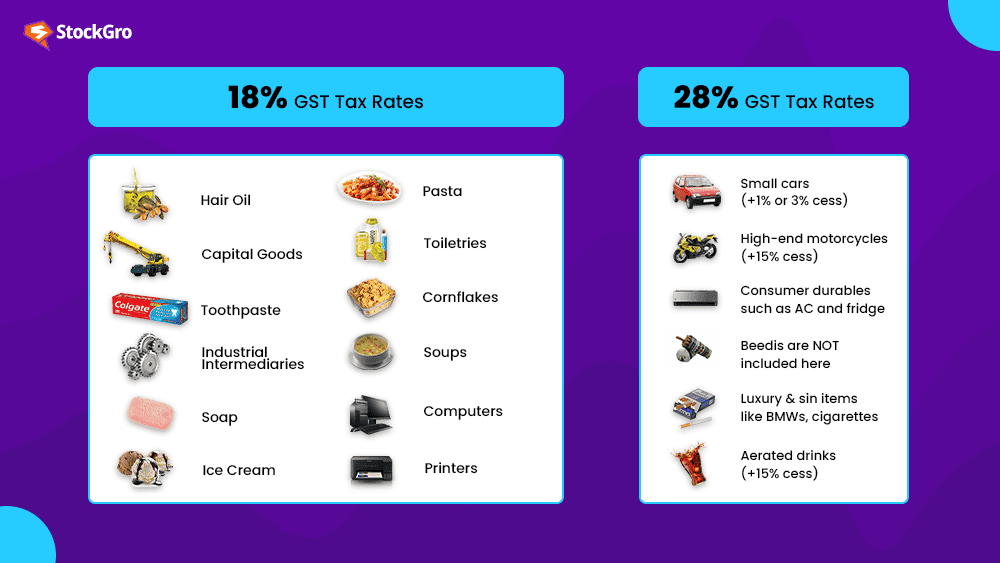

The GST Council, responsible for setting the GST rates, regularly reviews and updates them. Rates vary based on the nature of the product, with luxuries often bearing a higher burden than essentials. Currently, the GST rates in India are categorised into four slabs: 5%, 12%, 18%, and 28%.

- 05% – The Essentials: Think food, healthcare, and education.

- 12% – The Common Goods: Textiles, footwear, and essential services, for everyday use.

- 18% – The Middle Ground: Not luxury, not essential.

- 28% – The Luxury Lane: For the fancier stuff, not your everyday needs.

Certain items like cigarettes and motor vehicles come with an extra punch called “cess,” with rates ranging from 1% to a whopping 204%.

Over the years, GST rates have been a bit of a puzzle! With more than 500 goods and 100 services in the mix, there have been countless amendments. The goal? Eliminating duty issues, resolving classification headaches, and ensuring rates that benefit the public.

You may also like: What do the GST council’s decisions mean for your wallet?

Components of GST

Now, let’s meet the GST family members:

CGST: The Central Government’s tax on intra-state sales. It’s like a tax high-five within the same state – for example, a transaction happening within Maharashtra.

SGST: The state government’s tax on intra-state sales. Another tax high-five, but this time it’s within the state – for example, a transaction happening within Maharashtra.

IGST: The Central Government’s tax on inter-state sales. This tax crosses state borders – like a transaction from Maharashtra to Tamil Nadu.

Tax laws before gst: A taxing tale!

In the pre-GST era, the tax scene was chaotic, with various state and central taxes. It led to cascading taxes, making things a bit tangled. Each state had its own VAT rules, and inter-state sales faced the dreaded CST with overlapping taxes creating a cascading effect.

Here’s the list of pre-GST taxes:

| Central Excise Duty | State VAT |

| Duties of Excise | Central Sales Tax |

| Additional Duties of Excise | Purchase Tax |

| Additional Duties of Customs | Luxury Tax |

| Special Additional Duty of Customs | Entertainment Tax |

| Cess | Entry Tax |

Taxes on advertisements, lotteries, betting, and gambling

Now, GST (CGST, SGST, IGST) comes to the rescue!

Under the new regime, the tax structure will typically look like this:

| Transaction | New Regime | Old Regime | Revenue Distribution |

| Sale within the State | CGST + SGST | VAT + Central Excise/Service tax | The revenue will be divided equally between the Centre and the State. |

| Sale to another State | IGST | Central Sales Tax + Excise/Service Tax | Inter-state sales will have only one type of tax (central), and the Centre will distribute the IGST revenue based on the goods’ destination. |

HSN and SAC system

The HSN (Harmonized System Nomenclature) code system classifies goods, while the SAC (Services Accounting Code) system does the same for services under GST. The HSN code, internationally accepted for customs tariffs, plays a crucial role in GST classification, alongside the SAC code for services.

Every product and service has a secret code – either HSN (Goods) or SAC (Services). These codes classify them into the five tax slabs.

Also Read: A closer look at India’s latest Q4 GDP data: Key takeaways

The GST rates in 2023

The following are some of the changes that were made-

| Category | Old GST Rates | New GST Rates |

| Railways Goods and Parts under Chapter 86 | 12% | 18% |

| Pens | 12% | 18% |

| Metal Concentrates and Ores | 5% | 18% |

| Certain Renewable Energy Devices | 5% | 12% |

| Recorded media reproduction and print | 12% | 18% |

| Broadcasting, sound recordings, and licensing | 12% | 18% |

| Printed material | 12% | 18% |

| Packing containers and boxes | 12% | 18% |

| Scrap and polyurethanes | 5% | 18% |

Decrease in the GST rates

| Category | Old GST Rates | New GST Rate |

| If vehicles are equipped with retrofitting kits for disabled people, | Applicability | 5% |

| Keytruda for cancer | 12% | 5% |

| IGST is levied on goods sold at the Indo-Bangladesh border | Applicability | NIL |

The good and the bad of GST

Advantages of GST:

- Streamlined Taxation: One tax to rule them all, making life easier for businesses and people.

- Boost to the Economy: GST fuels business growth and better tax compliance, good for the economy.

The Disadvantages of GST:

- Initial Hiccups: A rocky start with some issues, but every new thing needs some adjustments.

- Complex Structure: Simplified but still complex, businesses need to adapt to the new tax.

Also Read: Gold vs Equities- Which is the right investment option?

Over the years, GST rates have undergone numerous changes to resolve issues, expand the tax base, and support public interests. Despite the challenges, the GST treasury has shown consistent growth, barring the global setback caused by the COVID-19 pandemic in 2020.

That’s a peek into the world of GST and its fascinating rates. So, the next time someone talks about GST rates, you’ll be armed with tax wisdom!