IGST, or Integrated Goods and Services Tax, is a core component of India’s taxation system. It is like a bridge toll for goods and services crossing state borders. So, integrated GST ensures everything is fair and transparent in interstate trade.

In this article, we will study the fundamentals of IGST, its calculation, implications, and how it impacts businesses and consumers.

What is IGST?

IGST’s full form is Integrated Goods and Services Tax, and it is a part of India’s tax system. It is essential to understand because it affects how goods and services are taxed when they move between different states within the country. When goods or services are sold from a single state to another, IGST is applied to ensure that taxes have been collected and distributed properly between the states.

You may also like: What do the GST council’s decisions mean for your wallet?

Scope and features of IGST

- Interstate transactions: IGST applies when goods or services move from one state to another within India.

- Uniform tax rate: IGST maintains a consistent tax rate across India for such transactions.

- Input tax credit: Businesses can claim credit on the tax paid on inputs, reducing their tax burden.

- E-commerce: IGST applies to online purchases from other states, fostering e-commerce growth.

Key components of IGST

Integrated Goods and Services Tax (IGST): IGST is collected on the sale of goods and services that cross state borders within the country. IGST simplifies taxation for businesses involved in interstate trade by ensuring a uniform tax rate and efficient tax collection.

Destination-based tax: The tax is applicable in the state where the goods or services are ultimately used by the end customer. This ensures that the tax revenue is allocated to the state where the final consumer resides.

Input Tax Credit (ITC) mechanism: Businesses engaged in interstate transactions can demand Input Tax Credit (ITC) under IGST. It allows them to offset the GST paid on inputs and services against their final tax liability. The ITC mechanism prevents double taxation.

Revenue sharing and GST council: The revenue generated through collection of the IGST is distributed between the central and state governments. GST Council governs the distribution of the revenue generated. This council comprises representatives from both central and state governments.

Also read: Understanding GST: The tax superhero of India

IGST payment and refund

IGST is calculated on the value of the goods and services being supplied. It is calculated as the sum of the Central Goods and Services Tax (CGST) and State Goods and Services Tax (SGST) or Union Territory Goods and Services Tax (UTGST), as applicable.

The formula for calculating IGST is:

IGST = (Value of goods + freight + any other charges) x IGST rate

| IGST percentage | 5% | 12% and 18% | 28% |

| Goods | Many essential items fall under this category, such as food items, books, etc. | Various goods, including electronics, industrial items, and processed foods, are taxed at these rates. Such goods are usually considered less essential. | Luxury items and goods like high-end cars, electronics, and certain beverages are taxed at this highest rate. |

| Services | Services include transportation, small restaurants, and some healthcare services. | Services like hotels, telecom, and financial services may have these rates, depending on their specifics. | A few services, like entertainment events, may attract this higher rate. |

IGST Refund:

Input Tax Credit (ITC): Under IGST, businesses can demand Input Tax Credit (ITC). It means that when they purchase goods or services for their business, they pay GST. They can offset this GST paid against the IGST liability on their sales. If the ITC is higher than the IGST liability, a refund is generated.

Refund application: Businesses must file a refund application with the appropriate authorities to claim a refund. They must provide necessary documentation, including invoices, to support their claim.

Verification and approval: Tax authorities review the refund application and validate the ITC claim. Once approved, the refund amount is processed back to the business.

Timely filing: It is crucial to file refund applications quickly to avoid delays. The government has specific timelines for processing refunds.

Also read: Unlocking tax benefits: Your guide to section 80GG deductions

IGST example

Say you have an online business of selling mobile phones, and you are based in Delhi. You received an order from a customer in Mumbai. Here’s how IGST and its calculation work in this scenario:

Tax Rate: The government has set a GST rate for mobile phones at 18%. This is the tax rate applicable to your product, and it is the same all over India.

Value of Supply: You sell a mobile phone for ₹ 20,000, and the customer pays an additional ₹ 500 for shipping. So, the total value of supply is ₹ 20,500.

IGST Calculation: To calculate IGST, you simply multiply the tax rate (18%) by the value of supply (₹ 20,500).

IGST = 18% of ₹ 20,500 = ₹ 3,690

So, in this case, you would need to charge your Mumbai customer ₹ 3,690 as IGST on top of the cost of the mobile phone.

Now, here’s where it gets interesting:

Input Tax Credit (ITC): Let’s say you had previously bought mobile phones worth ₹ 10,000 from a supplier in Bangalore. When you purchased those phones, you paid 18% GST on them, which amounts to ₹ 1,800.

Refund: Since you have already paid GST on your purchase, you can claim that amount as an Input Tax Credit (ITC) against the IGST you are supposed to collect from your Mumbai customer.

IGST to Collect = ₹ 3,690

ITC Available = ₹ 1,800

Now, you only need to pay the remaining amount of IGST, which is ₹ 3,690 – ₹ 1,800 = ₹ 1,890. This amount is what you will need to remit to the government.

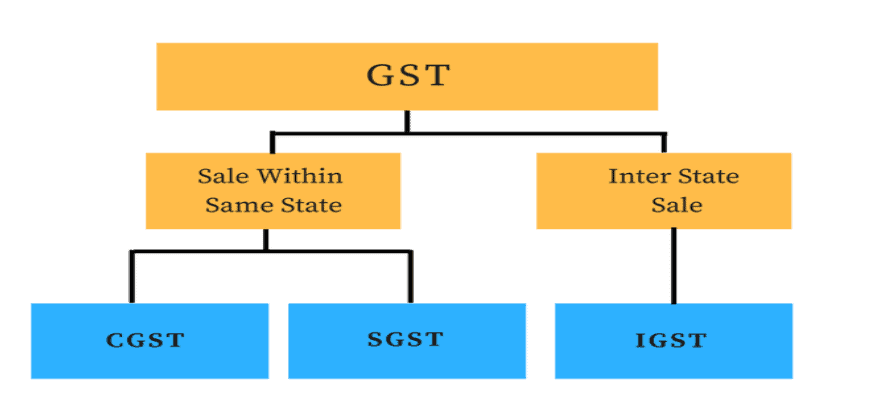

Difference between CGST, SGST and IGST

Source: CBIC

| Factors | CGST | SGST | IGST |

| Applicable | It applies to transactions that take place within the same state. It is known as intra-state transactions. | It is applicable when buyer and seller are located in the same state. It is known as intra-state transactions. | It is applicable to transactions that occur between different states. It is known as inter-state transactions. |

| Collected by | Tax collected by the Central Government | Tax collected by the State Government | Tax collected by the Central Government, but is later apportioned between Central and State. |

| Use of revenue | The revenue collected is used to fund various national programs and initiatives. | The revenue collected is used for state-level development projects and programs. | The revenue is shared between central and state based on the destination of the end user. |

| Tax rate | Determined by the Central Government | Determined by the State Government in coordination with the Central Government. | Single tax rate system is followed for inter-state transactions. |

Bottomline

In conclusion, IGST is a vital component of the GST system in India, streamlining taxation for interstate transactions, ensuring uniformity, and facilitating the ideal movement of goods and services across state boundaries. It also promotes fair revenue distribution between the central and state governments, contributing to the overall efficiency and equity of the tax system.

Never miss an opportunity! Get daily trade calls and real-time stock alerts from SEBI-registered experts. Download StockGro app now!