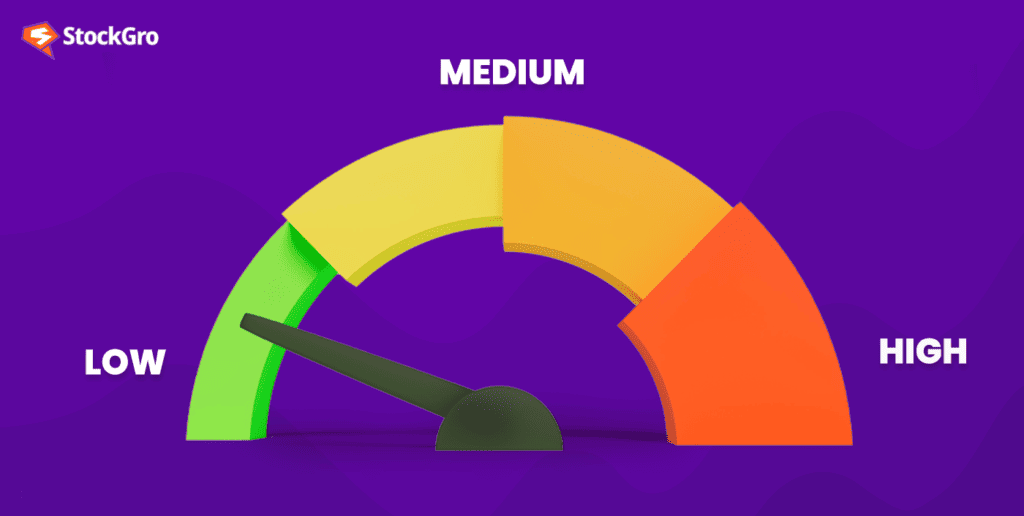

A balanced portfolio contains the right amount of investments in equity and debt. The investors should have a balanced portfolio to manage their risks and rewards well.

Investing heavily in equity stocks may be rewarding but is risky as the share prices and dividends depend on various market conditions.

On the other hand, debt investments are relatively safer, but their returns are low, too.

While it is true that debt investments are lower in risk, they are not risk-free.

What is interest rate risk?

Interest is the price paid on debt to lenders at regular intervals, over and above the repayment of the principal amount.

Interest is a reward for the lender’s risk-taking ability.

The initial rates are influenced by the Reserve Bank of India (RBI). Later, external forces like demand and supply determine the rates.

Interest rate risk refers to the risk of reduced bond prices due to fluctuation of interest rates in the market.

You may also like: What does Secured Overnight Financing Rate (SOFR) mean?

Bond prices and interest rates

Interest rate risks are primarily caused by the inverse relationship between interest rates and bond prices.

Bonds are issued with a fixed rate of interest. However, the market rates are not fixed. They keep fluctuating based on economic conditions.

Let us assume a scenario where the rate of interest in the market goes up.

So, the existing bondholders receive lower interest rates than the market.

The lower income leads to a reduction in the market value of the bond.

When investors want to sell these bonds in the secondary market, they may have to sell them at a loss.

Buyers in the market have better options with higher rates, which makes the existing bonds less attractive.

This fall in the price of bonds due to fluctuating rates in the market is called interest rate risk.

Types of interest rate risks

While we have various kinds of interest rate risks, the two common types are:

- Price risk – The risk of bond prices fluctuating, making it difficult to trade in the secondary market.

- Reinvestment risk – The risk of losing the opportunity to reinvest the money earned at current interest rates.

Mitigating interest rate risk

Bonds held until maturity do not bear the brunt of changing interest rates severely. The impact is more on holders who wish to trade their bonds on the stock exchange.

Some of the options below help in interest rate risk management:

- Diversification – One of the easiest ways of mitigating interest rate risks is to maintain a diverse portfolio with a blend of equity and debt. Investors who would like to keep their portfolios free of equity investments can invest in debt instruments offering different features.

Also Read: How does the US Fed’s interest rate pause impact global markets and India?

For example – An investor can maintain a balance between short-term and long-term debts. While long-term debts cater to stable income, short-term debts offering higher interests and less prone to fluctuations can mitigate the risk.

- Hedging – The process of making another investment to make good for the loss of previous ones is called hedging.

To hedge the risk of interest rates, below are some investment options:

- Forward Rate Agreements (FRA) – An understanding between two parties to pay a predetermined interest on a specified future date. The preset rate is based on the prevailing market rate and reference rates.

- Interest rate swaps – Swaps are derivatives where two parties agree to exchange their cash flows. Under interest rate swaps, two parties with different kinds of interest rates enter into an agreement to swap their returns.

For example: An investor with a fixed interest rate speculates an increase in market rates. Another investor with floating interest rates assumes that the market rate will decrease.

In order to mitigate the potential loss, they agreed to swap their interest rates. So, if the market rate increases, the first investor benefits from the floating rate. If the market rate decreases, the second investor benefits from the fixed rate.

- Investing in floating rate bonds – For investors apprehensive about interest rates in the market, floating rate bonds are ideal. These bonds alter their interest rates periodically according to market conditions. Reference rates like LIBOR (London Interbank Offer Rate), MIBOR (Mumbail Interbank Offer Rate), etc., are the basis for floating rate bonds.

Interest rate risk in banks

Banks are one of the major sectors that get impacted due to changing interest rates.

Banks receive deposits from customers and pay interest periodically. The deposits are then lent as loans to other customers. Banks receive interest payments from borrowers.

The difference between interest payment and interest receipt is the bank’s income.

When the interest rate for debts increases, the gap between interest paid and received widens, helping banks make more profits. Similarly, when the market interest rates for debts decrease, the gap shrinks and lowers the bank’s profits.

Also Read: The role of compound interest to reach your financial goals

In cases where the market rate for debts goes too high, the number of people borrowing from banks decreases. This again impacts the banks and lowers the income.

Interest rate risk example

Investor A invests in a bond with the following features:

Face value: ₹100 Interest rate: 10% p.a Duration: 10 years

After two years of holding the bond, the market interest rate increases to 12%. But A’s bond being a fixed-interest security, receives 10%.

He tries to trade the security in the secondary market. Buyers negotiate with him to buy it at a lower price because other bonds offer 12% p.a. This makes A’s bond less attractive, hence, he sells it at ₹95, incurring a loss of ₹5.

Bottomline

Interest rate risk is an inherent feature of all debt securities. Unless the holder decides to hold bonds until maturity, the prices are bound to be impacted by interest rates.

Hence, it is essential for debt investors to have a thorough knowledge of various options available to hedge risks. It helps with risk mitigation and opens other avenues for investors, making their investment journey more exciting.