If you’ve been keeping an eye on the financial headlines, you might have come across the recent news of ITC’s skyrocketing market capitalisation, reaching a staggering Rs 5.50 trillion and surpassing industry giants like Infosys, State Bank of India, and HDFC. That’s enough to make any investor’s heart skip a beat!

Now, you might be wondering, What does market capitalisation even mean, and why should I care? Whether you’re an active trader or a savvy investor, market capitalisation is a term you’ll frequently encounter in the realm of stocks. It holds the key to understanding the true value and ranking of a publicly traded company.

Let’s dive right into it!

Understanding market capitalisation

To put it simply, market capitalisation (or market cap, as the cool kids call it) is the sum total of a company’s value, and it’s calculated by multiplying the current market price of each share by the total number of outstanding shares.

Market capitalisation is a vital metric for investors to assess a company’s value and make informed investment decisions. By calculating the market cap, investors can gauge the size and potential returns of a company’s stock.

To grasp the concept of market capitalisation, it’s essential to understand two key terms: market value and outstanding shares.

Market value refers to the value of each share of a company, which is determined by the demand and supply in the market. When demand exceeds supply, the market value increases, and vice versa. As market values fluctuate over time, market capitalisation is also subject to change.

Outstanding shares represent the number of shares issued by a company and available for trading. It’s important to note that outstanding shares may differ from the total shares authorised by the company.

Some shares may be held by the company’s promoters or founders instead of being publicly traded. Therefore, when calculating market capitalisation, only the shares that have been issued to the public are considered.

You may also like: From runway to the red carpet: The remarkable journey of Priyanka Chopra Jonas

Market capitalisation formula

To calculate the market cap of a company, we’ll need two key ingredients: the number of outstanding shares and the market value of each share. Ready for the magic formula? Here it is:

Market cap = number of outstanding shares x market value of each share

Let’s dive into an example to make it crystal clear:

Imagine company A decides to let loose 1 lakh shares to the public. The market value of each share stands tall at Rs. 250. Multiply the number of outstanding shares (1 lakh) by the market value per share (Rs. 250), and the market capitalisation of company A pops out at Rs. 2.5 crores!

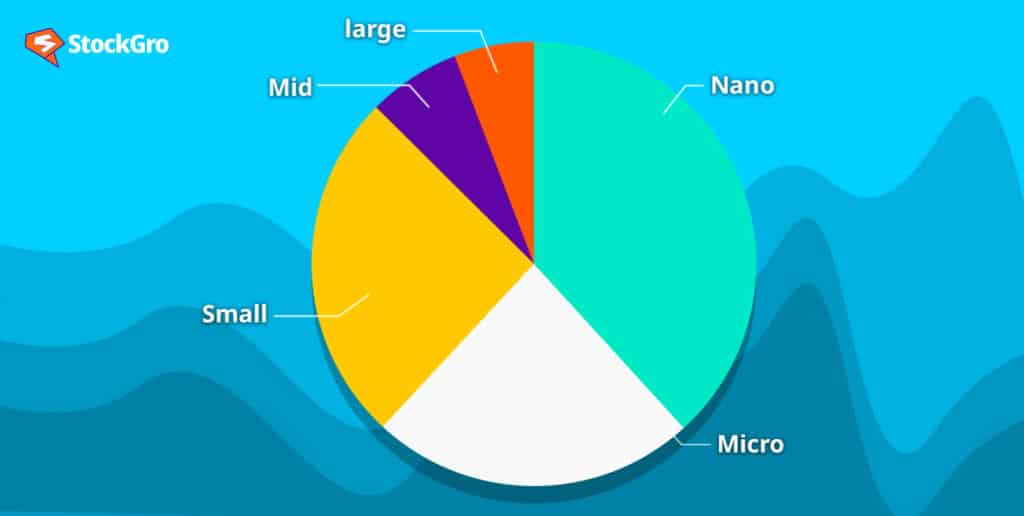

SEBI’s market capitalisation categorisation

The Securities and Exchange Board of India (SEBI), the governing body of the capital markets, has laid out a classification for companies listed on the stock exchange based on their market capitalisation. Let’s take a closer look at SEBI’s categorisation:

Large Cap companies

Large-cap companies are the stalwarts of the business world. They are well-established, reputable, and typically dominate their respective markets. These companies boast a market capitalisation of INR 10,000 crore or more.

Investing in large-cap stocks comes with low risk due to their low volatility. However, their growth potential tends to be relatively modest. Top large-cap companies based on their market cap:

| Company Name | Market Cap (Rs. cr) |

| Reliance | 1,676,071.10 |

| TCS | 1,203,425.41 |

| HDFC Bank | 896,744.11 |

| ICICI Bank | 661,980.30 |

| HUL | 633,402.81 |

Mid Cap companies

Mid-cap companies fall within the market capitalisation range of INR 2,000 crore to INR 10,000 crore. These companies offer a middle ground in terms of risk and growth potential. While their stocks are more volatile than large-cap stocks, they also present higher growth prospects.

Top mid-cap companies based on their market cap:

| Company Name | Market Cap (Rs. cr) |

| Aditiya Birla Capital Ltd AB Capital | 40,757.77 |

| ABB India Ltd | 85,462.65 |

| Abbott India | 46,391.79 |

| Adani Wilmar | 56,178.61 |

| Aditya Birla Fashion & Retail Ltd | 19,602.49 |

Small Cap companies

Small-cap companies operate on a smaller scale and consequently have lower market capitalisation, which is less than INR 2,000 crore. Stocks of small-cap companies carry significant growth potential but come with high volatility, making them the riskiest option for investors. Top small-cap companies based on their market cap:

| Company Name | Market Cap (Rs. cr) |

| Aarti Drugs | 4,357.76 |

| Aegis Logistics | 11,165.31 |

| Affle India | 13,143.22 |

| Alkyl Amines | 12,575.35 |

| Alok Industries | 6,777.55 |

What are the factors which impact market caps?

Let’s dive into the factors that can influence the market cap of a company.

- Demand for products/services:

It can make or break a company’s market cap. The higher the demand for a company’s products or services, the more likely its market cap will soar to new heights.

- Market fluctuations:

Market fluctuations, whether industry-specific or driven by an overall economic downturn, have a significant impact on market caps. The tides of the market can either lift a company’s market cap to new heights or bring it crashing down.

- Warrants and their effects:

Exercising warrants on a company’s stocks can have a considerable influence on its value. This exercise can sometimes lead to a reduction in market cap, like a sudden twist in a thrilling tale.

- Competitor performance:

The performance and innovation of rivals can either elevate or diminish the financial worth of a company. A strong competitive landscape may impact investors’ perceptions of a company’s growth potential and subsequently affect its market cap.

- Corporate Actions:

Companies can make strategic moves that impact their market capitalisation. Share buybacks, rights issues, bonus shares, or stock splits can lead to changes in the number of outstanding shares, potentially altering the company’s market cap.

Also Read: A closer look at India’s latest Q4 GDP data: Key takeaways

Importance of market capitalisation

You know what they say: size matters. Well, when it comes to the stock market, it definitely does. That’s where market capitalisation swoops in, like a financial superhero, to save the day and help investors make smarter decisions.

Market capitalisation plays a crucial role in financial analysis, offering valuable insights for investors. It allows for:

- Universal method: Market cap is a widely accepted global method to evaluate companies, making it easier for investors to understand a company’s value across different locations and economies.

- Precise evaluation: While market conditions can be unpredictable, the market cap provides a precise evaluation method, aiding investors in assessing the risk associated with investing in a company.

- Impact on indices: Market cap determines the weight of companies in stock market indices, with higher market cap companies having a greater impact.

- Facilitating comparisons: Market cap allows for convenient comparisons between companies, aiding in understanding their size and associated risk.

- Balancing portfolios: Maintaining a balanced portfolio involves considering market cap and investing in top companies while also exploring high-risk opportunities in developing enterprises.

Also Read: Margin trading: Exploring the risks and rewards

However, it’s important to note that market cap evaluation doesn’t consider a company’s debt, financial liabilities, or various types of returns, such as stock splits or dividends. Nonetheless, market capitalisation remains a vital metric that enables investors to gauge the value and potential of a company’s shares in the dynamic world of finance.

So, the next time you consider investing, ask yourself: What does the market capitalisation reveal about the company’s size and potential?