The time value of money is a double-edged sword. It can be cruel to wipe out the value of your idle money, but it can also compound your investments in the long-term. Inflation is driven by the concept of the time value of money.

Investors have a rationale that selling their investment in the long-term may benefit them with higher returns as the value of investment in future would increase. So, these gains are retained when the investor pays less tax on it, else they would, on average, only gain the sum, which they paid and no extra benefit.

In this view, some investments provide benefits to tax on inflation-adjusted returns. It is known as the indexation benefit. Let’s understand its meaning, features, calculation and path ahead.

Check this out! Unlocking financial literacy tips for buying, maintaining, and selling homeownership

What is indexation?

The technique to adjust investment cost, as per the inflation factor, is known as indexation. It benefits long-term investors, as it inflates the cost and reduces the perceived gain. It eventually attracts lower taxes. This technique is legal and is a strong motivation for investors.

Long-term investments, like real estate, gold, mutual fund units, bonds, etc, would benefit the investors from inflation when otherwise, their money is losing its value. It is also the reason why investors have such investments to hedge their gains overall.

Every nation has its benchmark inflation factor for calculating this indexation benefit. In India, this inflation factor is the Cost Inflation Index (CII). It is released per annum by the Central Board of Direct Tax (CBDT). The CII for FY 2023-24 was 348. The CII for FY 2024-25 is 363.

Indexation ruled out in Budget 2024-25

Budget 2024 presented a bitter surprise for long-term investors. It removed the indexation benefit from certain asset classes, and real estate and gold were part of it. Moreover, the capital gain rates were changed.

Investors did not seem happy with these verdicts. This effect was visible in the NIFTY Realty index. It fluctuated during the day and closed down by 2.3% on July 23, 2024. Similarly, weakness was evident in real estate stocks. Godrej Properties plunged by 2.7%, Macrotech Developers (Lodha) by 4.7%, and DLF by 2.7% on the budget day.

Some indexation changes of budget 2024-25 were as follows:

- Previously, rates on bonds and debentures were 20% without indexation. Now, it changed to 12.5% for listed debt securities, and unlisted debt securities were charged as per tax slab rates.

- The duration for the long-term would be more than 24 months.

- Indexation on gold, property and other unlisted assets was removed, and LTCG rates were 12.5%.

Also, read: Is real estate growth in India sustainable? Opportunities vs Challenges!

Let’s understand with an example!

Mr Rakesh purchased a house in August 2006 for ₹20 lakhs when CII was 122. He further sold this property in September 2012 for ₹30 lakhs, when the CII was 200.

| Particulars | With Indexation | Without indexation |

| Acquisition Year | 2006 | 2006 |

| The sale year | 2012 | 2012 |

| Acquisition Price | ₹20 lakhs | ₹20 lakhs |

| Sale Price | ₹30 lakhs | ₹30 lakhs |

| CII 2006 | 122 | – |

| CII 2012 | 200 | – |

| Inflation index | 0.61 (122/200) | – |

| Final/Indexed cost of acquisition | ₹12.2 lakhs (₹20 lakhs*0.61) | – |

| Taxable capital gain | ₹7.8 lakhs (₹30 lakhs-₹12.2 lakhs) | ₹10 lakhs(₹30 lakhs-₹20 lakhs) |

| Tax rate | 20% | 12.5% |

| Tax liability | ₹1.56 lakhs | ₹1.25 lakhs |

Recent amendments

The indexation and tax changes made in the budget 2024-25 were not accepted well by the citizens. So, when the finance bill was introduced in Lok-Sabha, after much discussion, some amendments were made. It was regarding the indexation benefits restoration on immovable property (real estate). Property sellers who have acquired property before July 23, 2024, will have the following options:

- They can either charge a 20% tax on long-term capital gains with indexation benefits or

- They can charge a 12.5% tax on long-term capital gains without indexation benefit.

Bottomline

Indexation is a strategy that accounts for inflation and helps reduce the base of the long-term gains for taxation. It works as a motivation for investors to stay invested for the long-term and reduces the risk of market volatility in some sectors.

Government norms regarding taxation immensely affect investor’s motives. The indexation benefit removal for some asset classes, like real estate, in the budget 2024-25 could be a disincentive for the investors to stay invested in the long-term, and more inclination towards short-term investing can create fluctuations in the market.

Hence, the recent amendments have the potential to benefit real estate investors.

Must read: How to do tax planning for high-income earners?

FAQs

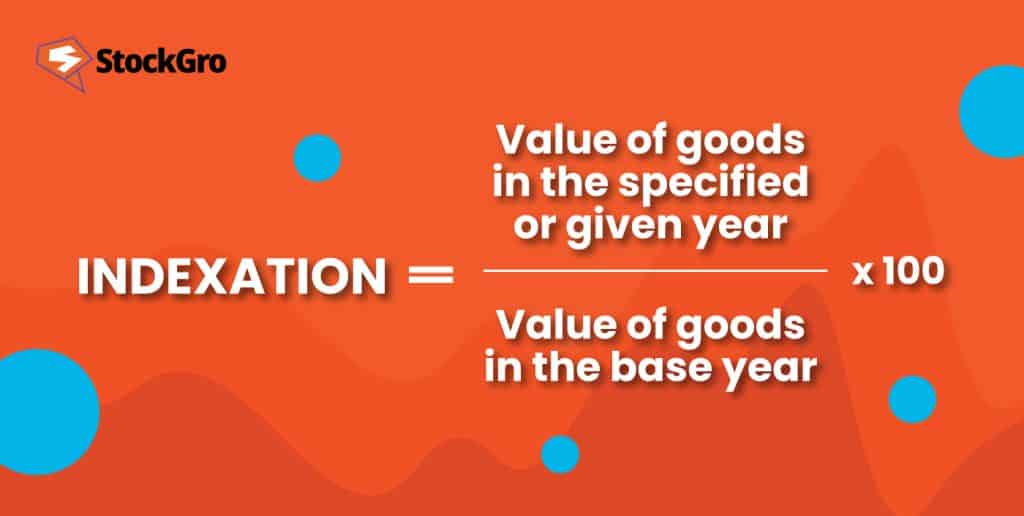

Q1. How is indexation calculated?

Indexation is a technique that considers the effect of inflation on the cost of acquisition. One can calculate indexation based on the inflation factor mandated by a particular country. In India, the Capital Inflation Index (CII) is used. Your indexation would be as follows:

- Indexation factor = CII in purchase year/CII in selling year.

- Indexed cost of acquisition = Indexation factor * cost of acquisition

- Final gain after indexation = Sale value – the indexed cost of acquisition

Q2. What is a tax with and without indexation?

The indexation benefit was removed from the 2024-25 budget for certain asset classes like real estate. As per the new amendment after the passing of the Finance Bill in the Lok Sabha, the indexation benefit is restored. Now, the assessee is provided with two options for long-term capital gain tax as follows:

- With indexation, the rate would be 20%

- Without indexation, the rate would be 12.5%

Q3. What is the difference between indexation and inflation?

Inflation is the rise in prices due to a reduction in the value of money over some time. Indexation is a technique which accounts for this inflation. The indexed price is always after multiplying the original price with the inflation index. Hence, the difference is that inflation is the base phenomenon for indexation.

Q4. Can you explain indexation with an example?

Indexation safeguards the investors from inflation effects. Understand it with this example:

Ms K purchased a property for ₹10 lakhs in 2016 and sold it for ₹20 lakhs in 2020. The inflation factor is 1.6 (assumptions). So the indexed cost of acquisition would be ₹16 lakhs.

Thus, it would reduce the capital gain from ₹10 lakhs to ₹4 lakhs.

Q5. Is capital gain tax-free?

No, only the long-term capital gain under the limit of ₹1.25 lakhs is tax-free.

- Short-term capital gain tax is 20% for equity and related funds, while other assets are taxed at slab rate.

- Long-term capital gain tax is 12.5% for all the asset classes except debt-oriented funds, where tax is the slab rate.

- Real estate, gold, and other unlisted assets capital gains tax rates are the same as above. Only the indexation benefit is removed.