Net Asset Value (NAV) is a term used to express the value of a company by taking the total assets and reducing the total liabilities from it.

For mutual funds or exchange-traded funds (ETF), NAV depicts the fund’s value at a specific moment. It’s a crucial term when examining mutual funds, ETFs, and indexes. To engage with these assets, one needs an investment account.

What exactly is the net asset value of a mutual fund?

The difference between assets and liabilities of any business entity or financial item is referred to as “net assets” or “net worth” or “capital.” NAV becomes important in fund valuation and pricing.

It shows the result when the difference between assets and liabilities is divided by the number of shares or units held by investors. This division gives a “per-share” value, making it easy to price and trade a mutual fund’s stock.

NAV (Net Asset Value) in mutual funds is like the price of a portion of a dish. Just as a dish’s price is the total cost of its ingredients, a mutual fund’s NAV is the total value of its investments (stocks, bonds, etc) divided by the total number of units.

So, NAV gives you the value you get for each unit of the mutual fund you own.

How is NAV calculated?

NAV or Net Asset Value is the per-share price of a mutual fund, showing how much one share of the fund is worth. Here’s how it’s calculated:

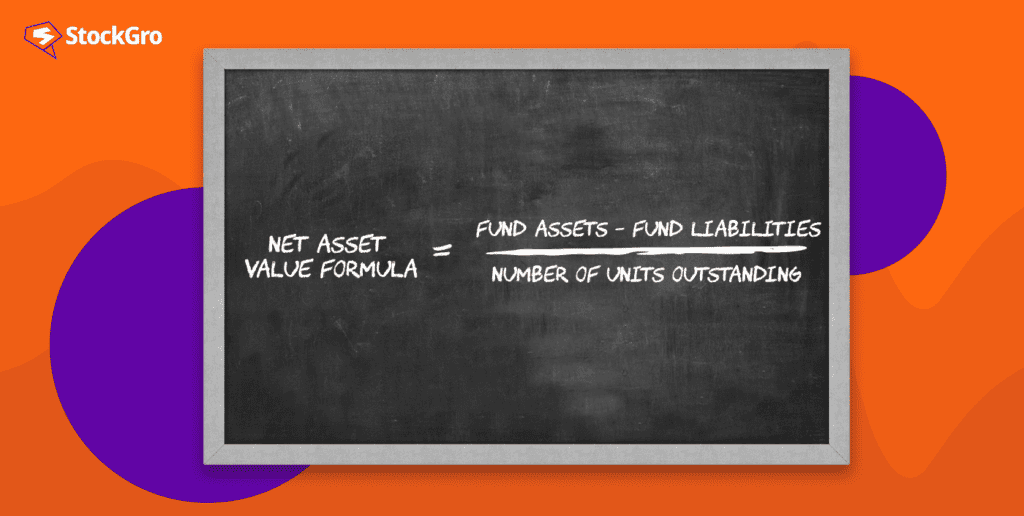

Formula: NAV = (Assets – Liabilities) / Total Shares

Let’s understand this with simple words:

- Assets: This is the total worth of the fund. It includes the market value of investments, money to be received, and other valuable things the fund owns.

- Liabilities: This is what the fund owes, like unpaid bills.

- Total Shares: This is the total number of fund shares that investors own.

Now, to calculate NAV, you take the total assets, subtract the total liabilities, and then divide by the total shares.

Example: Suppose there’s a fund named ABC Fund. The total assets are Rs. 180 lacs, liabilities are Rs. 1 lac, and there are 10 lacs shares. Now, using the formula, NAV = (180 lacs - 1 lac) / 10 lacs = Rs. 17.90 per share. So, each share of ABC Fund is priced at Rs. 17.90.

You may also like: Understanding AUM: Mastering financial skills

The relationship between NAV & mutual funds

Investors pool their money to form a mutual fund. This money is used to buy a variety of stocks and other financial products. Each investor gets a share of the fund according to the money they put in. They can sell their share later and keep the profit or bear the loss.

To manage the buying and selling of shares, there is a pricing system based on NAV (Net Asset Value). NAV is the price of one share in the mutual fund. The price of the mutual fund changes with the change in NAV per share (NAVPS).

Mutual fund prices don’t jump up and down every second like stocks do. They get a new price only at the end of the day. Think of it like taking a photo of a busy street only once a day to see what’s changed.

When the day ends, the fund looks at all its financial dealings—money, investments, and incoming dues. Then, it subtracts what it owes, like bills or loans, to find out what’s left. This left-over amount is the treasure (net asset).

Let’s say, a fund’s treasure is 500 crore rupees and there are 10 crore shares. So, each share gets a value of 50 rupees.

Our fund bought pieces of big companies like TATA and Reliance. The value of these pieces changes every day. At the end of the day, the fund looks at the new total value and distributes it among all the shares again to find the new value per share.

So, if you own a share in this mutual fund, this new value (called NAV) tells you the current value of your share. If the NAV goes up, your share value goes up. If it goes down, your share value goes down. This way, you know how your share is doing through the NAV.

When is NAV calculated?

Mutual Funds release their Net Asset Value (NAV) every day after the market closes, unlike shares whose prices can change every minute during market hours. The NAV tells you the price at which you can buy or sell units of a mutual fund. The calculation is based on the closing market value of the securities in the fund.

As per SEBI Mutual Fund rules, each scheme follows a cut-off schedule to report NAVs, depending on the type of transaction.

Also Read: Mutual funds or stocks: Which is a better investment?

Let’s explore the cut-off timeline:

Transaction type – purchase / SIP installment

- If a transaction is received and money reaches the mutual fund before the cut-off time, your mutual fund units are allotted on the same day.

- If a transaction is received after the cut-off time but the money reaches before, you get the units on the next business day.

- If a transaction is received before the cut-off time but the money reaches after, you get the units on the next business day when the funds are received before the cut-off time.

Transaction type – Inter-scheme switch transaction

- For a switch-out transaction received before the cut-off time, your units are allotted at the same day’s NAV.

- For a switch-in transaction, when the money is received, the NAV of that business day is applicable. This should match with the redemption payout of the switch-out scheme and reach before the cut-off time in the switch-in scheme.

This way, the NAVs are determined and disclosed daily, keeping in line with the SEBI’s rules and the mutual fund’s cut-off schedule.

What does a high or low Nav indicate?

A high NAV (Net Asset Value) often suggests that the mutual fund has performed well previously or has been around for a longer time.

However, it’s a misconception to think a high NAV fund is expensive and gives less return, and a low NAV means the fund is cheap. The truth is, NAV doesn’t tell you whether the fund is expensive or cheap. It merely shows the market value of all the fund’s net assets per share.

So, a high or low NAV doesn’t affect the fund’s potential to earn returns. For instance, whether a fund’s NAV is Rs 10 or Rs 100, it doesn’t affect how well the fund can perform in the future.

Ignoring a scheme just because its NAV is high is like penalizing it for having done well in the past. NAV is not priced by market demand-supply forces but by the asset size of the fund, which is linked to the amount of investments it holds. So, it can’t be overpriced or undervalued.

Also Read: How to compare stocks? Explore the various tools available.

Conclusion

Many people equate a mutual fund’s net worth (NAV) to a stock’s price, assuming lower NAV funds are more affordable and thus, better. However, there’s no link between a mutual fund’s NAV and its performance. A low net worth of a fund doesn’t make it a bad investment choice.

For a mutual fund to be significant, it should reflect how its underlying assets have performed over time. Investors, when choosing funds, should not only look at the NAV but should assess other factors like the fund’s past performance and current cost of capital.

Knowing a fund’s NAV is vital for tracking its daily performance, but it doesn’t show how profitable a fund is.

Hence, it’s crucial for investors to look beyond just the NAV and consider other factors like the fund’s financial goals, risk profile, and type of scheme for making a wise investment decision.