Non Convertible Debentures (NCDs) have emerged as a distinctive investment option for those pursuing stable and predictable returns. Unlike their convertible counterparts, NCDs provide investors with fixed interest rates and do not possess the convertible feature into equity shares.

This article delves into the world of NCDs, exploring their benefits, risks, and why they have become a noteworthy choice in the realm of investments.

What are Non-Convertible Debentures?

The NCD full form is Non-Convertible Debentures. Corporations frequently tap into public funds by issuing debt instruments featuring fixed interest rates and specified tenures, commonly referred to as debentures.

These instruments serve as a means to raise capital. Contradictory to some debentures that can be converted into equity shares at maturity, another category is Non-Convertible Debentures (NCDs).

Unlike their convertible counterparts, NCDs lack the provision for conversion into equity shares. Instead, upon maturity, NCDs ensure repayment of the principal amount and accrued interest to the debenture holder.

NCDs represent long-term debt instruments to help organisations to raise capital. Investors who opt for NCDs pay the issuer for a predetermined duration. The issuer agrees to make interest payments periodically, i.e. semi-annually or annually.

Non-convertible debentures (NCDs) can be divided into secured and unsecured. Secured NCDs are supported by the company’s assets, ensuring that in case of default, debenture holders can seek recourse through asset liquidation.

Conversely, unsecured NCDs lack this collateral protection. NCD issuers are mandated to obtain credit ratings from renowned agencies like CRISIL, ICRA, CARE, and Fitch Ratings.

A higher rating (e.g., CRISIL AAA or AA-Stable) indicates strong debt-servicing capability and lower default risk. Conversely, a lower rating implies higher credit risk.

You may also like: What are bonds and debentures? How are they different from each other?

Benefits of NCD investment

- Steady returns: NCDs deliver a reliable income stream with fixed interest rates, which makes them a steady-paying option for investors who seek stability in their investments.

- Competitive interest rates: NCDs offer higher rates of interest when compared to conventional fixed-income avenues like bank fixed deposits.

- Diversification: They facilitate portfolio diversification within the fixed-income asset class by allowing investors to spread their risk across various issuers and industries.

Risks of investing in NCD

- Interest rate risk: Interest rate risk is a significant concern when investing in NCDs. These instruments have fixed interest rates, meaning that the interest income remains consistent throughout the investment period.

NCDs are sensitive to changes in rates of interest in the market. If market interest rates rise after you’ve invested in NCDs, the fixed interest rate on your NCDs may become less attractive than the newer, higher rates available. - Credit risk: Default risk, another name for credit risk, is a crucial consideration when investing in NCDs. It pertains to the issuer’s ability to meet its financial obligations, including interest payments and the return of principal at maturity.

NCDs issued by financially strong and reputable organisations are generally considered safer investments. - Liquidity risk: Liquidity risk is also a factor to be considered when investing in NCDs. These instruments are typically less liquid compared to stocks and more traditional bonds.

Unlike stocks that can be bought or sold throughout market trading hours, NCDs often have limited trading volumes and may not be easily tradable before their maturity date.

If investors need to access their funds before the NCDs’ maturity, they might face challenges in finding buyers for their NCDs in the secondary market. This could result in selling at a discount or waiting until maturity to receive the principal amount.

Also Read: Debt instruments in India: Understanding your investment options

Difference between non-convertible bonds and non-convertible debentures

| Factor of difference | NCD Bond | NCD Debentures |

| Structure | These are tradable debt instruments | These are loans with fixed rates of interest and have set repayment schedules |

| Issuance | Often issued through public offerings | Issued through private placements |

| Interest rate | Interest rates may vary based on market conditions | These are loans with fixed rates of interest and have set repayment schedules. |

| Liquidity | More liquid traded on stock exchanges | Less liquid often held until maturity |

How to buy debentures?

Given below are the steps to buy debentures in India:

- Get a Demat account: The Investor should create a demat account with any registered depository participant.

- Select debentures: After researching their terms, choose the debentures you want to buy.

- Open a trading account: The next step would be to open an account with a government-certified stock broker.

- Fund trading account: Deposit funds into your trading account for the debenture purchase.

- Place an order: Use your trading account to place an order specifying quantity and price.

- Payment: Once your order is executed, funds get debited from your trading account.

- Confirmation: Receive a contract note as proof and see debentures in your demat account.

- Management: It is necessary to keep a keen eye on your investments and adjust accordingly.

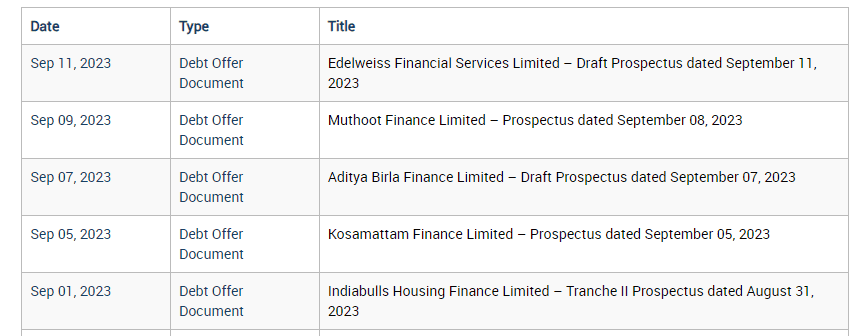

Non-convertible debentures example

Aditya Birla Finance Limited, Muthoot Finance Limited, Edelweiss Financial Services Limited, Kosamattam Finance Limited and Indiabulls Housing Finance Limited have filed their draft prospectus with SEBI for issuing Non-Convertible Debentures.

Source: SEBI

Bottomline

Investing in NCD debentures can be profitable for investors seeking fixed-income instruments. NCDs offer higher interest rates than traditional bank deposits, making them appealing for income generation.

Also Read: What are financial securities? Examples, types, and importance

Investors assessing their risk tolerance, financial goals, and the issuer’s creditworthiness before investing in NCDs is of the utmost importance. While they provide regular interest income and capital preservation, they also carry certain risks, including interest rate fluctuations and credit risk.

Diversifying one’s investment portfolio and seeking help from a financial advisor can help make an informed decision based on individual financial circumstances and objectives.