Overcapitalisation is a financial phenomenon that occurs when a company’s capital structure consists of an excessive amount of capital, often more than is required for its operations and growth plans. This surplus capital can negatively affect the corporation’s financials and profits and return on investment. .

Join us as we unravel the complexities of overcapitalisation and its implications for businesses.

What is overcapitalisation?

Overcapitalisation is a financial state in which a company’s capitalisation, consisting of equity and debt, exceeds its actual operational needs and the value of its underlying assets. When a corporation raises more funds than necessary, leading to an imbalance between capital investment and productive utilisation.

Overcapitalisation can be detrimental to a company, including reduced return on investment, lower profitability, and an inefficient allocation of resources. It can result from factors like overvalued assets, excessive borrowing, or overly optimistic growth expectations.

To address overcapitalisation, companies may consider strategies such as returning excess capital to shareholders, retiring debt, or reinvesting in growth opportunities.

You may also like: Power your investment portfolio with growth stocks

Effects of overcapitalisation

- Lower return on investment (ROI): Overcapitalised companies often struggle to generate sufficient returns on the excessive capital invested, resulting in a lower ROI for shareholders.

- Reduced profit margins: Inefficient resource allocation and higher operating costs reduce profits.

- Financial instability: Excessive debt and equity can create financial instability as companies may have difficulty meeting debt obligations and operational expenses.

- Inefficient resource use: Overcapitalisation may tie up capital in unproductive assets, hindering a company’s ability to invest in growth opportunities and innovate.

- Decreased market value: Overcapitalised firms may be undervalued in the stock market, leading to a lower market value compared to their actual worth.

- Dividend pressure: Shareholders may pressure management to distribute excess cash as dividends, even if reinvesting the funds could lead to better growth prospects.

- Slower growth: Excess capital can discourage innovation and expansion efforts, resulting in slower growth rates and missed market opportunities.

- Wasted resources: Capital tied up in unproductive assets represents wastage of resources leading to inefficiency.

- Increased debt burden: Companies may accumulate high levels of debt to finance overcapitalisation, leading to increased interest expenses and debt servicing challenges.

- Market perceptions: Investors may view overcapitalised companies as inefficient and less attractive, affecting their stock performance and access to capital.

Causes of overcapitalisation

Over-issuance of shares: When a company issues an excessive number of equity shares, it can lead to overcapitalisation. This usually occurs when a company raises more capital than it actually requires for its operations and growth plans. The surplus capital can remain idle, resulting in inefficient use of resources.

High debt levels: Accumulating a significant amount of debt can contribute to overcapitalisation if the company struggles to service the interest and principal payments. Excessive borrowing can lead to a situation where a substantial portion of the company’s earnings is used to cover debt obligations, leaving little for reinvestment or distribution to shareholders.

Conservative dividend policies: Companies that adopt conservative dividend policies tend to retain a large portion of their earnings instead of distributing them as dividends to shareholders. While this can be prudent in some cases, it can lead to overcapitalisation if the retained earnings are not reinvested in profitable ventures or utilised efficiently.

Inefficient asset management: Poor asset utilisation is another common cause of overcapitalisation. This includes underutilisation of assets or holding onto obsolete assets that no longer generate significant returns. Idle assets tied up in the balance sheet can result in excess capital.

Economic fluctuations: Economic downturns and unfavourable market conditions can lead to reduced production and sales, causing underutilization of assets. During such periods, companies may generate less revenue and profits than anticipated, resulting in excess capital.

Mismatched capital structure: An imbalance between debt and equity financing can also contribute to overcapitalisation. If a company relies heavily on equity financing and generates substantial profits, it may end up with more capital than necessary.

Also Read: India’s neighbours are in economic trouble! How is India booming?

Example of overcapitalisation

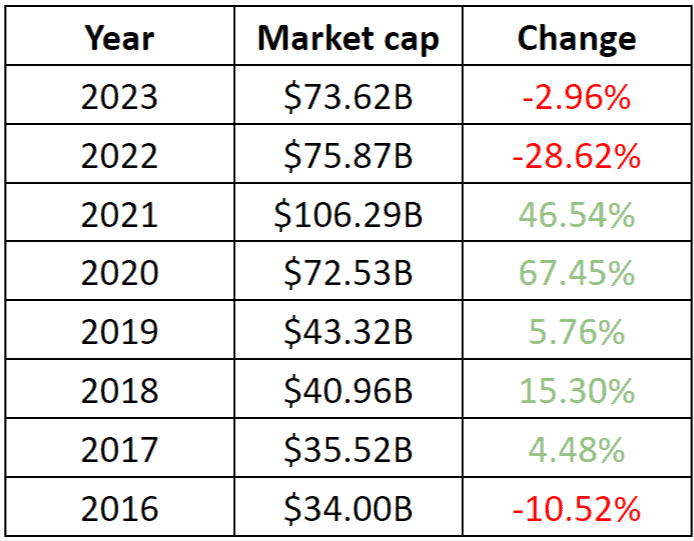

Let us understand this with an example of Infosys:

Infosys is actively addressing its overcapitalisation by implementing share buyback programs. This strategic move involves repurchasing its own, effectively reducing the number of outstanding shares.

By doing so, Infosys aims to return excess capital to shareholders, enhance earnings per share (EPS), and maintain a more efficient capital structure. These buybacks are part of Infosys’ broader capital management strategy to strike a balance between financial stability and shareholder value creation.

Source: Companies market cap

Difference between over capitalisation and under capitalisation

| Factors | Over capitalisation | Under capitalisation |

| Meaning | It occurs if a corporation raises capital more than required, resulting in an excess of assets or funds. | This situation arises when a company lacks sufficient capital to support its operations and growth, leading to financial instability. |

| Impact on financial health | It can lead to reduced return on investment and inefficient use of resources, impacting profitability. | It may hinder a corporation’s chance to fulfil its financial obligations, potentially leading to insolvency. |

| Debt levels | Companies experiencing overcapitalisation often have lower debt levels as they rely on equity financing. | Companies dealing with undercapitalisation may resort to higher debt levels to compensate for the lack of equity. |

| Profitability | It can lead to lower profitability as excess capital does not generate adequate returns. | It may result in reduced profitability due to financial constraints and higher interest expenses. |

| Dividend policy | Companies with excess capital may distribute higher dividends to shareholders. | Firms facing undercapitalisation may limit dividend payouts to conserve cash. |

| Risk levels | It is considered a lower-risk situation as companies have financial reserves. | It poses a higher risk of financial distress and default. |

| Management strategies | Management may explore avenues for expansion or invest in projects to optimise capital utilisation. | Management may seek additional financing, sell assets, or restructure debt to improve financial stability. |

Also read: Decoding the significance of market capitalisation

Bottomline

In conclusion, overcapitalisation can have significant consequences for a company and its stakeholders. It arises when a company raises more capital than it can effectively deploy in its operations, leading to inefficiencies, reduced profitability, and even financial distress. Identifying the signs of overcapitalisation and taking corrective measures is essential for maintaining a healthy financial structure.

Want to master stock trading? Learn from SEBI-registered experts, access real-time market insights, and practice risk-free with virtual trading. Start learning investment strategies app today!