Two asset classes often stand out for their popularity: equities and debt. While equities represent ownership in a company, debt is quite different. Debt signifies an amount of money borrowed by one party from another.

Under this broad umbrella of debt, we find a variety of instruments, one of which is junk bonds. This article aims to delve into the intricate world of junk bonds, shedding light on the potential risks and rewards of investing in them.

Understanding bonds

Bonds are essentially loans given to the issuer, who pays interest and repays the principal at maturity. They’re used for activities like expansions, refinancing, or welfare projects. Being less risky than equities, bonds offer stable returns, making them suitable for cautious investors.

India’s bond market has been expanding to draw global investors and foreign capital. Based on a CRISIL analysis, it is projected that by March 2025, the corporate bond market is expected to grow twofold, reaching an approximate total of ₹65-70 trillion.

Also read: Bond voyage: Unraveling the intrigue of Bonds

Understanding junk bonds

Bonds can be categorised into two main types: those issued by governments and those issued by corporations.

Within the corporate bond category, there exists a subset known as junk bonds. These are distinctive because they are offered by corporations that are not in a strong financial position. Such issuers are characterised by low creditworthiness, receive a rating lower than BBB- and are classified as non-investment grade.

This rating is apparent to investors prior to making an investment. Despite the issuer’s commitment to regularly disburse interest payments and return the principal at maturity, this pledge is contingent upon the company maintaining a positive cash flow.

To offset the elevated likelihood of non-payment, these bonds carry a higher rate of return, attracting investors who are willing to accept greater risks for the potential of higher returns.

Also read: Corporate bond – definition and how they’re bought and sold

Risks and rewards of investing in junk bonds

Risks

- Credit risk: Junk bonds carry a rating that is less than the investment grade, which signifies an increased probability of the issuer failing to meet their obligations.

- Default risk: There’s a risk that the issuer might not be able to fulfil their obligations, such as making interest payments or repaying the principal amount, which could result in potential financial losses for the investor.

- Market volatility: Junk bonds may exhibit greater vulnerability to economic slumps, which can influence their market worth.

Rewards

- Higher yields: To offset the increased risk, junk bonds provide higher yields relative to bonds that are rated as investment-grade.

- Diversification: Including junk bonds in a portfolio can provide diversification benefits, potentially improving overall returns.

- Potential for price appreciation: Should the financial reliability of the issuer enhance, it could lead to a rise in the bond’s value, thereby providing potential capital gains.

Asia junk dollar bond

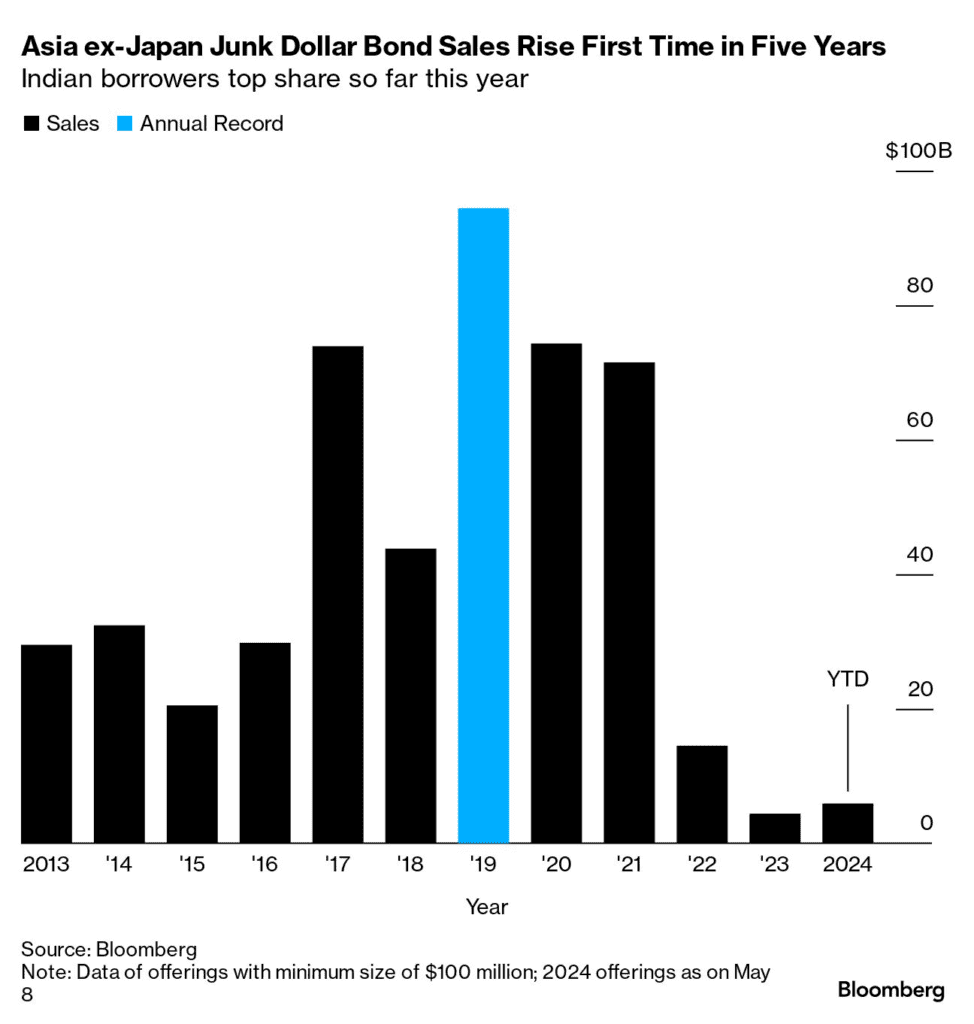

The market for junk dollar bonds in Asia has witnessed a remarkable surge in sales, hitting $5.9 billion in 2024 so far, a significant leap from the $4.4 billion total of the previous year. This expansion signifies the first yearly growth in half a decade, largely propelled by Indian financial entities aiming to engage offshore investors.

The first increase in 5 years is clearly represented in this chart:

Source: Bloomberg

Indian lenders are leading this wave, contributing to almost 44% of the overall sales. The appetite for high-yield dollar bonds is driven by strong consumer demand and faith in India’s economic progression. Conversely, other regional competitors, including China, are curtailing their offshore lending due to economic instabilities and escalating debt burdens.

While the Asian market is on an upward trajectory, it stands in contrast to the steady trend observed globally, particularly in the US and Europe. US corporations have offloaded over $137 billion worth of junk bonds this year, compared to nearly $194 billion in the entirety of 2023. European sales have reached €60.9 billion ($65.4 billion) this year, slightly lower than the just over €74 billion last year.

Must read: Exploring the bond market for beginners

Bottomline

Junk bonds play a significant role in the financial world. They offer high returns to compensate for their risk, providing an alternative investment avenue for those seeking diversification and higher yields.

While junk bonds may not be suitable for all investors due to their elevated risk profile, they can serve as valuable instruments for those willing to accept greater risk in pursuit of potentially higher returns.