Owning a share in another company may seem intimidating initially, but it’s just owning a share in a business venture abroad. Foreign Direct Investment (FDI) gives you access to fresh markets, innovative technologies, and abundant resources, not just money.

Understanding FDI: Definition and components

Foreign Direct Investment (FDI) refers to an individual or entity from one country making a significant investment in an enterprise located in another country. Beyond just financial involvement, FDI represents a long-standing partnership between the investor and the foreign enterprise.

Typically, an equity stake of 10% or more signifies a benchmark indicating substantial influence over the entity’s assets.

Major differences between FDI from FPI

Both Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) channel foreign capital into a country, yet they differ in intent and approach. Recent shifts in India underscore the importance of grasping their distinctions for astute global investment choices.

You may also like: What is the role of FIIs in the Indian stock market?

Foreign Direct Investment (FDI)

FDI signifies a long-term investment in a foreign entity. For example, in May 2018, Walmart procured a 77% stake in Flipkart. Furthermore, in September 2020, India garnered Rs 494 crore in the defence sector following an FDI policy revision.

Whether through mergers, like the Vodafone-Idea alliance, or by setting up subsidiaries, FDI often entails fund transfers, sharing of expertise, and resource allocation, reflecting a sustained commitment to the host nation’s economic prosperity.

Foreign Portfolio Investment (FPI)

FPI aims for immediate gains by investing in foreign financial assets like stocks or bonds. To illustrate, India’s FPI in equities stood at $542 billion in March, marking an 11% dip from the previous year, primarily due to foreign capital withdrawal. Given its transient nature, FPIs exhibit greater volatility than FDIs.

Understanding the entry routes of Foreign Investments in India

India welcomes foreign investment in most sectors through two main routes.

- Automatic Route: This is the more straightforward of the two routes. If an investor opts for the Automatic Route, they can move forward without seeking specific permission from the RBI or the Government of India.

It’s designed to facilitate a smoother and less bureaucratic process for foreign investments. The Automatic Route Allows 100% FDI in most sectors. - Government Route: A bit more intricate, this route mandates investors to gain prior approval from the Government of India. Specifically, the nod comes from the Ministry of Finance and the Foreign Investment Promotion Board (FIPB).

This step ensures that the investments align with India’s broader economic objectives and security concerns.

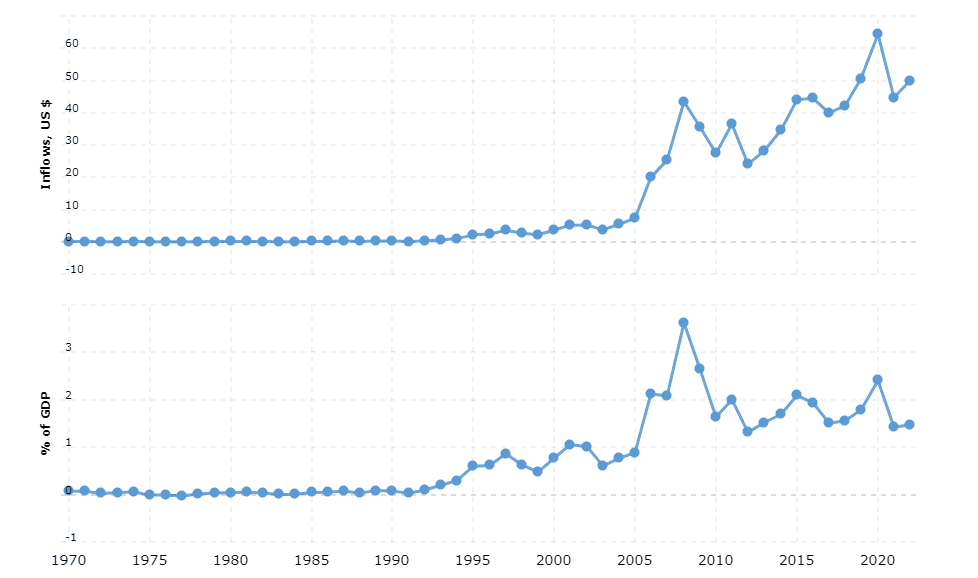

India Foreign Direct Investment 1970-2023

Data Source: World Bank

Exploring international expansion strategies: Types of FDI

Foreign Direct Investment (FDI) is not a one-size-fits-all concept. In order to expand their horizons outside of their borders, companies use a variety of strategies. Let’s dive into the three major types of FDI and understand how they work.

1. Horizontal FDI: Capturing new markets and technologies

This type of investment happens when a firm decides to extend its domestic operations to a foreign country but remains in the same line of business. Essentially, the company mirrors its home country operations in a foreign land.

The primary motivation behind horizontal FDI is the desire to tap into new markets, leverage local resources, and access advanced technologies.

Example: Suppose an American fast-food chain like McDonald’s decides to open a branch in India. The company replicates its fast-food business model overseas, making it a clear case of horizontal FDI.

Also Read: Over $3 billion in the month of May! FII dollars pouring non-stop on Dalal Street

2. Vertical FDI: Investing along the production chain

This investment strategy involves a firm moving upstream or downstream in its production process by investing abroad. Instead of replicating its business, the firm integrates different stages of its production process into the foreign country. This could either be through acquiring raw materials (backward vertical FDI) or selling the finished product (forward vertical FDI).

Example: A car manufacturer from Germany might set up a tire production plant in Thailand because of the availability of natural rubber. This would be a backward vertical FDI. Conversely, the same manufacturer might also set up a sales and distribution centre in Brazil, a forward vertical FDI, to directly access the South American market.

3. Conglomerate FDI: Diversification beyond expertise

This kind of FDI is interesting because the investment made overseas does not necessarily relate to the primary business of the investing company. The aim here is diversification. Companies indulge in conglomerate FDI when they want to venture into unchartered territories, test new waters or shield against risks in their core operations.

Example: An American tech giant known for its software services, like Microsoft, might decide to invest in a chain of retail clothing stores in Japan. While this doesn’t align with their core software business, it represents an attempt to diversify their portfolio through conglomerate FDI.

Top Investor Countries in FY 2023 for India:

| Investor Country | FDI Inflows (in USD billions) |

| Singapore | 17.2 |

| Mauritius | 6.13 |

| United States | 6.04 |

| United Arab Emirates | 3.35 |

| Netherlands | 2.49 |

Benefits of FDI for the host country

Foreign Direct Investment (FDI) offers a host of advantages to the receiving countries:

- Economic Growth: FDI introduces capital, technology, and expertise, propelling economic diversification and development. It can give rise to new industries and expand the business landscape.

- Employment: FDIs generate new job opportunities. Additionally, they elevate the local workforce’s skills through training and technology introduction.

- Infrastructure Development: FDI often boosts infrastructure, such as roads and ports, indirectly supporting the nation’s development and attracting further investment.

- Technology Transfer: FDI facilitates the movement of technology between nations, fostering local innovation and introducing modern managerial practices.

- Increased Export Potential: Through FDI, host countries gain better access to global markets, enhancing their export capabilities and sharpening the competitive edge of local businesses.

Also Read: The world of currency fluctuations: How does it impact your investments?

To better understand, let us see how FDI has helped India.

Benefits of FDI for India

Foreign Direct Investment meaning to usher in numerous benefits for India, marking substantial progress across various sectors:

Services Sector: From April 2000 to December 2021, the services sector, encompassing areas like banking, insurance, and outsourcing, attracted 22.5% of total FDI inflows.

Manufacturing Sector: Proactive government policies have bolstered FDI in industries like automobiles, textiles, and electronics, revitalizing the manufacturing landscape.

Infrastructure Sector: FDI has been instrumental in developing roads, ports, and communication networks, enhancing India’s connectivity and trade capabilities.

There’s no disputing that foreign direct investment has been a big driver of India’s socio-economic growth.

Aspects of foreign direct investment that are risky

While FDI can be lucrative, it comes with potential risks:

- Political instability: Changes in governments can lead to fluctuating policies, risking asset nationalisation or expropriation.

- Economic fluctuations: Currency devaluations or economic downturns can impact investment returns and demand.

- Cultural differences: Misunderstanding local customs can result in costly errors and misalignment with market needs.

- Regulatory challenges: Navigating unfamiliar labour laws, tax systems, or environmental regulations can be complex.

- Transfer and conversion risks: Restrictions on profit repatriation or currency conversion can impede returns to parent companies.

- Competitive risk: Entrenched local competitors can pose challenges to new entrants.

Endnote:

When a country invests money in another, it brings jobs and new technologies to the recipient. But there are also challenges. Both sides must plan well. Governments can support these investments by creating rules that are easy to understand.