Do you file your own taxes or take a CA’s help? Nothing wrong with either option. But if this is your first time filing ITR on your own, it can be a daunting task. So, before you wrestle around with the income tax portal, here’s a guide to make things simple.

Income tax filing deadline

Here’s some positive news – the income tax department has yet to open the portal to file taxes for 2022-23. Usually, the portal gets activated on April 01 and extends till July 31. This year, however, the portal for e-filing has not opened yet. We wonder why.

Still, you have nothing to worry about. If the portal for ITR e-filing activates late, the deadline will also be extended beyond July 31. But if you want to finish filing your taxes early, why not opt for offline sources?

Offline vs online ITR filing

Only last week, the income tax department uploaded the offline ITR-1 and ITR-4 forms (the significance of these numbers has been clarified later.) The choice between offline or online has more to do with your circumstances as a taxpayer and other related factors. These include internet availability, obligations that may come in the way, credit card application, etc.

Online ITR filing is preferred if –

- All documents and details are readily available

- Taxpayers are comfortable with the e-filing portal

Thus if you’re a salaried professional with a few small investments, online ITR filing is the best option.

The dynamics change if there are multiple sources of income, different investment types, various insurance policies availed, etc. In these circumstances, gathering and uploading all required documents and the appropriate ITR form is easier.

Offline tax filing is also helpful if multiple sources of information are spread across different periods. It’s tedious to make changes in e-ITR again and again, right? Better to wait for all the documents before uploading the form.

Now here’s a question – Is there any eligibility criteria for offline ITR filing? The answer is a straightforward ‘NO’.

As indicated on the IT department’s official website,

All persons eligible to file ITR can download the offline utilities for ITRs and use them to file returns.

Income Tax Department

So, depending on your preference and circumstances, you must choose between online and offline modes. In the case of the former, the e-filing process has not started yet. For the latter, you can download the appropriate ITR form.

Also read: Old vs. New – Which Tax Regime is Better For FY 2023-24?

Types of ITR explained

While filing ITR on your own, the first question is: which ITR type to file? What do the numbers 1-7 indicate?

For those unaware, ITR forms are categorised into seven types based on –

- Residence status

- Income slab

- Sources of income

- Whether or not you are involved in agriculture-related activities

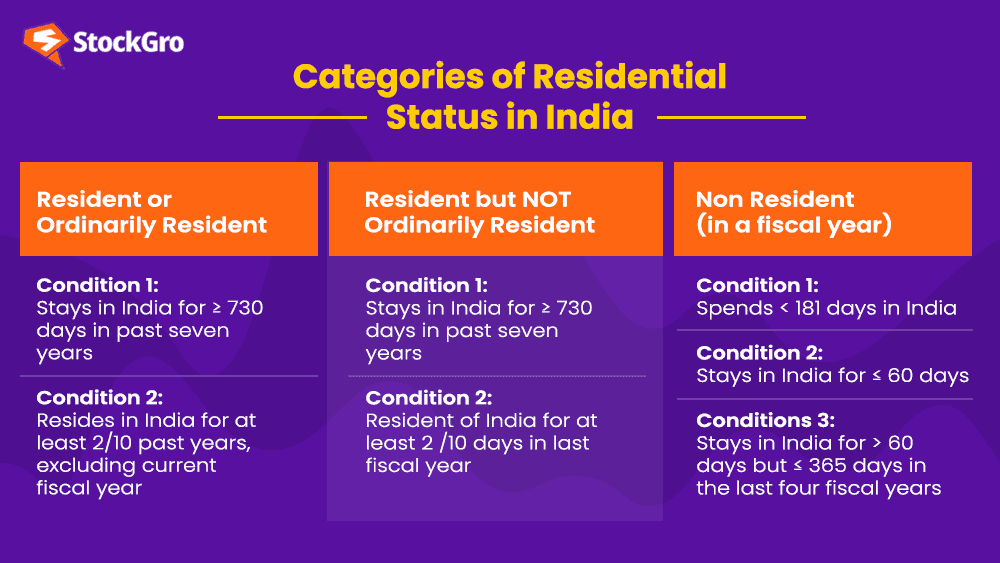

Before getting into the categories, you need a bit of clarity on the “status of residence”. Typically, as per the Income Tax Act 1961, residential status has been classified into three categories:

Now, let’s look at the different ITR forms and the form that you need to fill out based on your factors mentioned before:

ITR 1

- Only resident

- Total income not exceeding Rs. 50 lakh

- Income earned from salary, one house property, interest, etc

- Agricultural income not exceeding Rs. 5000

ITR 2

- For residents and ordinarily residents belong to Hindu undivided families (HUFs)

- Not earning any income from profits/gains earned from business or any profession i.e., zero capital gains

- Earns only from salary and interest on savings bank account, fixed deposit (FDs), etc

ITR 3

- For individuals and those falling under HUFs

- Earns income from specific profession (dancer, actor, photographer, chartered accountant, lawyer, doctor, etc) or

- Earns profit or capital gains from running a business

ITR 4

- For individuals, HUFs and companies (other than limited liability partnership – LLP) who are “residents”

- Total income not exceeding Rs. 50 lakh

- Income from business or profession availing presumptive taxation (to avoid tedious accounts, paperwork, etc) under:

- Section 44AD: gross earnings not more than Rs. 2 crore

- Section 44ADA: gross earnings not more than Rs. 50 lakh per year

- Section AE: engaged in business of plying, hiring or leasing goods carriages; not owning 10+ goods vehicles in a year

- Agricultural income not more than Rs.5000

ITR 5

For individuals or firms not eligible for ITR form 7

ITR 6

For firms NOT claiming exemption under Section 11 (income earned from charitable or religious reasons)

ITR 7

- For individuals or firms coming under:

- Section 139(4A): income earned from property devoted to charitable or religious reasons

- Section 139(4B): for political parties which earned more than the maximum tax exempted limit

- Section 139(4C): for institutes that earned more than the maximum tax exempted limit

- Section 139(4D): for university, college or institute that is not eligible to file ITR under any other point of Section 139

Note: In case of ITR 7, the “maximum tax exemption limit” for individuals is Rs. 2,50,000. Any income earned beyond this figure would be taxable.

You may also like: Why do Indian banks invest in their competition?

Importance of Form 26AS and AIR

Most individual taxpayers who file their ITRs tend to forget two important documents: a. Form 26AS and b. Annual information return (AIR). Without reviewing these documents carefully, taxpayers tend to submit their tax returns. And take that big sigh of relief. One huge responsibility done and dusted!

However, both documents act as proof to help you claim exemptions. Particularly if you work as a consultant or freelancer and paid a hefty advance tax amount. So, let’s understand the last aspect of filing your taxes before your tax return journey begins.

Summary of Form 26AS

Form 26AS is a comprehensive document that specifies where all you paid tax, during a particular financial year. It mentions the tax deducted at source (TDS) or tax collected at source (TCS), for your income.

It also acts as proof of your advance tax payment. And if you have made a high-value transaction, equal to or exceeding Rs.10 lakh, it would be reflected in your Form 26AS.

Thus, put simply, Form 26AIS summarises specific transactions and tax deductions/collections during a specific financial year. To claim exemptions, your ITR should tally with the transactions mentioned in this form. Hence, before submitting your IT return, make sure to check the form figures.

Annual Information Return (AIR)

If you think Form 26AS is comprehensive and detailed, you might just get “bamboozled” by the Annual Information Return (AIR). The latter describes Form 26AS in utmost detail. So, why bother checking AIR?

Well, for each high-value or specific transaction in the AIR, there are two figures mentioned:

- Reported value

- Modified value

As a taxpayer, you can add your feedback or corrections to the reported value. The IT department would consider these comments and report the modified value. Both those figures are then mentioned in the final AIS.

What you then need to do is tally the figures in AIS with your ITR to claim rightful exemption.

Here’s a question – did you know these documents existed? If not, there is no need to get disheartened. After all, taxes are like the common man’s Bermuda Triangle.

Once you go inside, there’s too much to know and yet, all we know is the iceberg’s tip!