![What is CAGR and how to calculate? [ Explained]](https://www.stockgro.club/blogs/wp-content/uploads/2023/06/what-is-cagr-in-share-market-1024x516.png)

We often come across statements like “the investor earned a CAGR return of 15% over 10 years” or “the profit grew at the rate of 15% CAGR compared to last year”. Have you ever wondered what CAGR is in the share market? Or what does it even mean in the general financial terms? Learn how to use the CAGR formula to calculate your investments’ return annually.

What is CAGR?

CAGR (Compound Annual Growth Rate) helps you measure the annual growth of your investment. In other words, CAGR depicts how your investment grew on average each year, making it easier to compare different investments. It is a valuable tool as it shows an investment’s growth (or fall) over time. Under CAGR, Profits are reinvested at the end of each year. An investment typically cannot increase at the same rate year after year. Despite this, many people compare various investments using the CAGR calculator.

Let’s say you made a total investment of Rs. 1,000 in any stock, giving you 10% returns. It means the stock appreciation is Rs. 100 for the first year. In the second year too, the price went up to 10%. So, in 2 years, does that mean the total price of the stock is Rs. 1,200? No!

After a year, your initial investment of Rs. 1,000 has increased to Rs. 1,100. After two years, an investment worth Rs. 1,100 will be worth Rs. 1,210, thanks to a 10% growth. In short, this is the CAGR Formula.

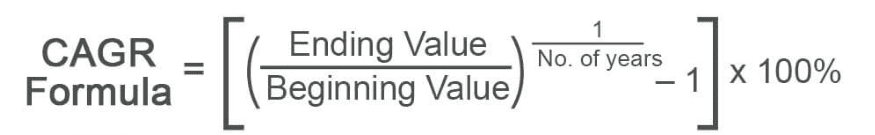

The CAGR calculator employs the concept of compounded annual growth rate.

Here-

- Ending Value is the final value of your investment after a period

- Beginning Value is the initial value of your investment at the beginning of the period

- Number of Years is the total years your investment has grown.

Let us check how to use CAGR formula example for calculation-

Let's say you invested Rs 1,00,000/- in a mutual fund, and after 3 years, the investment surges to 1,40,000 rupees. So here is how you can calculate the return- Ending Value = Rs 1,40,000 Beginning Value = Rs 1,00,000 Number of Years = 3 CAGR = (1,40,000 / 1,00,000) ^ (1 / 3) - 1 CAGR = 1.4 ^ 0.333 - 1 CAGR = 1.132 - 1 CAGR = 0.132 or 13.2% Therefore, the CAGR for this investment over the 3-year period is 13.2%. It also indicates that the investment grew by 13.2% yearly.

What is the difference between CAGR vs Absolute Returns?

Many people consider the absolute returns on their share market investments. Absolute returns show you how much money your investment has made overall. Let’s use a fictitious instance.

Let’s say you invested Rs. 20,000 in a mutual fund of a particular product or company in 2020. In 2025, the overall worth of your investment will be Rs. 35,000.

One of the major differences between CAGR and absolute return is that CAGR gives you year-to-year ROI, unlike absolute return, which covers point-to-point ROI, not considering the total time taken to earn from the investment.

By using absolute returns, you will see how much the investment appreciated and depreciated, but not how fast the process happens. CAGR, on the other hand, determines the average growth of the investment. It addresses the volatile nature of the market.

You may also like: RBI MPC meeting: Repo rate unchanged, what does it mean for you?

What is the importance of CAGR in selecting stocks and mutual funds?

CAGR is an important concept in stocks & mutual funds as it helps measure past and future ROI. Some of its benefits include:

- Compare the investments

When contrasting various forms of investments, you can use the CAGR. This approach to comparing different investments might help you determine the best returns.

- Calculate growth

Stock investment is volatile, so you can know the potential growth from a single investment over the period using the right CAGR formula example and calculation.

- Track performance

CAGR can be used by businesses to monitor various metrics of the company. They might employ it to compare the performance of other businesses operating in the same sector.

Moreover, companies may learn about their organisation’s or the market’s strengths and weaknesses by monitoring the performance of one or more business metrics.

Also Read: How much tax do you pay on stock market gains?

What are the benefits of CAGR in the share market?

- Assess overall return

It enables share market investors to evaluate the returns in various situations. For instance, you can model different CAGR scenarios to see how much your investment would increase to the designated period. It helps with your long-term financial planning.

- Easy to understand

It is simple to use for your share market investment. You must enter the initial value, the end deal, and the preferred investment time. You may simplify the math by using a CAGR return calculator, excel spreadsheets, or scientific calculators.

- Comparing stock performance

To determine whether a company or fund manager is performing better or worse than market benchmarks, use the CAGR calculator to compare stock performance to that of its peer group and the index. You will get the complete picture of high CAGR stocks.

- Not limited to stock market

CAGR calculates the rate of change in profits, investment value, costs, etc., over time. Investors might find a practical technique to calculate CAGR by considering this typical use. Thankfully, there are online CAGR return calculators, making the process much easier. You can’t do it manually when the period is too long, like five or ten years.

Also Read: Tax saving scheme in India 2023 [Explained]

What are the limitations of CAGR in the share market?

- It does not give a picture of market volatility

The share market is volatile. So, the CAGR does not include fluctuation in the stock market. Moreover, CAGR does not involve variations in the annual return rate of securities.

- It isn’t perfect for risk assessment

Share market investors may not clearly understand the instrument’s performance in the event of significant swings since the CAGR does not account for the volatility of a securities trade on the stock market. Simply comparing a company’s CAGR is insufficient to determine the overall pattern of the corresponding securities because it ignores short-term fluctuations.

- Additional tools

Thanks to its limitations, CAGR misses short-term stock abnormalities caused by both internal and external sources. For investors with a short-term investment objective, it is critical to investigate additional technical analysis methods.

Conclusion

Just like understanding the basics of the share market is essential, learning about CAGR and the calculation process for a suitable investment is critical. So get started and stay informed for a profitable long-term investment in the share market.