Did you know profit is the reward for taking risks in business?

Yes, Economist F.B. Hawley came up with this theory stating the higher the risk, the bigger the profit. While profit is not the only objective of businesses, it certainly is one of the primary objectives of every business.

The levels of profits determine the efficiency of organisations, along with assessing other significant factors such as their contribution to the country’s economy.

What is the meaning of gross profit?

Gross profit is the profit a company earns upon selling its products and services after deducting the costs incurred in making and selling its goods. It includes all variable costs associated with manufacturing and selling products and services.

The gross profit is an indicator of how efficient the company is in terms of utilising its materials and labour force.

Gross margin is the gross profit expressed in percentage.

You may also like: Mastering revenue expenditure – Categories, impacts and management

Gross profit in accounting

The gross profit is a significant factor in the company’s financial statements.

The income statement/ profit and loss account begins with the gross profit.

In a regular scenario, the gross profit only includes variable costs spent on manufacturing and selling goods. It does not consider fixed costs, like the building rent.

However, if the company recognises a portion of fixed costs involved in the direct manufacturing of products, they are considered absorption costs and are included in calculating the gross profit.

- Fixed costs: These are generic costs that do not vary based on the production of goods.

- Variable costs: Refers to costs directly linked to production and varies based on the quantity produced.

- Absorption costing: A concept of managerial accounting that suggests considering all costs – variable and fixed- associated with producing goods.

How to calculate gross profit?

Gross profit formula = Net Sales – Cost of Goods Sold (COGS)

Net sales is the revenue generated after considering gross sales, discounts, sales returns and other deductions.

Net sales = Gross sales – discounts – sales returns – other related deductions.

The cost directly linked to the production and selling of products is called the cost of goods sold.

COGS formula = Opening stock + Purchases – Closing stock

Gross margin formula = (Net Sales – COGS) / Net Sales * 100

Example

| Item | Amount |

| Product sales | ₹ 10,00,000 |

| Service sales | ₹ 7,00,000 |

| Sales return | ₹ 50,000 |

| Discounts offered | ₹ 12,000 |

| Cost of sale – Products | ₹ 4,50,000 |

| Cost of sale – Services | ₹ 3,00,000 |

| Salaries and wages | ₹ 2,00,000 |

| Office rent | ₹ 70,000 |

Net Sales = ₹ 10,00,000 + ₹ 7,00,000 - ₹ 50,000 - ₹ 12,000 = ₹ 16,38,000 COGS = ₹ 4,50,000 + ₹ 3,00,000 = ₹ 7,50,000 (Salaries and rent are not directly related to manufacturing, hence they are not considered while calculating gross profit). Gross profit = ₹ 16,38,000 - ₹ 7,50,000 = ₹ 8,88,000 Gross margin = (₹ 16,38,000 - ₹ 7,50,000) / ₹ 16,38,000 * 100 = 54.2%

Difference between gross profit and net profit

The overall profit earned after paying off all expenses including indirect costs is called the net profit / net income.

Examples of indirect costs are general administrative expenses, taxes, and depreciation.

Net profit = Gross profit – Indirect expenses

Breaking it down,

Net profit = Revenue + Other incomes – Cost of goods sold – Other expenses

Gross profit vs. Net profit:

While gross profit indicates the productional efficiency, net profit represents the overall efficiency of an organisation.

A higher gross profit does not always result in a higher net profit. They can be inversely related.

For example, increasing the labour force to expand production and sales may lead to higher gross profits, but this will increase expenses like salaries and wages, bringing the net profit down.

Also Read: EBITDA explained: Definition, calculation, significance, and more

Considering the example above, the calculation of net profit is:

Net profit = Net revenue - Cost of goods sold - Other expenses = 16,38,000 - 7,50,000 - 2,00,000 - 70,000 = 6,18,000 Net profit margin = (6,18,000/16,38,000) * 100 = 37.7%

Advantages and limitations of gross profit

Advantages of gross profit

- Gross profit is one of the significant numbers that goes into the company’s financial statements.

- It aids in analysing the company’s position with respect to operational efficiency, helping in making decisions about how production, purchase of raw materials and capacity of labour can be improved.

- Gross profit is the base that helps in the calculation of further components like net profit.

Limitations of gross profit

- When considered in isolation, gross profit is not very useful in determining the company’s overall financial health since it does not consider indirect costs.

- Gross profit requires the computation of stock/inventory, which can be calculated through different methods like weighted average, First In First Out (FIFO), Last In First Out (LIFO), etc.

Different companies use different methods, thereby impacting gross profit. Hence, gross profit cannot be a standard indicator in comparing two companies.

Case study and interpretation

Let us consider two companies:

| Company A | Company B |

| Net sales = ₹8,00,000 | Net sales = ₹4,00,000 |

| Cost of goods sold = ₹3,00,000 | Cost of goods sold = ₹1,00,000 |

| Gross profit of Company A = ₹5,00,000 | Gross profit of Company B = ₹3,00,000 |

While gross profit suggests that Company A is more efficient, upon considering all the numbers, it can be observed that the margin of Company B is higher than A.

Also Read: Calculating company valuations. Everything there is to know

Gross profit margin of A is 62.5%, the margin of B is 75%.

So, even though the volume of sales is higher for Company A, Company B is more efficient.

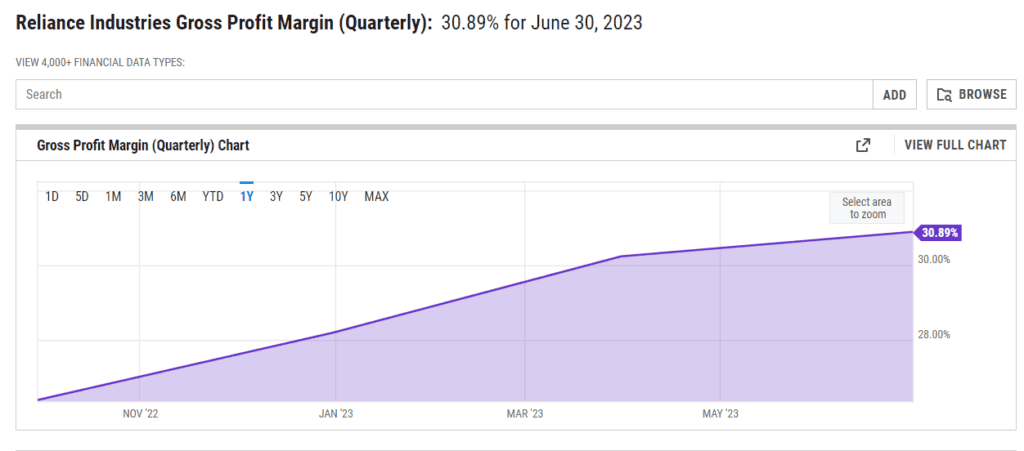

The graph below shows the quarterly gross profit margins of Reliance Industries Ltd.

Source: YCharts

Summing up

Gross profit is therefore an essential figure in analysing the company’s efficiency, but the results are accurate when it is combined with other significant indicators.

However, thoroughly examining the components of gross profit is critical in making decisions like increasing the scale of production, labour, machinery etc., thus contributing to the company’s growth.