Stock overview

| Ticker | BHARTIARTL |

| Sector | Telecom |

| Market Cap | ₹ 10,22,000 Cr |

| CMP (Current Market Price) | ₹ 1,708 |

| 52-Week High/Low | ₹ 1779/ ₹ 1097 |

| P/E Ratio | 41.54 (vs Industry average. of 40.8) |

| EV/EBITDA | 8.7x |

| Beta | 0.95 (Moderately volatile stock) |

About Bharti Airtel

Bharti Airtel is one of India’s leading telecom giants, providing mobile, broadband, and digital services to millions across the country. With a strong presence in Africa and a growing focus on 5G, enterprise solutions, and fintech, the company continues to drive innovation in the telecom space.

Key drivers of growth:

1. 5G expansion & Future growth prospects

- Airtel has aggressively rolled out 5G services across major cities and aims for nationwide coverage by 2025.

- The company’s 5G adoption rate is rising, with significant traction in enterprise and high-value customer segments.

- Focus on AI-driven network optimisation to enhance user experience and operational efficiency.

2. Revenue breakdown

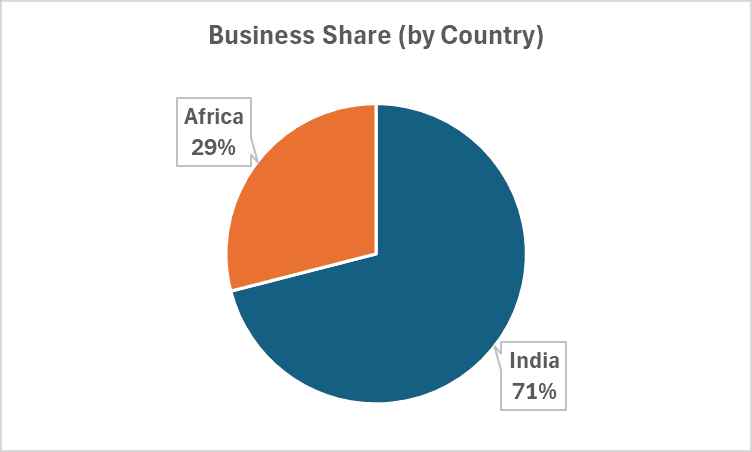

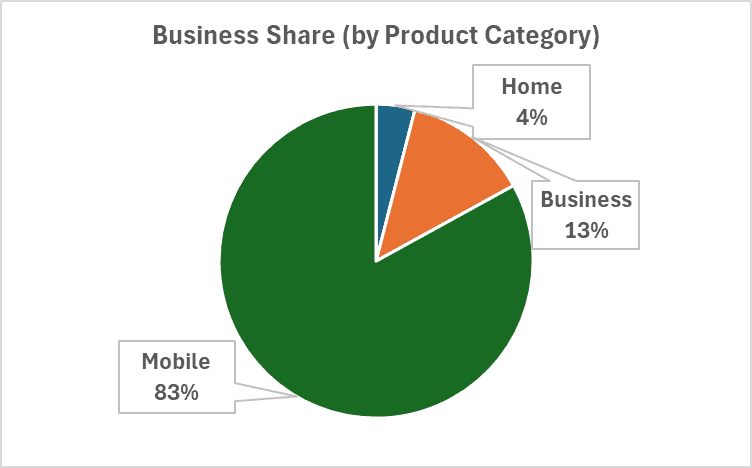

- Here is the revenue breakdown of Airtel at a product level and at a country level

- Africa business remains a high-margin segment, contributing strongly to EBITDA

- Mobile business continues to be the key contributor to Airtel’s revenues with only 1 major competitor in this space in the form of Reliance Jio.

3. Competition & Market position

| Company | Market Share | ARPU (Q3 FY25) |

| Bharti Airtel | 36% | ₹ 245 |

| Reliance JIO | 40% | ₹ 203 |

| Vodafone Idea | 18% | Yet to declare |

- Airtel continues to close the gap with Jio, outperforming in ARPU and premium customer retention.

- Vodafone Idea remains financially strained, limiting its ability to compete effectively.

- Upcoming tariff hikes across the industry will further strengthen Airtel’s financials.

4. Impact of Union Budget 2025 on Telecom

- The budget highlighted its focus on digital infrastructure, boosting 5G expansion.

- PLI (Production-Linked Incentive) schemes for telecom gear manufacturing will reduce dependency on imports.

- Increased focus on rural digital penetration presents a strong growth opportunity.

5. Upcoming Catalysts: Spectrum Auctions, and More

- Upcoming Spectrum Auctions (Mid-2025): The spectrum auction is a government‐run process where telecom operators bid to acquire network frequencies. This is especially significant for Airtel, as securing the right spectrum can strengthen its coverage, capacity, and competitive edge.

- Tariff hikes are likely in H2 2025, leading to further revenue and margin expansion.

Recent Financial Performance (Q3 FY25)

| Metric | Q3 FY 25 | Q3 FY 24 | YoY Growth |

| Revenue | ₹ 45,129 cr | ₹ 37,923 cr | +19% |

| EBIT | ₹ 13,126 cr | ₹ 9,844 cr | +33% |

| EBIT Margin | 29.1% | 26.0% | +311 bps |

| PAT | ₹ 5,514 cr | ₹ 2,492 cr | +121% |

| ARPU | ₹ 245 | ₹ 208 | +18% |

Highlights:

- Revenue growth of 19% YoY, driven by mobile business and Africa segment performance.

- EBITDA margin expansion, indicating strong cost control and operating leverage.

- High Double-digit profit growth reinforces the company’s ability to drive sustainable earnings.

Valuation insights

When we value a company like Bharti Airtel, we’re asking two questions:

- Is it cheap or expensive compared to how it’s been in the past—or to other companies?

- How much money could it make in the future, and what does that mean for its stock price now?

From a relative valuation standpoint:

- P/E Ratio: 41.54x (Airtel trades at a slight premium to Jio but offers better ARPU and diversified revenue streams.

- Vodafone Idea’s high debt levels and financial distress make it a less attractive competitor.

- EV/EBITDA: This compares the company’s overall value (including debt) to its operating profit. An 8.7x ratio means Airtel’s total value is roughly 8.7 times its yearly operating profit.

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of Bharti Airtel based on expected future cash flows:

- Intrinsic Value Estimate: ₹1850 per share

- Upside Potential: 10%

- Assumptions :

- WACC: 10.5%

- Cost of Equity: 12%

- Cost of Debt: 8.5% (Post-tax)

- WACC: 10.5%

Key risks to watch

- Regulatory uncertainty: Government policies on spectrum pricing and revenue-sharing could impact profitability.

- Competitive pricing pressures: If Jio delays tariff hikes, it could affect ARPU growth.

- Capex-Heavy business model: High 5G investment requirements may put pressure on free cash flows.

Technical outlook on Bharti Airtel share

- Resistance Level: ₹1720

- Support Level: ₹1650 (Short-term moving average)

- RSI (Relative Strength Index): 61 (Neutral, but leaning bullish)

- Trading Volume: Increasing, suggesting strong accumulation by institutional investors.

Bharti Airtel stock recommendation

Current Stance: BUY with a 12-month target of ₹1850.

Rationale:

Strong 5G rollout momentum

Rising ARPU & resilient financials

Industry tailwinds from digital infrastructure push

Risk-Reward Profile: Moderate risk with steady growth potential.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Bharti Airtel remains a leader in India’s telecom sector, leveraging its strong 5G adoption, pricing power, and diversified revenue streams. With consistent ARPU growth, robust financials, and sectoral tailwinds, the stock remains an attractive long-term investment. Investors can accumulate on dips, particularly below ₹1650.