Stock overview

| Ticker | INDIGO |

| Sector | Aviation |

| Market Cap | ₹ 1,63,000 Cr |

| CMP (Current Market Price) | ₹ 4,519.15 |

| 52-Week High/Low | ₹ 5035/ ₹ 3010 |

| P/E Ratio | 26.8x |

| Beta | 1.2 (Moderately volatile) |

About Indigo

InterGlobe Aviation, the parent company of IndiGo, is India’s largest airline, commanding over 60% market share. With a strong low-cost model, expanding fleet, and global ambitions, IndiGo continues to dominate the skies. But how does it stack up as an investment? Let’s find out!

Investment thesis:

1. Market leadership & dominance

- IndiGo is India’s largest airline with a 60%+ market share.

- Strong brand recall, best-in-class cost structure, and high fleet efficiency.

- Expanding international routes and partnerships to drive growth.

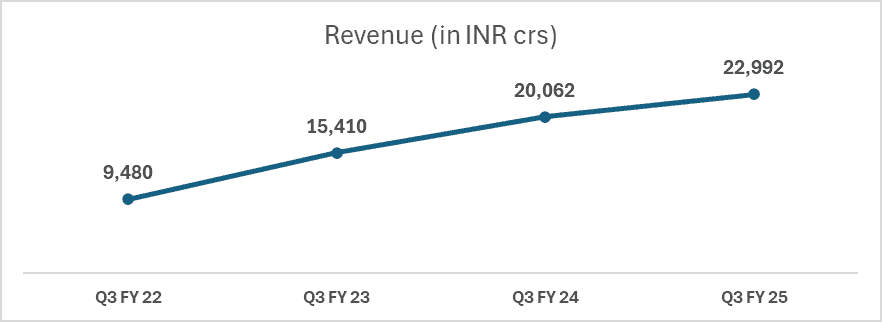

2. Strong financials & profitability

- Q3 FY25 results:

- Revenue: ₹22,992 crore (+14.6% YoY, on an increasing trend YoY for the last 4 years)

- EBITDA Margin: 27.4% (-70 bps YoY)

- PAT : ₹2,448 crore (-18.3% YoY)

- Load Factor: This measures what percentage of an airline’s seats are filled by paying passengers. IndiGo’s load factor at 86.9% means that out of every 100 seats, about 87 were occupied—1.1% higher than last year, indicating strong passenger demand and efficient seat utilisation.

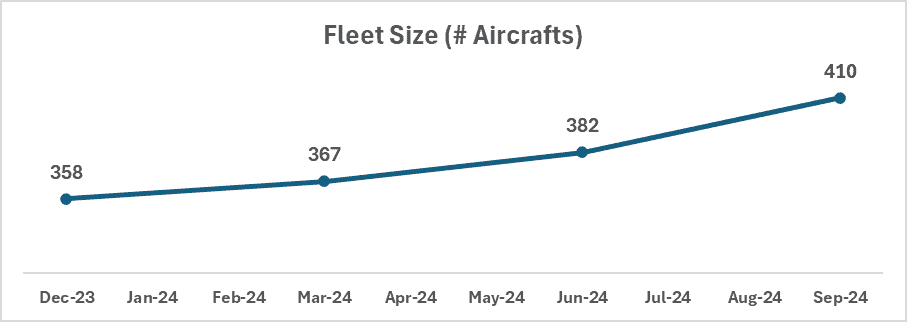

- Growing Fleet Size and ASK (Available Seat kilometers)

Both the above charts indicate strong supply positioning for Indigo which means Indigo is well-geared to meet the growing travel demand of customers

3. Further fleet expansion & cost optimisation

- IndiGo to add 500+ new fuel-efficient aircraft over the next five years.

- Focus on a low-cost carrier model ensures cost leadership.

- Strong demand from both business and leisure travellers.

Comparison with peers

| Company | Market Share | Market Cap | Revenue | P/E | RoCE |

| Indigo | 63% | 1,73,948 cr | ₹ 22,992 cr | 26.8x | 24.5% |

| Air India | 18% | Not Listed | ₹ 5,109 cr | Not Listed | Not Listed |

| SpiceJet | 3% | 5,871 cr | ₹ 851 cr | Negative | 1.6% |

- Indigo is the market leader in the Indian aviation space with a market share of 63%. The low-cost airline is ahead of its competitors on revenue, cost, ASK and number of customers served.

- Financial stability and profitability give it a competitive edge.

Valuation insights

IndiGo’s valuation looks promising, backed by its market leadership and strong financial recovery. With a return to profitability quarter after quarter, the airline is flying high. Its cost-efficient model, fleet expansion, and growing demand put it in a solid position for future growth. Despite industry challenges, IndiGo remains the top player in Indian aviation, making it a stock with strong upside potential.

From a relative valuation standpoint:

- P/E Ratio: 26.8x

- Spicejet is currently loss-making, hence it has a negative P/E Ratio.

- Air India is currently unlisted as a separate entity.

Due to Indigo’s high market share, the aviation industry’s P/E is defined largely by Indigo’s P/E which would indicate that Indigo will drive the industry metrics and the other players will be judged based on Indigo’s performance. This puts Indigo in a very dominant position, given that their financials are way better than that of their competitors.

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of Indigo based on expected future cash flows:

- Intrinsic Value Estimate: ₹4,800 per share

- Upside Potential: 14%

- WACC: 10.2%

- Growth Drivers:

- Expanding international operations.

- Strong domestic air travel demand.

- Operational efficiencies improving margins.

Key Risks

- High fuel price volatility impacting operating costs.

- Regulatory risks: government policies, airport charges, taxation.

- Competition from new entrants Akasa Air, Air India-Vistara merger.

Technical outlook on Indigo share

- Resistance Level: ₹4,450 (Recent high)

- Support Level: ₹4,150 (50-day moving average)

- RSI (Relative Strength Index): 64 (Bullish momentum)

- Volume Trends: Strong institutional buying observed.

Indigo stock recommendation

Current Stance: BUY with a 12-month target of ₹4,800.

Rationale:

Market leadership & financial strength

Expanding fleet & international routes

Undervalued compared to global peers

Risk-Reward Profile: Moderate risk, high growth potential.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

IndiGo continues to lead the Indian aviation sector, with strong financial health, market dominance, and expansion plans. With improving margins and a positive demand outlook, it remains a high-growth stock with further upside potential.