Stock overview

| Ticker | IDEA |

| Sector | Telecom |

| Market Cap | ₹ 58.600 Cr |

| CMP (Current Market Price) | ₹ 7.9 |

| 52-Week High/Low | ₹ 6.6/ ₹ 19.2 |

| P/E Ratio | N/A: Loss Making company (Industry average of 36.8) |

| Debt | ₹ 23,3 billion |

| Beta | 1.65 (Highly volatile stock) |

About Vodafone Idea

Vodafone Idea Ltd. (Vi) is India’s third-largest telecom operator, formed by the merger of Vodafone India and Idea Cellular in 2018. Despite a massive subscriber base, the company struggles with high debt, intense competition from Jio and Airtel, and the urgent need for fundraising to support 5G expansion.

Investment Thesis

1. Gradual recovery in financial performance

- Vi reported a 4% growth in revenue in Q3FY25 along with narrowing of losses. While Vi is overburdened with massive debts and huge interest costs, the major business fundamentals have shown recovery this quarter.

2. Recovery in ARPU

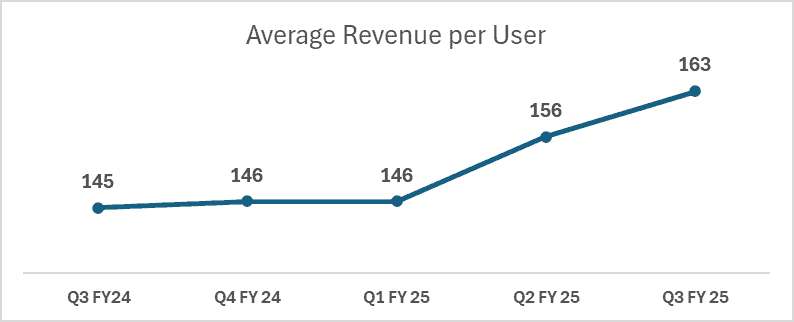

Vi has reported a Quarter on Quarter increase in ARPU as a result of rising tariffs by the private partners in the telecom space. Here is the breakdown of the average revenue per user that Vi generated in the last few quarters :

3. Competition & Market position

| Company | Market Share | ARPU (Q3 FY25) |

| Vodafone Idea | 18% | ₹ 163 |

| Bharti Airtel | 36% | ₹ 245 |

| Reliance JIO | 40% | ₹ 203 |

ARPU: Average revenue per user

- VIL faces challenges in raising funds for 5G rollout, lagging in network quality and coverage.

- Jio & Airtel continue to gain market share, with better pricing strategies and faster 5G adoption.

- Upcoming tariff hikes across the industry will potentially strengthen Airtel’s top line.

4. Subscriber Base continues to shrink

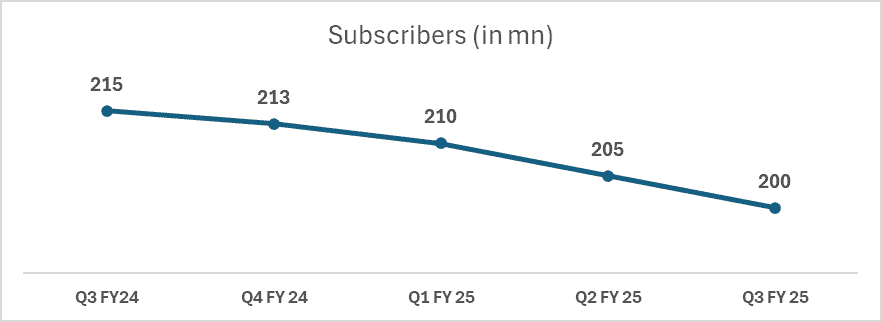

Here is the breakdown of Vi’s subscribers on a QoQ basis

- Vi continues to report a drop in their overall subscriber base due to an aggressive 5G roll-out by Airtel and Jio.

- This would have directly resulted in revenue loss for Vi in Q3 FY25 if it were not for the tariff hikes undertaken by the telecom industry players.

- Vi is in dire need of raising funds to boost their 5G expansion and at the same time reduce their debt position.

5. Massive debt leading to huge interest costs

- Vi has a debt of ₹ 2,330 crores on their books which would mean they would be in need to raise funds in the near future.

- The situation becomes trickier given that Vi is reporting close to 6000 crores loss every quarter.

- Investors should carefully watch out for the upcoming fund-raising efforts of the company.

6. Shareholding Pattern

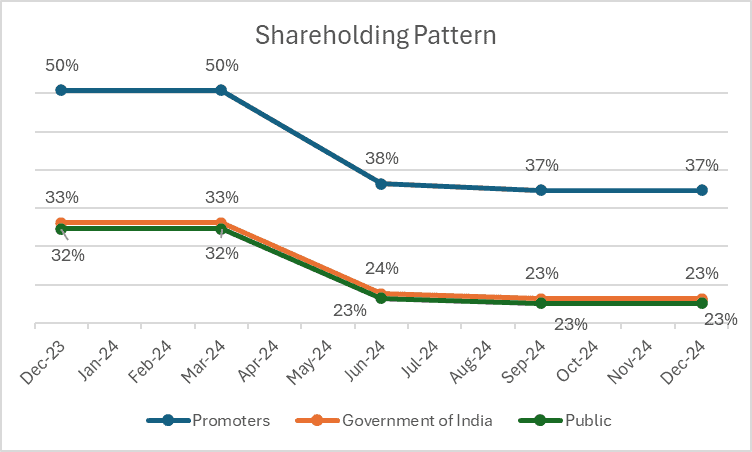

Here is the shareholding pattern of Vi on a Quarterly basis

- A worrying sign for Vi is that both promoters and Government of India have reduced their stakes in the company (in % terms) vs last year.

- On the other hand, we’re seeing a rising participation from the public.

- Investors need to be wary of such a situation as it signals reduced confidence of the promoters to bring the company back on its feet.

Recent Financial Performance (Q3 FY25)

| Metric | Q3 FY 25 | Q3 FY 24 | YoY Growth |

| Revenue | ₹ 11,117 cr | ₹ 10,673 cr | +4% |

| EBITDA | ₹ 4,712 cr | ₹ 4,350 cr | +8% |

| EBIT | ₹ -916 cr | ₹ -1,248 cr | +27% (narrowed losses) |

| PAT | ₹ -6,609 cr | ₹ -6,985 cr | +5% (narrowed losses) |

| ARPU | ₹ 163 | ₹ 145 | +12% |

Highlights:

- Revenue growth of 4% YoY, driven by higher tariffs in the telecom space. This is despite Vi reporting a loss in subscriber base.

- EBITDA margin expansion, indicating slight cost control and operating leverage vs Last year.

- Narrowed losses both in terms of EBIT and PAT.

Valuation insights

Vodafone Idea’s valuation raises red flags for investors. The intrinsic value seems lower than the current market price, suggesting the stock may still have room to fall. Despite fundraising efforts, the company struggles with high debt, continuous losses, and tough competition. ARPU growth has been slow, and profitability remains a challenge. Unless Vodafone Idea finds a strong path to recovery, investors could face more pain before seeing any real gains.

From a relative valuation standpoint:

- P/E Ratio: Not applicable in the case of Vodafone Idea as it is a loss-making company. On the contrary, a market leader in the telecom space has a P/E multiple of 41.54x.

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of Vodafone Idea based on expected future cash flows:

- Intrinsic Value Estimate: ₹6.2 per share

- Downside Potential: 23%

- Assumptions :

- WACC: 13.7%

- Cost of Equity: 16% given the business uncertainties.

- Cost of Debt: 10% (Post-tax) adjusted for high leverage of Vi.

- WACC: 13.7%

Technical outlook on Vodafone Idea share

- Resistance Level: ₹10.0

- Support Level: ₹7.1 (Short-term moving average)

- RSI (Relative Strength Index): 42 (Neutral to bearish)

- Trading Volume: Increasing, indicating speculation around fundraising news. Stock usually sees higher than average volumes due to massive retail participation.

Vodafone Idea stock recommendation

Current Stance: Based on the current positioning of the company, investors should look to exit the stock. The firm’s fate hangs in balance until it secures funding which is large enough to offset its interest costs and the overall debt. The fair value of the share comes out to Rs 6.2 per share which is 15% lower than the current price.

Investment Case for Vodafone Idea

Tariff hikes boosting ARPU growth.

Fundraising efforts could strengthen the balance sheet.

Attractive valuation for high-risk investors.

Investment Risks

Debt burden remains a major overhang.

Subscriber base continues to shrink.

Delayed 5G rollout affects long-term competitiveness.

Portfolio fit: Suitable only for investors with a high-risk appetite. Wait for fundraising confirmation before making fresh investments.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Vodafone Idea’s survival hinges on its ability to raise capital and roll out 5G competitively. While recent ARPU growth and revenue stabilization are positive signs, the company still faces significant hurdles in a highly competitive telecom market.