Stock overview

| Ticker | ZOMATO |

| Sector | Online Food Delivery & Quick Commerce |

| Market Cap | ₹ 2,12,000 Cr |

| CMP (Current Market Price) | ₹ 217 |

| 52-Week High/Low | ₹ 304/ ₹ 138 |

| P/E Ratio | 140.2 (vs Industry average. of 95.3) |

| EV/EBITDA | 45.7x |

| Beta | 1.25 (High volatile stock) |

About Zomato

Zomato, India’s top food delivery and dining platform, is scaling profitably with strong growth in food delivery, Hyperpure, and quick commerce arm Blinkit. Its strategic expansions and financial turnaround make it a stock to watch.

Key drivers of growth:

1. Strong revenue growth & market leadership:

- Zomato continues to lead the Indian food delivery market with over 60% market share.

- The company’s Quick Commerce segment (Blinkit) is seeing rapid expansion, contributing significantly to revenue.

- Expansion into tier 2 and tier 3 cities has unlocked new growth potential.

2. Path to sustainable profitability:

- The company reported profitability at an adjusted EBITDA level in recent quarters.

- Increasing average order values (AOV) and higher subscription revenue from Zomato Gold have improved unit economics.

- Cost optimization and delivery efficiency improvements are driving margin expansion.

3. Government & Regulatory tailwinds:

- The Union Budget 2025 focused on digital infrastructure and logistics, which could benefit Zomato’s last-mile delivery operations.

- Potential tax incentives for startups and digital businesses could provide additional support.

- Increasing internet penetration and UPI adoption continue to drive growth in digital commerce.

Recent Financial Performance (Q3 FY25)

| Metric | Q3 FY 25 | Q3 FY 24 | YoY Growth |

| Revenue | ₹ 5,405 cr | ₹ 3,288 cr | +64% |

| Net Profit | ₹ 59 cr | ₹ 138 cr | -57% |

| Gross Order Value | ₹ 13,750 cr | ₹ 9,850 cr | +39.6% pt |

| Blinkit Revenue | ₹ 1,200 cr | ₹ 600 cr | +100% |

Highlights:

- Revenue saw 64% YoY growth, driven by both food delivery, Blinkit and Hyperpure.

- There was pressure on profitability as company focused on expansion by opening more dark stores for servicing Blinkit orders

- Blinkit doubled its revenue YoY, solidifying Zomato’s Quick Commerce ambitions. Competition, however, intensified in the Quick Commerce space with Zepto and Swiggy expanding rapidly.

Valuation insights

When we value a company like Zomato, we’re asking two questions:

- Is it cheap or expensive compared to how it’s been in the past—or to other companies?

- How much money could it make in the future, and what does that mean for its stock price now?

From a relative valuation standpoint:

- P/E Ratio: 140.2x (High due to early profitability stage but justified by growth).

- EV/EBITDA: 45.7x

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of Zomato based on expected future cash flows:

- Intrinsic Value Estimate: ₹240 per share

- Upside Potential: 10%

- Assumptions:

- Revenue CAGR of 30% (FY25-FY30)

- EBITDA Margin expansion to 12% by FY30

- WACC: 11.5%

- Cost of Equity: 13% (Risk-Free Rate: 7%, ERP: 6%, Beta: 1.25)

- Cost of Debt: 8% (Post-tax)

Key risks to watch

- Competition from Swiggy & new entrants: Pricing wars could pressure margins.

- Regulatory risks: Potential changes in gig worker policies or platform fee regulations.

- Execution risks: Scaling Blinkit profitably while maintaining food delivery leadership.

Competitor analysis for Zomato

Key financial metrics (FY 24 snapshot)

| Company | Market Cap (₹ cr) | P/E Ratio | EBITDA Margin | YoY Growth |

| Zomato | 2,12,,000 | 140.2 | 5.4% 👍 | 64% 👍 |

| Swiggy | 94,000 | NA | 3.8% 👎 | 30% 👎 |

Observations:

- Zomato is trading at a premium valuation due to strong revenue growth and consistent profitability in the last few quarters.

- Swiggy lags slightly in margins but remains a formidable competitor on almost all revenue avenues including dining out, food ordering and quick commerce space.

- Players like Flipkart and Minutes made their entry in the quick commerce space thereby intensifying competition in the space.

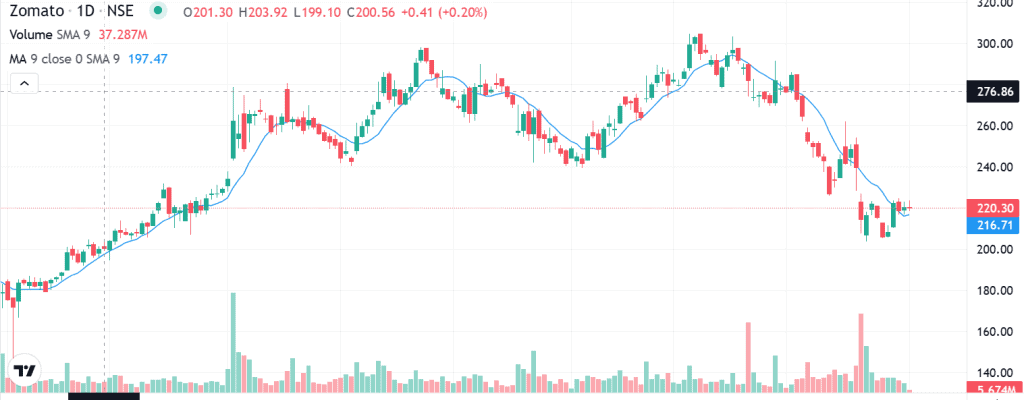

Technical outlook on Zomato share

- Short-Term Trend: The stock is in a consolidation phase at the moment, trading below its 50-day moving average of ₹250.

- RSI: 38 (Approaching oversold zone)

- Support Levels: ₹205

- Resistance Levels: ₹225

- Trading Volume: Higher than average, indicating decent investor interest.

Union Budget 2025: Key outcomes

- Incentives for Startups & Digital Platforms: Possible tax reliefs for digital-first businesses like Zomato.

- Logistics & Infrastructure Boost: Investments in warehousing and faster delivery networks could enhance Blinkit’s efficiency.

- Food Tech & Agriculture Support: Government initiatives to support local restaurants and farm-to-table models could benefit Zomato’s supply chain.

Zomato stock recommendation

Current Stance: Buy with a 12-month target of ₹240.

Rationale:

-Strong growth in food delivery and Quick Commerce (Blinkit).

-Clear path to sustained profitability.

-Potential upside from government incentives and logistics infrastructure improvements.

Risk-Reward Profile: Moderate risk with high growth potential.

If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Zomato is well-positioned to capitalise on India’s growing digital economy and changing consumer habits. While the stock trades at a high valuation, its market leadership, profitability turnaround, and expansion into Quick Commerce make it an attractive long-term investment.

Investors with a high-risk appetite can consider accumulating on dips, while short-term traders should watch for breakouts above ₹225.