In an era where national security is paramount, defense technology companies play a crucial role. Bharat Electronics Limited (BEL), a key player in India’s defense sector, stands out with its robust portfolio and strategic initiatives.

But does BEL offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BEL |

| Industry/Sector | Capital Goods (Defence) |

| Market Cap (₹ Cr.) | 2,08,548 |

| Free Float (% of Market Cap) | 48.86% |

| 52 W High/Low | 340.50 / 221.00 |

| P/E | 41.02 (Vs Industry P/E of 39.69) |

| EPS (TTM) | 6.83 |

About Bharat Electronics

Bharat Electronics Limited (BEL) is a government-owned company in India specialising in manufacturing advanced electronic products and systems for the defence forces.

Apart from defence products, the company also caters to various sectors like homeland security, smart cities, e-governance, space electronics, energy storage, network security, railways, airports, telecom, and medical electronics.

Key business segments

Bharat Electronics operates primarily in the following key business segments:

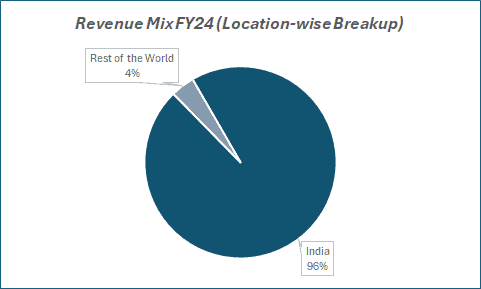

- Defense (90%) – BEL’s primary revenue driver, offering products such as radars, missile systems, and electronic warfare equipment to the Indian armed forces.

- Non-Defense (10%) – Includes electronic voting machines, healthcare solutions, and solar power systems, diversifying the company’s portfolio beyond defense.

Primary growth factors for Bharat Electronics

Bharat Electronics key growth drivers:

- Rising defence spending – Increased government allocation toward defence modernization and indigenisation directly benefits BEL.

- Diversification beyond defence – Expanding into civil aviation, homeland security, healthcare, and railways opens up new revenue streams.

- Strong R&D backbone – Robust in-house R&D drives innovation and enables BEL to deliver advanced, tailored solutions.

- Strategic collaborations – Partnerships with DRDO, ISRO, and private players enhance tech capabilities and accelerate development.

- Robust order book – Consistent large orders from the armed forces and exports ensure strong revenue visibility.

- Expanding exports – Rising global demand from Southeast Asia, Africa, and Latin America boosts BEL’s international footprint.

Detailed competition analysis for Bharat Electronics

Key financial metrics – FY 24;

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE % | ROCE % | Order Book as of 31st Dec ‘24 (₹ Cr.) | P/E (TTM) |

| Bharat Electronics | 20268.24 | 24.90% | 19.45% | 26.12% | 34.97% | 71100 | 41.21 |

| Hindustan Aeronautics | 30381.08 | 32.06% | 25.00% | 28.92% | 38.89% | 130000 | 32.57 |

| Bharat Dynamics | 2369.28 | 22.65% | 25.86% | 17.99% | 24.39% | 18852 | 83.60 |

| Zen Technologies | 439.85 | 41.10% | 29.44% | 34.13% | 48.86% | 817 | 61.26 |

| Data Patterns Ltd. | 519.80 | 42.64% | 34.95% | 14.59% | 20.19% | 1094 | 53.90 |

Key insights on Bharat Electronics

- Achieved a revenue CAGR of 11% (5Y) and 13% (3Y), supported by strong order execution across defence and non-defence segments.

- Maintains robust EBITDA margins of 22%–27%, driven by scale, operational efficiency, and cost control.

- Delivered profit CAGR of 16% (5Y) and 24% (3Y), reflecting consistent growth and diversified revenue streams.

- Debt-free balance sheet underscores financial prudence and enables future investments in R&D and capacity expansion.

- Working capital cycle improved from 188 days in FY20 to 133 in FY24, reflecting operational efficiency.

- Strong order book of over ₹70,000 crore (~3x annual revenue), ensuring healthy revenue visibility.

- Impressive return ratios with ROE at 26% and ROCE at 35%, indicating efficient capital deployment.

- Maintains a healthy dividend payout ratio of 43.4%, signaling strong cash generation and commitment to shareholder returns.

Recent financial performance of Bharat Electronics for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 4162.16 | 4604.90 | 5770.69 | 25.32% | 38.65% |

| EBITDA (₹ Cr.) | 1072.50 | 1399.95 | 1669.49 | 19.25% | 55.66% |

| EBITDA Margin (%) | 25.77% | 30.40% | 28.93% | -147 bps | 316 bps |

| PAT (₹. Cr.) | 848.12 | 1083.88 | 1301.27 | 20.06% | 53.43% |

| PAT Margin (%) | 20.38% | 23.54% | 22.55% | -99 bps | 217 bps |

| Adjusted EPS (₹) | 1.18 | 1.49 | 1.79 | 20.13% | 51.69% |

Bharat Electronics financial update (Q3 FY25)

Financial Performance

- Revenue grew 39% YoY in Q3FY25, beating estimates on strong execution.

- PAT surged 53% YoY; EBITDA rose 56% YoY.

- EBITDA margin improved by 316 bps YoY to 28.93%, driven by better product mix and cost control.

- Order backlog at ₹71,100 crore, ~3x FY25E revenue.

- Cumulative order intake YTD: ₹10,000 crore, lower than expected.

Outlook

- FY25 order inflow guidance retained at ₹25,000 crore.

- QRSAM could contribute ₹25,000–30,000 crore to future orders.

- Gross margin guidance for FY25 at 42% (vs. 49.5% in H1FY25).

- Planned CAPEX of ₹800 crore for FY25 to support growth.

Company valuation insights – Bharat Electronics

Bharat Electronics Ltd (BEL) currently trades at a TTM P/E of 41.21, slightly above the industry average of 38.98, and has delivered a 1-year return of 23.2%, significantly outperforming the Nifty 50’s -1.1%.

BEL is well-positioned to benefit from the government’s focus on indigenization, the rising share of electronics in defence procurement, and its market leadership in defence electronics. A robust order book exceeding ₹70,000 crore (~3x annual revenue), healthy EBITDA margins between 22%–27%, and a debt-free balance sheet further enhance its long-term visibility and financial strength.

We value BEL at 36x FY27E EPS of ₹9, arriving at a target price of ₹325, implying an upside potential of 13%.

Major risk factors affecting Bharat Electronics

- High client concentration: Over 80% of revenue comes from the Indian defence sector; any budget cuts could impact performance.

- Supply chain disruptions: Material delays and rising input costs may affect production and margins.

- Regulatory uncertainty: Shifts in defence policies or trade restrictions could impact operations and growth prospects.

Technical analysis of Bharat Electronics share

Bharat Electronics Ltd (BEL) has recently broken out of a descending channel with a 1.7% move, suggesting a momentum-driven entry opportunity. The stock is above its 50-DMA and nearing a 100-DMA crossover, indicating a bullish trend setup.

While the MACD is positive at 1.82, the line is still below the signal line. However, shrinking negative histograms signal a possible bullish crossover ahead. The RSI at 51.70 indicates healthy buying interest. Relative RSI remains positive over 21-day and 55-day periods (0.03 each), showing outperformance vs. benchmark. ADX at 21.94 points to a developing trend, which may strengthen if momentum sustains.

A sustained move above ₹300 can drive the stock toward ₹325, and eventually its all-time high of ₹340. ₹270 serves as a key support level.

- RSI: 51.70 (Neutral–Positive)

- ADX: 21.94 (Developing trend)

- MACD: 1.82 (Positive, bullish crossover awaited)

- Resistance: ₹300

- Support: ₹270

Bharat Electronics stock recommendation

Current Stance: Buy with a target price of ₹325 (12-month horizon); BEL’s leadership in defence electronics, strong order book, and margin resilience make it a compelling play on India’s defence indigenization push.

Why buy now?

Defence push: Direct beneficiary of India’s rising defence spend and indigenization drive.

Strong order book: ₹70,000+ crore backlog (~3x revenue) ensures earnings visibility.

Diversification: Expanding into non-defence sectors reduces reliance on military orders.

Operational strength: Healthy margins, improving working capital, and a debt-free balance sheet.

Export growth: Increasing global footprint adds to long-term growth potential.

Portfolio Fit

As India’s premier defence electronics PSU, BEL offers a unique blend of public sector stability and high-growth potential. Its dominant market position, healthy return ratios (ROE 26%, ROCE 35%), and attractive dividend yield make it a strong core holding for investors seeking steady compounding from the defence and manufacturing theme.

If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBharat Electronics: Budget 2025-26 opportunities

- Higher defence allocation: Continued rise in defence budget to support modernization and indigenous procurement.

- Make in India push: Increased outlay towards Atmanirbhar Bharat initiatives to boost domestic defence manufacturing.

- Capital expenditure focus: Enhanced capital allocation for defence infrastructure, radar systems, and surveillance tech.

- Export promotion: Government incentives and defence diplomacy aiding BEL’s international expansion.

- R&D support: Additional funding and tax benefits to accelerate indigenous technology and product development.

Final thoughts

Bharat Electronics Limited stands as a pivotal entity in India’s defense sector, underpinned by a strong order book, commitment to indigenization, and diversification into non-defense areas. While financial indicators highlight robust growth and stability, potential investors should weigh the risks associated with client concentration and supply chain dynamics. For those seeking exposure to India’s defense modernization and technological advancement, BEL presents a compelling opportunity.