Pharmaceutical stocks have long been a favorite for investors seeking stability, defensive plays, and long-term growth. Among them, CIPLA, one of India’s largest and most reputable pharmaceutical companies, has stood the test of time with its strong fundamentals, robust business model, and consistent performance. But does CIPLA remain an attractive investment today?

Let’s dive deep into its business, growth drivers, valuation, and risks to help you make an informed decision.

Stock Overview

| Ticker | CIPLA |

| Industry/Sector | Pharmaceuticals |

| Market Cap (Rs Cr.) | 1,19,688 |

| Free Float (% of Market Cap) | 67.97% |

| 52 W High/Low | 1702.05 / 1317.25 |

| P/E | 23.99 (Vs Industry P/E of 33.46) |

| EPS (TTM) | 61.78 |

About Cipla

Cipla Limited, a global pharmaceutical company established in 1935, provides affordable medicines to those in need. The company manufactures, develops, and markets a wide range of branded and generic formulations and APIs, covering various therapeutic segments. With a presence in India, South Africa, North America, and other markets, Cipla is expanding its portfolio globally.

Key business segments

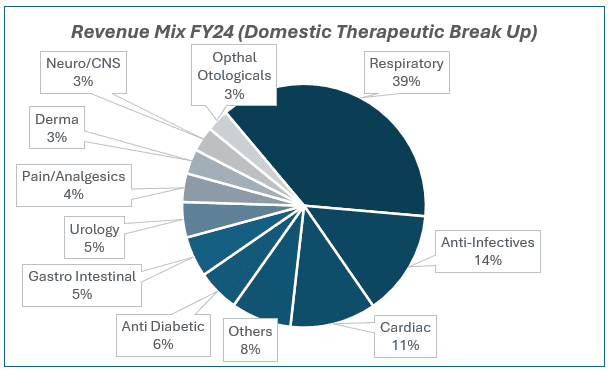

Cipla’s diversified portfolio and strong presence in both regulated and emerging markets contribute to its global pharmaceutical leadership.

1. Prescription drugs

- Focuses on branded and generic medicines across therapeutic areas such as:

- Respiratory (inhalers, asthma, COPD)

- Cardiovascular

- Anti-infectives

- Diabetes

- Central Nervous System

2. Consumer health (OTC & Wellness)

- Nicotex (smoking cessation)

- Cofsils (cough relief)

- ActivKids (nutritional supplements)

- Prolyte ORS (rehydration)

3. Active pharmaceutical ingredients (API)

- Supplies APIs to pharmaceutical companies globally, covering:

- Antiretrovirals

- Respiratory drugs

- Oncology drugs

- Cardiovascular drugs

4. Generics

- Manufactures and supplies affordable generic medicines, particularly in:

- US, India, South Africa, and other emerging markets

- Chronic and acute therapy areas

5. Institutional business

- Supplies medicines to global health institutions like:

- WHO, Global Fund, and PEPFAR

- HIV/AIDS, malaria, and tuberculosis treatment programs

6. Emerging markets & Global Expansion

- Strong presence in South Africa, the US, Europe, and emerging markets in Asia and Latin America

Primary growth factors for Cipla

1. Strong domestic business (India)

- Cipla is a market leader in respiratory, urology, and anti-infective therapies.

- Growth in chronic therapies such as respiratory, cardiology, and diabetes.

- Expansion into consumer health and OTC products.

2. North America expansion

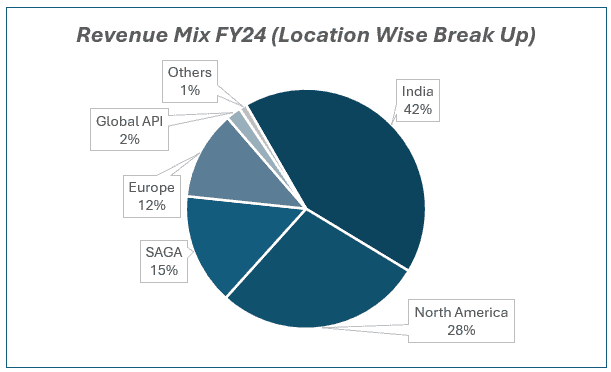

- Strong presence in the U.S. generics market approx. 28% of revenue comes from NA.

- Growth in complex generics, including inhalers and injectables.

- Pipeline of ANDA (Abbreviated New Drug Application) approvals.

3. Respiratory portfolio leadership

- Market dominance in inhalers, nebulizers, and DPI (Dry Powder Inhalers).

- Expansion of respiratory products in the U.S. and emerging markets.

4. South Africa and Emerging markets

- Leading player in South Africa’s pharmaceutical market close to 15% of revenue comes from Africa where Cipla is one of the dominant players.

- Growing presence in emerging market across the Global API players. Emerging markets contributes to 39% (ex. India) of the API Segment.

5. API and CDMO Business

- Strong Active Pharmaceutical Ingredient (API) business. Currently, 41% of the API revenue comes from Europe alone followed by emerging markets 39%.

- Growing Contract Development and Manufacturing Organization (CDMO) partnership.

6. Biologics & Specialty business

- To build an innovation engine, company’s plan to develop in-house capabilities as well as strike more strategic alliances.

- Cipla is building strong in house capabilities for specialty and exploring CDMO partnerships for peptides, Long-Acting Injectables (“LAIs”), biosimilars specialty products and complex injectables.

Detailed competition analysis for Cipla

Key Financial Metrics – FY 24;

| Company | Revenue(Rs Cr.) | EBITDA (Rs Cr.) | EBITDA Margin (%) | PAT (Rs Cr.) | PAT Margin (%) | P/E (TTM) |

| Cipla | 25774.09 | 6291.05 | 24.41% | 4155.31 | 16.12% | 23.99 |

| Torrent Pharma | 10728.00 | 3368.00 | 31.39% | 1656.00 | 15.44% | 55.37 |

| Dr. Reddy’s Lab | 28011.10 | 7933.10 | 28.32% | 5563.20 | 19.86% | 18.61 |

| Mankind Pharma | 10334.77 | 2535.07 | 24.53% | 1926.56 | 18.64% | 48.23 |

| Lupin | 20010.82 | 3800.01 | 18.99% | 1935.57 | 9.67% | 32.03 |

Key insights on Cipla

- One India: This segment includes Branded Prescription (Rx), Trade Generics (Gx), and Consumer Health (Chl). Q3FY25 saw approximately 10% YoY growth across the segment, driven by strong performance in chronic therapies like Respiratory, Cardiac, and Urology, which continued to outpace market growth. Trade Generics (Gx) showed signs of recovery, while the Acute segment faced seasonal headwinds.

- North America: North America reported quarterly revenue of $226 Mn, a 1.7% YoY decline, impacted by supply chain disruptions in Lanreotide. However, positive traction in the differentiated portfolio and gAlbuterol’s market share increase to 21% provided support.

- One Africa: The South Africa prescription business maintained its market leadership, growing 28% YoY, driven by the strong performance of the private market. In the private market, secondary growth reached 8.8%, significantly outpacing the overall market growth of 2%.

- Others: Cipla’s Goa facility, cleared by the USFDA, is preparing to launch key products like generic Abraxane (H2FY26) and generic Advair (H1FY26). For the quarter, R&D investments stood at Rs 360 Cr (5% of revenue), focused on product filings. Additionally, Cipla paid a Rs 1,000 Cr dividend during the quarter.

Financial performance of Cipla for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (Rs Cr.) | 6,603.81 | 7,051.02 | 7,072.97 | 0.31% | 7.10% |

| EBITDA (Rs Cr.) | 1,747.53 | 1,885.59 | 1,988.92 | 5.48% | 13.81% |

| EBITDA Margin (%) | 26.46% | 26.74% | 28.12% | 138 bps | 166 bps |

| Net Profit (Rs Cr.) | 1,068.51 | 1,306.02 | 1,583.72 | 21.26% | 48.22% |

| Net Profit Margin (%) | 16.18% | 18.52% | 22.39% | 387 bps | 621 bps |

| Adjusted EPS (Rs) | 13.08 | 16.13 | 19.45 | 20.58% | 48.70% |

In the third quarter ending December 31, 2024, Cipla reported a consolidated net profit of ₹15.71 billion, a 49% increase from the previous year, surpassing analysts’ expectations of ₹12.12 billion.

This growth was primarily driven by a 10% rise in revenue from the Indian market, totaling ₹31.46 billion, due to strong demand for respiratory and urology-related drugs. Despite a 1% decline in North American sales, affected by supply issues with the tumor drug Lanreotide, overall revenue increased by 7.1% to ₹70.73 billion.

Company valuation insights – CIPLA

Cipla is currently trading at a TTM P/E of 23.99, which is lower than the industry average of 33.46, indicating a relative valuation discount. Over the last 12 months, the stock has delivered a marginally negative return of -0.42%, underperforming the Nifty 50’s 3.66% gain.

The company remains well-positioned in the pharmaceutical sector, benefiting from strong domestic demand and a robust U.S. business. Cipla’s focus on respiratory, chronic, and complex generics strengthens its long-term growth potential.

Additionally, increased traction in the U.S. speciality segment and regulatory approvals for new launches are expected to drive future revenue growth. If no significant regulatory disruptions affect product launches and approvals, Cipla is well-placed to capitalise on upcoming opportunities.

For valuation, we employ a Price-to-Earnings (P/E) approach, assuming an EPS growth rate of 5% over the next 12 months. With the current TTM EPS at ₹61.78, the projected EPS for the next year stands at ₹64.87. Applying a valuation multiple of 25x, Cipla’s 12-month target price is estimated at ₹1,620, implying a potential upside of 11% from current levels.

While short-term headwinds exist, Cipla’s strategic focus on speciality pharma and operational efficiencies make it a compelling investment for long-term value creation.

Major risk factors affecting Cipla

· Regulatory challenges: Operating in over 100 countries, Cipla must navigate a complex landscape of varying regulatory standards and compliance requirements. Changes in regulations, especially in major markets like India, South Africa, and the U.S., can lead to increased operational costs and potential delays in product launches.

· Market concentration: A significant portion of Cipla’s revenue is derived from its operations in India and North America. This dependence makes the company vulnerable to market-specific risks, such as economic downturns or regulatory changes in these regions.

· Competition and pricing pressures: The pharmaceutical industry is highly competitive, with numerous players offering similar products. Cipla faces strong competition from both international and domestic companies, which can lead to pricing pressures and affect market share.

Technical Analysis of Cipla share

Cipla is on the verge of breaking out from a falling channel pattern around the ₹1,450 level. A decisive breakout above this level could push the stock towards its immediate resistance at ₹1,550. If Cipla sustains above ₹1,550, it may further extend gains towards the target price of ₹1,620.

The Relative Strength Index (RSI) at 55.7 indicates a neutral stance but is approaching the overbought region, suggesting that the stock has the potential for a strong breakout if the momentum continues. The MACD is positive at 2.81, with the MACD line above the signal line, indicating bullish momentum. Additionally, the widening MACD histogram suggests strong buying interest.

Cipla’s relative strength against the benchmark index stands at 0.03, implying that the stock has been slightly outperforming the broader market, reflecting increasing investor confidence.

Currently, Cipla is trading below its 100-day and 200-day moving averages, indicating that the longer-term trend remains weak. However, the stock is about to cross its 50-day moving average from below, signalling a potential short-term trend reversal and strength building.

- RSI: 55.7 (Neutral)

- ADX: 11.94 (Range Bound)

- MACD: 2.81 (Positive)

- Resistance: ₹1,550

- Support: ₹1,320

Cipla Ltd stock recommendation

Current stance: Buy with a target price of ₹1,620 (12-month horizon), short-term volatility expected.

Why buy now?

Cipla trades at a discount to industry peers yet leads in respiratory, chronic therapies, and complex generics. Its U.S. business is expanding on key launches, while strong inhalation and peptide pipelines promise further growth.

In India, Cipla’s dominance in chronic and acute therapies leverages a robust distribution network.

Barring major regulatory setbacks, new product approvals should sustain earnings momentum. Cost optimisation, operational efficiency, and investments in biosimilars and digital healthcare further boost profitability.

Portfolio Fit

Cipla is an ideal addition for investors seeking exposure to defensive, high-quality pharmaceutical stocks with steady earnings growth. Given its discounted valuation and improving technical setup, Cipla offers a compelling risk-adjusted return, particularly for investors looking for stable growth within the healthcare sector.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebCipla Ltd: Budget 2025 – 26 opportunities

· Incentives for Research and Development (R&D): The budget emphasizes the importance of R&D in the pharmaceutical industry. While specific incentives were not detailed, the focus on innovation suggests potential support for companies investing in R&D, which could benefit Cipla’s efforts in developing new therapies.

· Customs Duty Exemptions on Life-Saving Drugs: The inclusion of 36 life-saving drugs and six others under concessional duties aims to reduce costs, benefiting both the pharmaceutical industry and patients. This measure could enhance Cipla’s ability to provide affordable medications.

· Healthcare Infrastructure Development: Increased allocation for healthcare infrastructure is expected to improve access to medical services. This development may lead to higher demand for pharmaceutical products, presenting growth opportunities for companies like Cipla.