Stock overview

| Ticker | COFORGE |

| Sector | Information Technology |

| Market Cap | ₹ 44,190 Cr |

| CMP (Current Market Price) | ₹ 6,480 |

| 52-Week High/Low | ₹ 10,027 / 4,287 |

| P/E Ratio | 58x |

| Beta | 1.35 (High volatility) |

About Coforge

Coforge Ltd. is a global digital services and solutions provider headquartered in India. Formerly known as NIIT Technologies, the company rebranded to reflect its evolved focus on digital transformation. It operates across:

- Banking & Financial Services (BFS)

- Insurance

- Travel, Transportation, and Hospitality (TTH)

- Healthcare and Public Sector

With over 26,000 employees across 25+ countries, Coforge focuses on cloud, data, AI, automation, and platform-based services to drive client success.

Primary growth factors for Coforge

1. Digital transformation tailwinds

- Enterprise spending on cloud, AI, and automation is rising globally.

- Coforge’s domain-centric delivery and agile execution are winning deals.

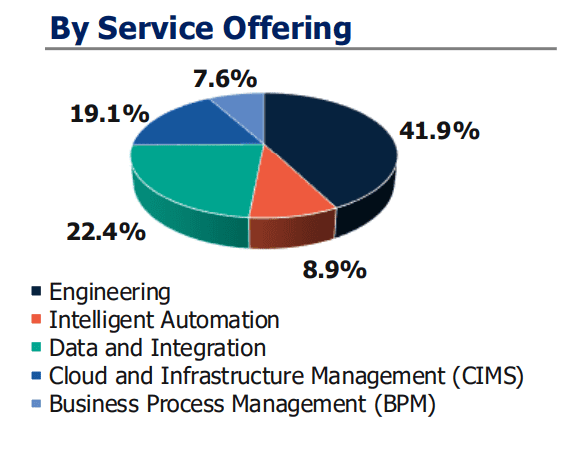

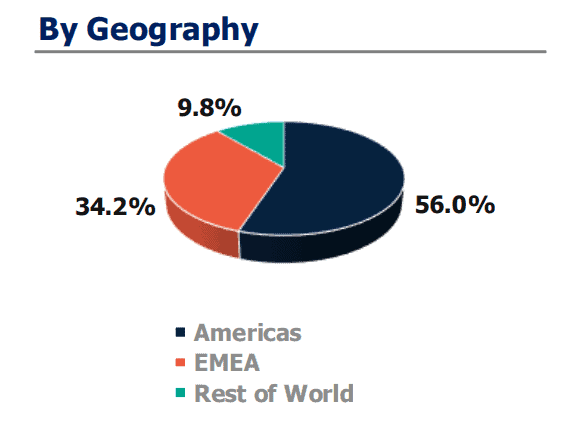

- Coforge boasts a well-diversified portfolio across geographies as well as across its various service offerings

2. Strong presence in BFSI and TTH

- ~45% of revenues from BFSI, where demand for digitization remains resilient.

- TTH vertical recovery post-COVID has helped boost volumes.

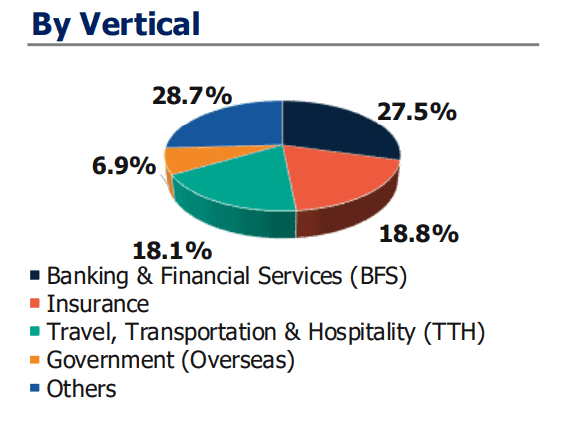

- Here’s a detailed breakdown of vertical-wise revenue for COFORGE

3. Strategic acquisitions and alliances

- Acquired Cohesive Technologies to enhance cloud and DevOps offerings.

- Partnerships with AWS, Microsoft Azure, Salesforce, and ServiceNow strengthen service breadth.

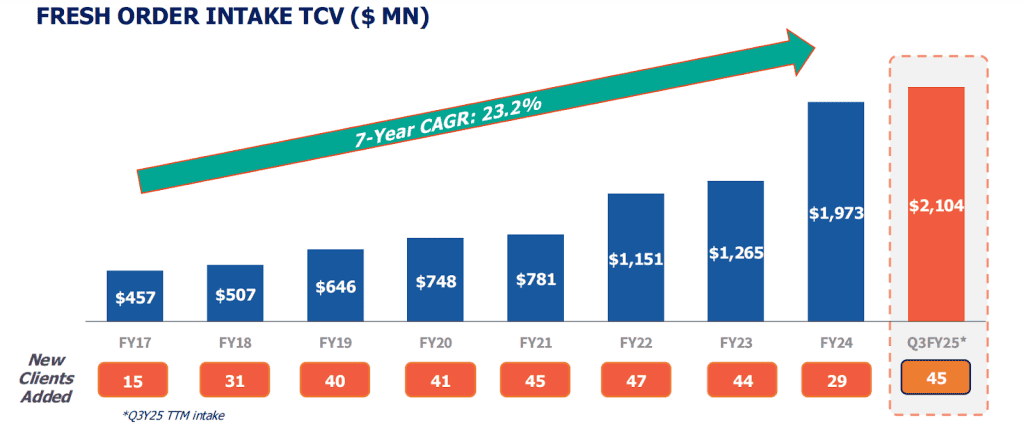

4. Robust order book and pipeline

- TCV for Q3 stood at $2104 million, with multiple large deal signings and 45 new clients.

- Visibility for the next 12-18 months remains strong.

5. Focus on high-value work

- Shift from legacy to next-gen services, including low-code platforms, cybersecurity, and platform re-engineering.

Q3 FY25 Financial performance

Solid revenue growth driven by large deal wins and continued client additions in BFS and Insurance sectors, despite margin pressures due to rising wage costs and offshore transition.

Detailed competition analysis for Coforge

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Coforge | 44,190 Cr | ₹ 3,318 cr | 58x | 28% |

| PB Fintech | 69.081 Cr | ₹ 1,291 cr | 332x | 2% |

| OFSS | 65,334 cr | ₹ 1,715 cr | 28x | 40% |

| Hexaware | 39,837 cr | ₹ 3,154 cr | 34x | 29% |

- While Coforge trades at a premium valuation, its higher margins, brand equity, and expansion plans justify investor confidence.

- Coforge’s metrics place it in the top bracket among mid-tier IT players with strong profitability and premium valuation.

Company valuation insights: Coforge

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of Coforge shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹6,900 per share

- Upside Potential: 15%

- WACC: 10%

- Terminal Growth Rate: 4.6%

Despite rich valuations, Coforge remains attractive due to its consistent execution, high client retention, and digital-first approach..

Major risk factors affecting Coforge

1. Client budget constraints

- Global macro pressures could result in IT budget cuts, affecting deal pipeline.

2. Currency fluctuations

- USD-INR volatility can impact profitability due to significant export revenue exposure.

3. Talent costs and attrition

- Wage inflation and higher attrition in IT services can compress margins.

4. Competitive intensity

- Larger players (Infosys, TCS) are entering the mid-market client space.

- Pricing pressure in digital transformation deals.

Technical analysis of Coforge

- Resistance: ₹6,600

- Support: ₹5,800

- Momentum: Neutral, Bullish

- RSI (Relative Strength Index): 53 (Neutral)

- 50-Day Moving Average: ₹6420

- 200-Day Moving Average: ₹5800

Coforge is trending within a bullish channel. A breakout above ₹7,000 could lead to a rally toward ₹7,400+. Short-term corrections could be buying opportunities.

Coforge stock recommendation by Ketan Mittal

Buy / Accumulate on Dips

Target Price: ₹6,900 (12 months)

If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0d

Outlook: Positive with strong execution and visibility

Investment Horizon: 12–18 months

Recommendation: Accumulate on dips

Coforge represents a solid long-term story in the mid-cap IT space, supported by digital tailwinds, healthy financials, and execution strength. While valuation is rich, the growth narrative remains intact.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0d