DLF Limited is a dominant force in India’s real estate sector, known for its premium residential and commercial projects. With a strong legacy, vast land bank, and a strategic focus on luxury housing and commercial leasing, the company continues to shape urban landscapes.

Stock Overview

| Ticker | DLF |

| Industry/Sector | Realty (Construction – Real Estate) |

| Market Cap (Rs Cr.) | 1,74,869 |

| Free Float (% of Market Cap) | 25.85% |

| 52 W High/Low | 967.60 / 687.05 |

| P/E | 45.19 (Vs Industry P/E of 43.80) |

| EPS (TTM) | 16.18 |

About DLF

DLF Limited is one of India’s largest real estate developers, with a legacy spanning over seven decades. Established in 1946 by Chaudhary Raghvendra Singh, DLF played a pivotal role in shaping urban landscapes, particularly in Delhi NCR. The company operates across multiple real estate verticals, including residential, commercial, and retail properties, and has a strong presence in high-growth regions such as Gurugram, Delhi, and Chennai.

The company has the capability to efficiently manage the construction of 40-50 million sq. ft annually. At present, its project pipeline stands at 40 million sq. ft, which includes the two Downtown projects currently under construction.

The company boasts a 70.6 million sq. ft leasable area, with 2.2 million sq. ft of ongoing residential projects and 14 million sq. ft of non-residential projects under construction, further strengthening its growth outlook.

Key business segments

- Residential development:

- Premium housing projects in prime locations.

- Luxury and super-luxury apartments, villas, and plotted developments.

- Upcoming projects with sustainable and smart-living features.

- Commercial leasing:

- Development and leasing of office spaces to multinational corporations.

- Significant footprint in corporate hubs such as Gurugram and Chennai.

- Retail & Hospitality:

- High-end shopping malls such as DLF Emporio and DLF Avenue.

- Partnerships with leading brands for premium retail experiences.

- Hotels and hospitality ventures through joint ventures.

- New ventures:

- Expansion into sustainable urban infrastructure.

- Digital innovations and PropTech investments.

Primary growth factors for DLF

· Growing demand for premium housing: Urbanization and rising disposable incomes are driving demand for high-end residential properties. The luxury real estate market in India is experiencing growth, with sales of ultra-luxury homes priced above $4.6 million rising by 17% in 2024. This trend suggests a favourable environment for DLF’s high-end projects.

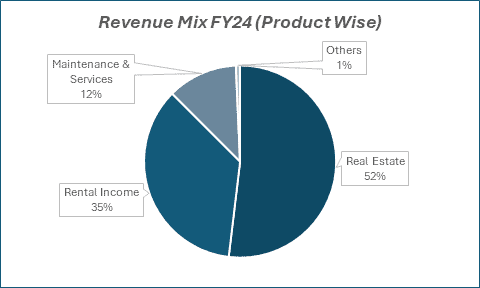

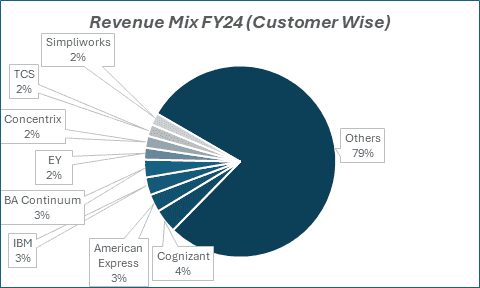

· Strong commercial leasing: Consistent demand from IT/ITES and MNCs ensures stable rental yields, while a well-positioned land bank in high-growth corridors supports long-term expansion.

· Favourable government policies: Initiatives like RERA and Smart City projects continue to support real estate investments and industry growth.

· Execution excellence: DLF’s strong brand reputation attracts premium clientele, while its proven execution capabilities enhance market confidence.

Detailed competition analysis for DLF

Key Financial Metrics – FY 24;

| Company | Revenue(Rs Cr.) | EBITDA(Rs Cr.) | EBITDA Margin (%) | PAT (Rs Cr.) | PAT Margin (%) | P/E (TTM) |

| DLF | 6427.0 | 2123.6 | 33.04% | 1630.4 | 25.37% | 45.19 |

| Macrotech Developers | 10316.1 | 2675.7 | 25.94% | 1567.1 | 15.19% | 46.72 |

| Oberoi Realty | 4495.8 | 2409.9 | 53.60% | 1917.8 | 42.66% | 25.45 |

| Godrej Properties | 3035.6 | -129.7 | -4.27% | 719.3 | 23.70% | 42.91 |

| Sobha Ltd | 3097.0 | 277.0 | 8.95% | 49.1 | 1.59% | 211.08 |

Key insights on DLF

- DLF has maintained a 6% CAGR in revenue over the past three years, driven by strong residential and commercial real estate demand.

- The company enjoys healthy operating margins of 35-40%, supported by premium pricing and cost efficiencies.

- Its pre-sales remain robust, consistently exceeding ₹8,000 crore annually, ensuring strong cash flow visibility.

- DLF follows a prudent financial strategy, reducing debt significantly, with a net debt-to-equity ratio below 0.2x, reinforcing balance sheet strength.

- The company consistently rewards shareholders with dividends, maintaining a payout ratio of ~45-50%, reflecting its stable cash generation.

Financial performance of DLF for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) | |

| Revenue (Rs Cr.) | 1521.15 | 1975.02 | 1528.71 | -22.6% | 0.5% | |

| EBITDA (Rs Cr.) | 510.97 | 502.04 | 399.99 | -20.3% | -21.7% | |

| EBITDA Margin (%) | 33.59% | 25.42% | 26.17% | 75 bps | -742 bps | |

| PAT (Rs Cr.) | 376.50 | 1043.41 | 440.40 | -57.8% | 17.0% | |

| PAT Margin (%) | 24.75% | 52.83% | 28.81% | -2402 bps | 406 bps | |

| Adjusted EPS (Rs) | 2.65 | 5.58 | 4.28 | -23.3% | 61.5% |

· Strong demand: DLF’s pre-sales rose 34% YoY to ₹12,093 crore, led by the Dahlias project, where 41% of inventory was sold for ₹11,816 crore. The average selling price stood at ₹64,000/sq. ft., with an exit price of ₹75,000/sq. ft.

· Key launches: DLF plans four key launches (9 msf, GDV: ₹44,100 crore) in Gurugram, MMR, and Goa. Beyond FY25, it has 28 msf (₹70,400 crores) in the pipeline, bringing the total upcoming launches to 37 msf (~₹1,14,500 crore) over four years.

· Strong occupancy and leasable area: DCCDL’s Q3FY25 revenue grew 9% YoY to ₹1,609 crore, backed by higher office occupancy and increased leasable area. Office and retail occupancy stood at 98% each, while office vacancy declined to 7.2% from 9% at the beginning of the year (non-SEZ vacancy dropped to ~2%, while SEZ vacancies remained around 12%).

· Strong pipeline: Having exceeded its FY25 sales guidance, DLF has raised its Q4FY25 launch pipeline to 9 msf (GDV: ₹44,100 crores). Beyond FY25, it plans ₹70,400 crore (28 msf) in launches, ensuring sustained growth.

· Robust collections & Debt metrics: Collections rose 24% YoY to ₹3,116 crore, boosting OCF to ₹1,850 crore. Net cash in DevCo grew to ₹4,534 crore, while DCCDL’s net debt fell 3% QoQ to ₹16,713 crore, with debt cost easing to 8.24%.

Company valuation insights – DLF

DLF is currently trading at a TTM P/E multiple of 45.19x, slightly above the industry average of 43.80x. The stock has underperformed the Nifty 50, posting -12.2% returns over the past year compared to the index’s 6.7% gain.

However, robust pre-sales, strong free cash flows, and a lean Balance Sheet have strengthened DLF’s financial position. The residential business enjoys a solid cash profile, supported by a sizeable land bank, ensuring growth without major land acquisitions.

The DCCDL portfolio benefits from a strong rental pipeline, driven by higher retail rentals and improving office occupancy, reinforcing a resilient annuity model. An expanded launch pipeline and strong sales momentum will further boost cash flows.

DLF’s relative dominance in the NCR market and a growing rental portfolio enhance revenue visibility. With an improving cash flow trajectory and a robust business model, the company is well-positioned for long-term growth.

Using the Sum-of-the-Parts (SOTP) valuation approach, the stock’s target price is set at ₹950, indicating a 35% potential upside from current levels.

Major risk factors affecting DLF

- Demand & market cyclicality – The real estate sector is highly cyclical, and a slowdown in demand due to economic downturns, rising interest rates, or weak consumer sentiment could affect sales and cash flows.

- Execution & leverage risks – Delays in project execution, rising construction costs, or higher-than-expected debt levels could strain the company’s financials and impact shareholder returns.

- Regulatory & policy risks – Changes in real estate regulations, land acquisition policies, and taxation laws can impact project approvals, timelines, and overall profitability.

Technical analysis of DLF share

The Parabolic SAR has moved above the price, indicating a potential near-term downtrend. The RSI at 36.37 is approaching the oversold zone, which may present a buying opportunity if momentum stabilises. However, the stock’s relative strength against the benchmark has weakened (-0.06), reflecting underperformance.

DLF has breached last year’s key support at 740, confirming a bearish trend. The next major support is at 690, which can act as a stop-loss level. If the stock rebounds and breaks above 760, it could rally toward 840, its next resistance and crossing which the price may extend up to 900-950.

Currently, DLF is trading below all its key moving averages, reinforcing a weak technical setup. The stock needs a strong reversal above 760 for bullish momentum to regain strength.

- RSI: 36.37 (Range Bound)

- ADX: 21.16 (Weak Trend)

- Resistance: 760

- Support: 690

DLF stock recommendation

Current Stance: Buy with a target price of ₹950 (12-month horizon), likely near-term pain.

Why Buy Now?

DLF’s strong pre-sales, robust cash flow, and expanding rental portfolio provide a solid foundation for long-term growth. Its lean balance sheet, strong annuity model, and extensive land bank ensure sustainable expansion without major land investments. A healthy recovery in retail rentals and rising occupancy in offices further strengthens its outlook. While the stock has underperformed recently, an enhanced launch pipeline and improving sales velocity could drive a turnaround.

Portfolio Fit

DLF is an ideal pick for investors looking for exposure to India’s booming real estate sector. Its dominance in NCR, strong cash flow visibility, and rental income growth make it a compelling addition to portfolios focused on real estate and long-term value creation. While near-term price weakness persists, a breakout above ₹760 could trigger a rally towards higher targets.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebDLF: Budget 2025 opportunities

- Infrastructure & Housing push: Increased government spending on urban infrastructure and affordable housing could drive demand for residential projects.

- Tax benefits on real estate: Potential tax incentives for homebuyers may boost pre-sales and overall demand.

- REIT & rental market support: Policies promoting REITs and rental housing could enhance demand for DLF’s commercial portfolio.

- Lower stamp duty & GST cuts: Reduction in transaction costs could accelerate property sales, improving cash flows.

- Smart City & Sustainable development incentives: Encouragement for green buildings and smart city projects may provide growth opportunities.

- Credit & liquidity support: Easier access to financing for developers and buyers could enhance market sentiment and sales momentum.