In a world full of uncertainties, insurance is that one safety net everyone wants but often overlooks. As India witnesses a demographic shift, with a young population becoming increasingly financially aware, life insurance is no longer a luxury – it’s a necessity. At the heart of this evolving financial landscape stands HDFC Life Insurance, one of India’s leading life insurers.

But is it just a defensive play, or does it offer long-term growth potential? Let’s dive into the fundamentals.

Stock overview

| Ticker | HDFCLIFE |

| Industry/Sector | Financial Services (Insurance) |

| Market Cap (₹ Cr.) | 1,47,480 |

| Free Float (% of Market Cap) | 49.59% |

| 52 W High/Low | 761.20 / 511.40 |

| P/E | 82.16 (Vs Industry P/E of 15.26) |

| EPS (TTM) | 8.11 |

About HDFC Life

HDFC Life Insurance Company Limited, founded in 2000 as a joint venture between Housing Development Finance Corporation Ltd (HDFC) and Standard Life (UK), is one of the top private life insurance companies in India. The company went public in 2017 and has since become synonymous with innovation, strong distribution, and consistent profitability in the life insurance sector.

HDFC Life offers a wide range of individual and group insurance solutions, including protection, pension, savings, and investment-linked plans.

Key business segments

HDFC Life operates primarily in the following key business segments:

- Savings & investment products – Traditional participating and non-participating plans, and ULIPs that combine insurance with wealth creation.

- Protection (Term Insurance) – High-margin, pure protection products aimed at replacing income in case of the policyholder’s untimely demise.

- Group Insurance – Employer-employee benefit plans such as group term, superannuation, gratuity, and credit life insurance.

- Pension & Annuity – Retirement-focused products, including deferred and immediate annuities; rising demand due to low pension penetration.

- Health Riders & Add-ons – Supplementary coverage enhancing base life products with critical illness, waiver of premium, and hospital cash benefits.

Primary growth factors for HDFC Life

HDFC Life’s key growth drivers:

- Underpenetrated market – Insurance penetration in India is still low, offering huge growth potential.

- Young, earning population – Rising incomes and financial awareness are pushing insurance adoption.

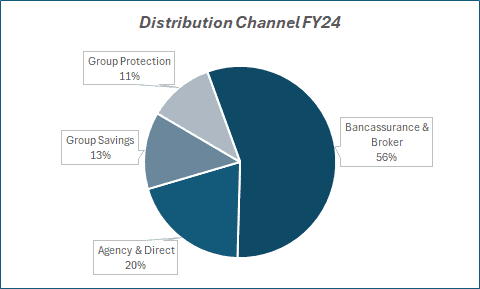

- Strong distribution – 300+ partners including HDFC Bank; a key strength in reaching customers.

- Favorable regulations – IRDA-led initiatives are promoting awareness and simplifying products.

- Product innovation – Custom offerings like Click2Protect and Sanchay Plus help target diverse needs.

Detailed competition analysis for HDFC Life

Key financial metrics – FY 24;

| Company | NBV – 9MFY25 (₹ Cr.) | New Business Margin (%) | AUM (₹ Cr.) | Solvency Ratio (%) | 13th Month Persistency (%) | P/E (TTM) |

| HDFC Life | 2586 | 25.10% | 328684 | 188% | 87% | 82.16 |

| LIC India | 6477 | 17.10% | 5477651 | 202% | 76.7% | 11.53 |

| SBI Life | 4290 | 26.90% | 441680 | 204% | 86.1% | 61.88 |

| ICICI Prudential | 1575 | 22.8% | 310414 | 212% | 89.8% | 18.81 |

Key insights on HDFC Life

- Revenue CAGR of 21% over the last 5 years, driven by consistent growth in premium collections across segments.

- Profit CAGR of 6% over the last 5 years, supported by stable margins and operating efficiency.

- Total AUM stands at ₹3.29 lakh crore, reflecting scale and strong fund management capabilities.

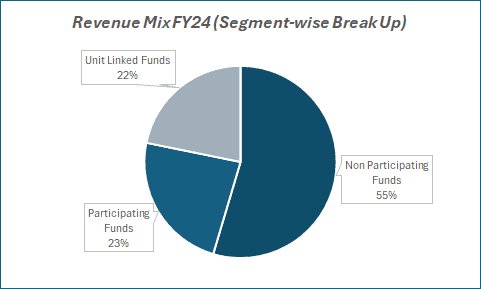

- Value of New Business (VNB) continues to grow, with a VNB margin of 25.1%, reflecting a balanced and profitable product mix.

- The solvency ratio is 188%, well above the regulatory requirement, ensuring financial resilience.

- 13th Month Persistency at 87%, indicating strong customer retention and product stickiness.

Recent financial performance of HDFC Life for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 15273.25 | 16613.72 | 16831.84 | 1.31% | 10.20% |

| EBITDA (₹ Cr.) | 367.03 | -30.20 | 418.73 | 1486.52% | 14.09% |

| EBITDA Margin (%) | 2.40% | -0.18% | 2.49% | 267 bps | 9 bps |

| PAT (₹. Cr.) | 367.54 | 435.18 | 421.31 | -3.19% | 14.63% |

| PAT Margin (%) | 2.41% | 2.62% | 2.50% | -12 bps | 9 bps |

| Adjusted EPS (₹) | 1.71 | 2.02 | 1.96 | -9.47% | -26.98% |

HDFC Life financial update (Q3 FY25)

Revenue & profitability:

- Gross premium (standalone) rose 11.3% YoY to ₹17,275 crore.

- Net premium witnessed a 10.1% YoY and 1.2% QoQ increase.

- Net profit (standalone) for 9M FY25 grew 15% YoY to ₹1,326 crore, supported by 18% growth in profit emergence from back book.

New business metrics:

- New Business Premium (NBP) for 9M FY25 increased 11% YoY.

- Value of New Business (VNB) grew 14% YoY to ₹2,586 crore.

- VNB margin declined by 140 bps YoY to 25.1%, largely due to a shift in product mix aligned with evolving macro trends.

Operational highlights:

- Maintained a strong 15.3% market share in the private sector and 10.8% overall in Individual WRP for 9M FY25.

- Retail sum assured grew 22% YoY, with traction seen across Tier 1, 2, and 3 cities.

- Policy sales volume increased 15% YoY in 9M FY25, outperforming private sector growth of 9%.

- Average ticket size improved by 8% YoY, reflecting quality growth in business.

- Assets Under Management (AUM) expanded to ₹3.29 lakh crore.

Outlook:

- The company remains focused on delivering its FY25 VNB growth guidance of 15%-17%, supported by strong distribution, expanding reach, and a balanced product mix.

Company valuation insights – HDFC Life

HDFC Life currently trades at a TTM P/E of 82.16, significantly above the industry average of 15.26. Over the past year, the stock has delivered a positive return of 8.3%, outperforming the Nifty 50’s -0.5% return.

India continues to remain structurally under-insured, despite improving financial awareness. This creates a long-term structural opportunity for HDFC Life, supported by potential regulatory tailwinds such as an anticipated GST cut on health insurance. Its diversified product suite, strong brand equity, wide distribution reach, and a well-balanced product mix position the company well to capture growth across customer segments and geographies.

Expansion into tier 2 and tier 3 markets, a growing presence in the non-participating segment, and consistent investment in its agency and bancassurance channels are expected to support sustained growth. Additionally, HDFC Life’s disciplined margin focus and new product initiatives help it maintain leadership in an increasingly supportive competitive landscape.

Applying a 2x FY27E EVPS, we derive a target price of ₹780, implying an upside potential of 14% from current levels.

Major risk factors affecting HDFC Life

- Regulatory risks – Changes in tax incentives or commission norms can impact margins.

- Rising competition – Other private players aggressively expanding; price wars possible.

- Economic cycles – Premium collections could slow in downturns; investment returns may vary.

- Digital disruption – Fintechs and insure-techs may challenge traditional players.

Technical analysis of HDFC Life share

HDFC Life has recently broken out of a descending channel in late March and has gained strong momentum since, crossing above its 200-day moving average—a bullish sign suggesting further upside potential. The stock is currently trading above all key moving averages, indicating a positive short-to-long-term trend setup.

The MACD remains firmly positive, with the MACD line above the signal line and consistent positive histograms, reflecting bullish momentum. The RSI stands at 60.88, pointing to strong buying interest. Relative RSI remains firmly positive over both 21-day (0.11) and 55-day (0.10) periods, suggesting sustained outperformance against its benchmark. ADX at 23.19 indicates a developing trend, leaning toward strength.

If the stock sustains above the key resistance of ₹740, it could rally towards its target price of ₹780. On the downside, ₹650 serves as a critical support zone.

- RSI: 60.88 (Positive)

- ADX: 23.19 (Moderate trend)

- MACD: 14.86 (Positive momentum)

- Resistance: ₹740

- Support: ₹650

HDFC Life stock recommendation

Current Stance: Buy with a target price of ₹780 (12-month horizon); HDFC Life’s strong brand equity, diversified business mix, and consistent execution support its long-term growth trajectory.

Why buy now?

Underpenetrated market: India remains structurally under-insured, offering long-term growth potential.

Strong product & distribution mix: Balanced portfolio and wide reach across bancassurance, agency, and digital channels.

Regulatory tailwinds: Expected GST cut and policy support to boost insurance demand.

Tier 2/3 expansion: Focused rural penetration to unlock the next phase of growth.

Consistent execution: Robust VNB growth, rising AUM, and improving persistency ratios reflect operational strength.

Portfolio Fit:

HDFC Life is a leading private life insurer with a proven track record of innovation, scale, and profitability. It offers investors stable compounding potential through exposure to India’s long-term protection, savings, and retirement planning themes. A must-have for portfolios seeking consistent growth in the financial services sector.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebHDFC Life: Budget 2025-26 opportunities

- Higher tax deductions: Raised limits under Section 80C/80D to boost insurance adoption.

- GST relief: Potential cut in GST on premiums may improve affordability.

- Financial inclusion push: Increased focus on Tier 2/3 cities to drive awareness and penetration.

- Digital infrastructure: Investments to enhance policy issuance and customer servicing.

- Social security schemes: Higher allocations to PMJJBY/PMSBY to increase insurance awareness.

Final thoughts

HDFC Life offers a rare mix of defensive stability and secular growth. With a trusted brand, tech-driven distribution, and robust product mix, it’s poised for long-term wealth creation.

Its consistent performance across cycles and leadership in value-added products gives it an edge. As insurance awareness deepens and digital channels expand, HDFC Life seems well-positioned to ride the next wave of growth.