Stock markets are often a reflection of industrial strength, and when it comes to the metal sector, Hindalco Industries Limited stands tall. As a key player in India’s aluminium and copper market, Hindalco has a strong global presence and a diversified business model. But what makes Hindalco a compelling stock to analyse?

Let’s take a deep dive into its business, growth drivers, valuation insights, and potential risks.

Stock Overview

| Ticker | HINDALCO |

| Industry/Sector | Metals (Non – Ferrous Metals) |

| Market Cap (Rs Cr.) | 1,36,856 |

| Free Float (% of Market Cap) | 64.60% |

| 52 W High/Low | 772.65 / 499.00 |

| P/E | 9.88 (Vs Industry P/E of 13.44) |

| EPS (TTM) | 61.82 |

About Hindalco

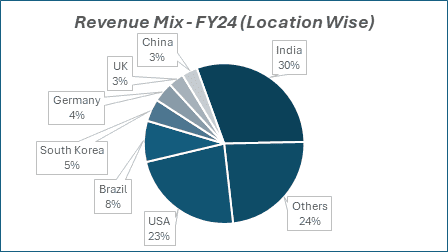

Hindalco Industries Limited, a flagship company of the Aditya Birla Group, is one of the largest aluminium and copper producers in India. Established in 1958, it has grown into a global force with operations spanning North America, Europe, and Asia. With its fully integrated value chain, Hindalco is not just a commodity manufacturer but a provider of innovative solutions across various industries, including aerospace, automotive, construction, and packaging.

Hindalco operates 52 manufacturing units across 10 countries, including 17 in India, 19 bauxite mines, and 35 overseas units under Novelis.

Novelis, Hindalco’s subsidiary, specialises in automotive and beverage, with an advanced rolling and recycling network spanning North America, South America, Europe, and Asia.

As of FY24, Hindalco has installed 173 MW of renewable energy capacity and aims to expand it to 300 MW by 2026.

Key business segments

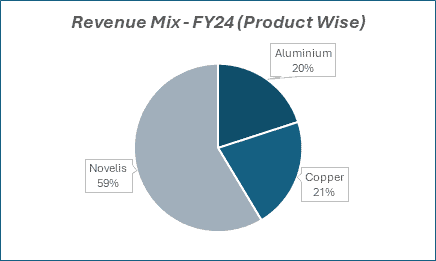

Hindalco operates across three verticals:

- Aluminium Business:

- Includes bauxite mining, alumina refining, aluminium smelting, and downstream operations.

- Products: Aluminium ingots, sheets, foils, extrusions, and rolled products.

- Subsidiary: Novelis Inc. (world’s largest producer of aluminium rolled products and recycler of aluminium cans).

- Copper Business:

- One of the largest copper manufacturers in India.

- Products: Copper cathodes, rods, and precious metals like gold and silver (by-products of copper smelting).

- Operates the Dahej smelter and refinery, which is among the most cost-efficient globally.

3. Chemical Business:

- One of the largest copper manufacturers in India.

- Engaged in manufacturing calcined alumina, used in grinding media and wear-resistant ceramic components.

- Produces alumina hydrates, essential in manufacturing water treatment chemicals such as aluminium sulphate and zeolite.

Primary growth factors for Hindalco

Hindalco’s impressive growth can be attributed to several factors:

1. Global aluminium demand surge

- Aluminium is in high demand due to its application in electric vehicles (EVs), renewable energy, and lightweight automotive manufacturing.

- Hindalco, with its cost-efficient operations, is well-positioned to capitalise on this.

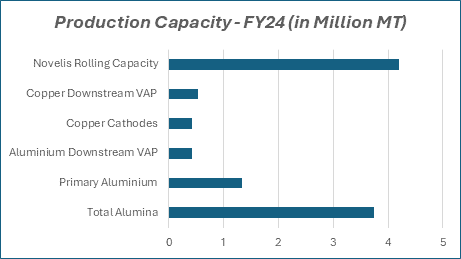

2. Expansion plans & Capacity augmentation

- Hindalco has been increasing its production capacity through brownfield expansions.

- Investments in downstream aluminium products improve margins by reducing reliance on commodity prices.

3. Sustainability and recycling initiatives

- Novelis is a global leader in aluminium recycling, positioning Hindalco as a sustainability-driven company.

- As industries shift towards eco-friendly materials, Hindalco benefits from its strong recycling ecosystem.

4. Copper business resilience

- Copper demand is increasing with infrastructure development and renewable energy expansion.

- Hindalco’s integrated supply chain helps mitigate input cost fluctuations.

5. Government initiatives

- Policies like the Production-Linked Incentive (PLI) scheme for aluminium encourage domestic manufacturing.

- Investments in infrastructure, railways, and smart cities boost metal consumption.

Detailed competition analysis for Hindalco

Key Financial Metrics – FY 24;

| Company | Revenue(Rs Cr.) | EBITDA(Rs Cr.) | EBITDA Margin (%) | PAT(Rs Cr.) | PAT Margin (%) | P/E (TTM) |

| Hindalco | 215962.00 | 23872.00 | 11.05% | 10153.00 | 4.70% | 9.88 |

| Vedanta | 143727.00 | 35198.00 | 24.49% | 7537.00 | 5.24% | 12.61 |

| Hindustan Copper | 1717.00 | 547.00 | 31.86% | 295.73 | 17.22% | 51.78 |

| Hindustan Zinc | 28932.00 | 13656.00 | 47.20% | 7759.00 | 26.82% | 18.71 |

| National Aluminium | 13149.15 | 2872.91 | 21.85% | 2059.95 | 15.67% | 7.91 |

Key insights on Hindalco

· Achieved a robust 11% revenue CAGR over the past five years, driven by strong demand across aluminium and copper segments.

· Maintains EBITDA margins of 12-15%, reflecting efficient operations and cost management.

· PAT has grown at a 14% CAGR over the last five years, supported by operational efficiencies and value-added product growth.

· Holds a leading market share in India, with >40% in aluminium and >50% in copper, reinforcing its industry dominance.

· Strengthened its balance sheet by reducing the Debt-to-Equity ratio from 1.15 in FY20 to 0.55 in FY24, enhancing financial stability.

· Novelis, its subsidiary, remains the world’s largest aluminium rolling and recycling company, catering to high-growth sectors like automotive and packaging.

· Installed 173 MW of renewable energy capacity by FY24, with plans to scale up to 300 MW by 2026, reinforcing its sustainability commitment.

· Expanding downstream capabilities to increase high-margin value-added products in aerospace, EVs, and sustainable packaging solutions.

Recent financial performance of Hindalco for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (Rs Cr.) | 52808.00 | 58203.00 | 58390.00 | 0.32% | 10.57% |

| EBITDA (Rs Cr.) | 5865.00 | 7883.00 | 7583.00 | -3.81% | 29.29% |

| EBITDA Margin (%) | 11.11% | 13.54% | 12.99% | -55 bps | 188 bps |

| PAT (Rs Cr.) | 2330.00 | 3909.00 | 3734.00 | -4.48% | 60.26% |

| PAT Margin (%) | 4.41% | 6.72% | 6.39% | -33 bps | 198 bps |

| Adjusted EPS (Rs) | 10.50 | 17.61 | 16.82 | -4.49% | 60.19% |

Novelis Performance

- Revenue grew 4% YoY to $4.1 billion, but EBITDA declined 19% YoY to $367 million due to higher aluminium scrap costs and an unfavourable product mix.

- EBITDA per tonne fell 19% YoY to $406, while shipments declined 1% YoY to 904 KT.

Aluminium Upstream

- Revenue surged 25% YoY to ₹9,993 crore, with EBITDA increasing 73% YoY to ₹4,222 crore, driven by lower input costs and a favorable macro environment.

- EBITDA per tonne grew 68% YoY to ₹1,480, while shipments rose 1% YoY to 338 KT.

Aluminium Downstream

- Revenue expanded 25% YoY to ₹3,195 crore, with EBITDA rising 36% YoY to ₹150 crore, supported by higher realizations and operating leverage.

- EBITDA per tonne increased 22% YoY to ₹179, while shipments grew 10% YoY to 99 KT, aided by market recovery.

Copper Segment

- Revenue climbed 15% YoY to ₹13,732 crore, with EBITDA improving 18% YoY to ₹777 crore, driven by higher by-product realizations.

- Shipments rose 1% YoY to 120 KT, with Continuous Cast Copper Rod (CCR) volumes reaching 95 KT (+1% YoY).

Industry & Operational Updates

- Domestic aluminium demand is expected to grow 11% YoY to 1,403 KT, led by strong demand from packaging, consumer durables, solar panels, and cables.

- Domestic copper demand grew 4% YoY to 206 KT, with domestic suppliers increasing their market share to 76% (vs. 67% in Q3 FY24).

- Coal costs remained stable sequentially.

- Renewable energy capacity is on track to reach 300 MW by H1 CY25, with a 20 MW hybrid solar & wind project set for commercialization in H2 CY26.

- Novelis’ Bay Minette Project ($2.5 billion low-carbon aluminium recycling and rolling plant) is progressing as planned and will be operational in H1 CY26, with an initial capacity of 600 KT per annum.

- Planned Capex for FY26 is ~₹8,000 crore, while Novelis has budgeted ~$6 billion in capital investments (including Bay Minette) over the next three years.

Company valuation insights – Hindalco

Hindalco is currently trading at a TTM P/E of 9.88, which is lower than the industry average of 13.44, indicating a valuation discount. Additionally, the stock is trading below its 3-year historical average, making it an attractive opportunity for value investors. Over the last 12 months, Hindalco has delivered an impressive 19.4% return, significantly outperforming the Nifty 50’s 3.7% gain.

The company is well-positioned to capitalize on the rising demand for aluminium and copper, driven by EVs, renewable energy, packaging, consumer durables, aerospace, infrastructure, and automobile sectors. Hindalco’s ongoing expansion in FRP (Flat Rolled Products) and VAP (Value-Added Products) strengthens its competitive edge. Additionally, its backward integration efforts and primary metal capacity enhancements will improve operational efficiency and margins.

Novelis, Hindalco’s US-based subsidiary, is expected to benefit from tariff policies despite short-term disruptions due to imported scrap. The company’s capex plans, including the Bay Minette project and expansion into sustainable aluminium recycling, further support long-term growth.

Based on our valuation approach, we apply EV/EBITDA multiples of 7x for Novelis, 6x for Indian Aluminium, and 4.5x for copper, leading to a 12-month target price of ₹700, implying a potential upside of 15% in next 12 months.

Major risk factors affecting Hindalco

· Slower Project Expansion: Delays in growth projects could lead to cost overruns and lower returns on investment.

· Commodity Price Volatility: Exposure to global aluminium and copper price fluctuations may impact profitability and margins.

· Regulatory & Environmental Challenges: Stringent mining regulations, carbon emission policies, and evolving environmental norms could pose operational risks.

· Currency & Interest Rate Risks: As a global company, Hindalco faces risks from currency fluctuations and rising interest rates, which may affect overall profitability.

Technical analysis of Hindalco share

Hindalco is forming a bullish cypher pattern on the weekly charts and has recently bounced back from point D around ₹565 levels. This suggests a potential trend reversal with an immediate resistance at ₹665. If the price breaches this level, it could extend further toward the target price of ₹700.

On the daily charts, the stock has given a breakout from a descending channel around ₹600 levels, confirming a shift in momentum to the upside.

The Relative Strength Index (RSI) at 55.7 indicates a neutral stance, suggesting that the stock is neither overbought nor oversold, leaving room for further upward movement.

The MACD is positive at 0.71, reflecting bullish momentum, supporting a continued upward trend. However, the relative strength against the benchmark index remains slightly negative at -0.02, indicating marginal underperformance compared to the broader market.

Hindalco is trading below its 100-day and 200-day moving averages, suggesting that the longer-term trend is still weak. However, the stock has crossed its 50-day moving average from below, which signals a short-term trend reversal and potential strength building.

· RSI: 55.7 (Neutral)

· ADX: 13 (Range Bound)

· Resistance: ₹665

· Support: ₹565

Hindalco stock recommendation

Current Stance: Buy with a target price of ₹700 (12-month horizon), short-term volatility expected.

Why Buy Now?

Hindalco presents a compelling investment opportunity, trading at a discount to both the industry average and its historical P/E multiple. The company is well-positioned to benefit from rising demand in key sectors such as electric vehicles (EVs), renewable energy (RE), packaging, aerospace, and automobiles, where aluminium and copper play an increasingly vital role.

Hindalco’s robust growth prospects are further supported by its ongoing capacity expansions in Flat Rolled Products (FRP) and Value-Added Products (VAP), alongside backward integration strategies aimed at improving margins and cost efficiency. With Novelis, its US-based subsidiary, expected to benefit from positive tariff dynamics, Hindalco’s global footprint and integration of recycling capabilities further strengthen its competitive position.

The company’s capital expenditure plans, including projects like Bay Minette and green energy initiatives, provide long-term growth visibility, positioning Hindalco as a key player in the non-ferrous metals space.

Portfolio Fit

The company’s diversified global operations, robust macroeconomic tailwinds, and strong market share in aluminium and copper make it a strong pick for long-term growth. Given its discounted valuation, Hindalco offers a high risk-adjusted return, especially for investors targeting sustainable, green infrastructure and commodities.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebHindalco: Budget 2025 opportunities

· Infrastructure & Construction push: Increased government spending on infrastructure, housing, and railways could drive higher demand for aluminium and copper products.

· Manufacturing & Export incentives: Support for domestic manufacturing under ‘Make in India’ and PLI schemes could enhance cost efficiencies and boost exports.

· Renewable energy & EV growth: Incentives for solar, wind, and electric vehicles (EVs) could accelerate demand for Hindalco’s aluminium in battery casings, auto parts, and renewable energy applications.

· Mining & raw material policy reforms: Streamlining mining regulations and ensuring raw material security could improve production efficiency and cost competitiveness.

· Carbon credit & ESG incentives: Policies promoting low-carbon technologies, recycling, and green energy adoption could support Hindalco’s sustainability goals and cost savings.

· Interest rate & Credit support: Access to cheaper credit and financing for capital expansion projects could drive growth and investment in high-margin value-added products.