Stock overview

| Ticker | ICICIBANK |

| Sector | Banking & Financial Services |

| Market Cap | ₹ 8,57,900 Cr |

| CMP (Current Market Price) | ₹ 1,244.15 |

| 52-Week High/Low | ₹ 1,362/ ₹ 1,048 |

| P/E Ratio | 17.4 x |

| Beta | 1.1 (Moderate volatility) |

About ICICI Bank

Established in 1994, ICICI Bank Limited has evolved into one of India’s foremost private-sector banks. Headquartered in Mumbai, it offers a diverse spectrum of banking and financial services, including retail and corporate banking, investment banking, insurance, and asset management.

With an extensive network of over 6,600 branches and 16,000 ATMs across India and a presence in 11 countries, ICICI Bank caters to a vast and varied customer base. Let’s do a deep dive into the company’s financial performance and understand what makes it a must-have portfolio stock for the investors.

Primary growth factors for ICICI Bank

1. Digital Transformation & Fintech Collaboration

- ICICI is a leader in digital banking, with over 60% of transactions happening online.

- iMobile Pay, InstaBIZ, and other apps offer seamless services, boosting customer acquisition and stickiness.

- Strategic partnerships with fintech startups help the bank stay agile and tech-forward.

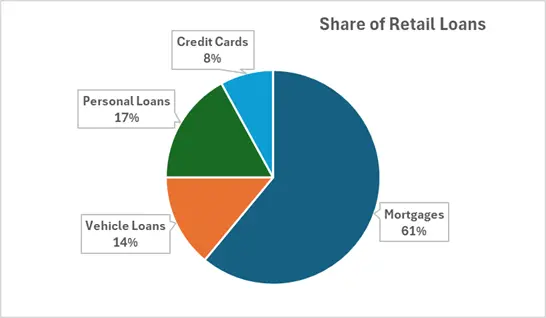

- Retail Banking Dominance

- Retail loans contribute over 50% of the loan book, driven by housing, vehicle, and personal loans.

- Expanding into Tier 2 & Tier 3 cities ensures consistent loan growth and market penetration.

- Here’s the detailed breakdown of their retail loan portfolio

- Corporate & SME Lending Strength

- ICICI has a well-diversified corporate portfolio with prudent risk management practices.

- ‘Small Business’ lending is growing at 32% YoY, supported by India’s manufacturing and export boom.

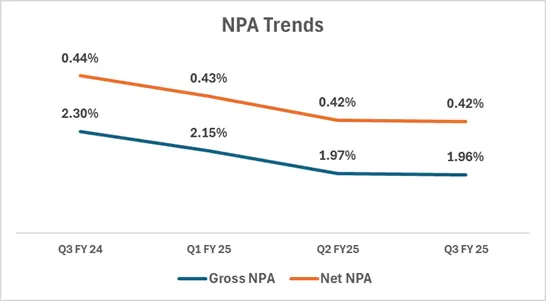

- Declining NPAs

- ICICI Bank has seen a consistently declining trend in its NPAs.

- This signals a healthy asset quality on a QoQ basis which is going to have a compounding effect on their balance sheet since their overall loan book is also reporting a YoY growth.

- Here’s the trend of their NPAs :

- India’s Economic Tailwinds

- As India’s economy grows at 6-7% annually, credit demand is set to rise — directly benefiting ICICI.

- Government initiatives like Make in India and infra-development spur financing opportunities.

- Consistent Fee Income & Cross-Selling

- Fee-based income (cards, insurance, asset management) adds a steady revenue stream.

- ICICI cross-sells products aggressively, leveraging its vast customer base.

Q3 FY25 Financial Performance

| Metric | Q3 FY 25 | YoY Growth | QoQ Growth |

| Net Interest Income | 20,371 cr | 9% | 2% |

| Operating Profit | 16,516 cr | 13% | 5% |

| Provisions | 24.5 cr | 17% | 0% |

| Profit after Tax | 11,792 cr | 15% | 0% |

- ICICI Bank reported an impressive 9% growth in Net Interest Income and 13% growth in operating profit in Q3 FY25.

- The bank saw a 13% surge in the overall provisions and contingencies which put a slight pressure on their profitability.

- Profit grew by 15% vs Last year which is one of the highest in the private banking sector in Q3 2025.

- ICICI Bank demonstrated a solid performance in Q3 FY 25 amid a volatile market environment and declining industry deposits.

Detailed competition analysis for ICICI Bank

| Company | Market Cap | Profit | P/E | RoCE |

| ICICI Bank | 8,57,900 cr | ₹ 12,880 cr | 17.4x | 7.6% |

| HDFC Bank | 13,25,400 cr | ₹ 17,656 cr | 18.8x | 7.7% |

| Kotak Bank | 3,78,300 cr | ₹ 4,700 cr | 19.3x | 7.9% |

| Axis Bank | 3,21,200 cr | ₹ 6,740 cr | 11.4x | 7.1% |

| IndusInd Bank | 77,100 cr | ₹ 1,401 cr | 10.3x | 7.9% |

- ICICI Bank’s higher margins and strong return ratios are competitive advantages.

- The stock trades at a more reasonable valuation compared to HDFC and Kotak, which suggests room for upside.

Company valuation insights: ICICI Bank

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of ICICI Bank shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹1,3,80 per share

- Upside Potential: 14%

- WACC: 12%

- Terminal Growth Rate: 6%

While the stock may not be deeply undervalued, ICICI Bank’s consistent performance and future growth potential justify the current pricing, with a decent upside potential.

Major risk factors affecting ICICI Bank

- Macroeconomic sensitivity: Rising interest rates or slowing economic growth could impact credit demand.

- Asset quality pressure: While NPAs are declining, a significant economic shock could reverse this trend.

- Competitive landscape: Aggressive competition from other private banks may pressure margins and market share.

Technical analysis of ICICI bank

- Resistance: ₹1,250

- Support: ₹1,180

- Momentum: Bullish but nearing resistance levels

- RSI (Relative Strength Index): 62 (approaching overbought)

- MACD (Moving Average Convergence Divergence): Positive crossover, indicating bullish momentum

- Bollinger Bands: Trading near the upper band, suggesting potential short-term consolidation

- 50-Day Moving Average: ₹1,180 (short-term support)

- 200-Day Moving Average: ₹1,050 (long-term bullish trend intact)

The stock is in a well-established uptrend, but caution is advised near resistance zones. A breakout above ₹1,250 could signal further upside, while corrections towards the ₹1,180 level may present buying opportunities.

ICICI stock recommendation by Ketan Mittal

Current Stance: BUY with a 12-month target of ₹1,380.

Rationale:

Consistent loan growth with a diversified loan book.

Strong capital adequacy and deposit growth.

Undervalued stock relative to sector peers.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

ICICI Bank presents a stable long-term opportunity with consistent earnings growth, digital leadership, and improved asset quality. While short-term volatility is possible, the bank’s resilience and future growth potential make it a compelling investment for long-term investors.