Infosys Ltd. is a name synonymous with India’s IT revolution. Founded in 1981, the company has grown to become a global leader in IT services, digital transformation, and consulting. As one of the key players in the Indian stock market, Infosys is often a favorite among investors looking for stability and growth in the IT sector. But is Infosys a good buy at current levels?

Let’s dive into a detailed stock research analysis of Infosys, covering its business segments, growth drivers, valuation insights, and potential risks.

Stock Overview

| Ticker | INFY |

| Industry/Sector | Information Technology (IT Software) |

| Market Cap (Rs Cr.) | 7,00,317 |

| Free Float (% of Market Cap) | 86.69% |

| 52 W High/Low | 2006.45 / 1358.35 |

| P/E | 25.73 (Vs Industry P/E of 28.32) |

| EPS (TTM) | 66.58 |

About Infosys

Infosys is the second-largest IT services company in India, following Tata Consultancy Services (TCS). With operations spanning across 50+ countries, the company provides IT consulting, software development, and outsourcing solutions.

Infosys’ revenue comes from IT services, including software development, maintenance, consulting, package implementation, and software licensing. These services are categorized into:

- Core Services: Application management, proprietary software development, validation solutions, product engineering, infrastructure management, enterprise application implementation, support, and integration services.

- Digital Services: AI-driven analytics, digital product engineering, IoT solutions, cloud migration, legacy system modernization, and cybersecurity.

Infosys is known for its strong corporate governance, consistent dividend payouts, and robust financials, making it a favorite among institutional and retail investors alike.

Key business segments

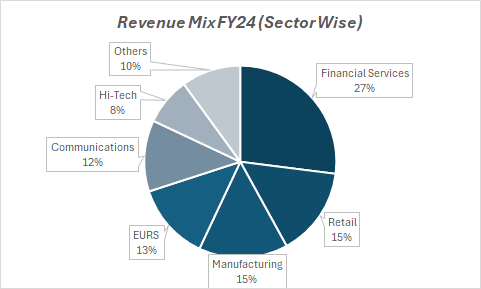

Infosys derives its revenues from the following key business segments:

- Financial Services & Insurance (FSI) – The largest contributor to revenue, Infosys serves global banks, insurance firms, and financial institutions.

- Retail, Consumer Packaged Goods & Logistics – Offers digital transformation and supply chain optimization for global retailers.

- Communications, Media & Technology (CMT) – Provides IT solutions to telecom companies, digital media platforms, and high-tech enterprises.

- Energy, Utilities, Resources & Services – Helps energy and utility companies with automation, digital solutions, and enterprise software.

- Manufacturing – Enables digitization and automation for global manufacturing giants.

- Life Sciences & Healthcare – Supports pharmaceutical firms, hospitals, and healthcare institutions with technology-driven solutions.

Primary growth factors for Infosys

Several factors drive Infosys’ long-term growth:

- Digital Transformation Boom – Increasing adoption of cloud computing, AI, and automation is leading to higher demand for Infosys’ services.

- Global IT Spending Recovery – As companies ramp up IT investments post-pandemic, Infosys is well-positioned to benefit.

- Large Deal Wins – Infosys continues to secure multi-billion-dollar contracts, ensuring long-term revenue visibility.

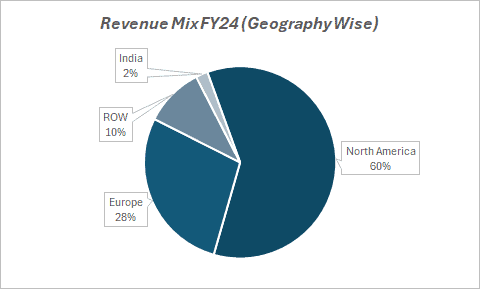

- Expansion into New Markets – Growth in North America and Europe, along with a rising presence in emerging markets, enhances its revenue streams.

- Strong Financials & Cash Flow – Infosys maintains a high cash reserve, strong profitability, and consistent dividend payouts.

Detailed competition analysis for Infosys

Key Financial Metrics – FY 24;

| Company | Revenue(Rs Cr.) | EBITDA(Rs Cr.) | EBITDA Margin (%) | PAT(Rs Cr.) | PAT Margin (%) | P/E (TTM) |

| Infosys | 153670.00 | 36425.00 | 23.70% | 26248.00 | 17.08% | 25.73 |

| TCS | 240893.00 | 64296.00 | 26.69% | 46099.00 | 19.14% | 26.71 |

| Wipro | 89760.30 | 16775.80 | 18.69% | 11135.40 | 12.41% | 24.13 |

| HCL Tech | 109913.00 | 24198.00 | 22.02% | 15710.00 | 14.29% | 25.20 |

| Tech Mahindra | 51995.50 | 4506.30 | 8.67% | 2386.30 | 4.59% | 39.30 |

Key insights on Infosys

- Achieved a 13% revenue CAGR over the past five years, reflecting strong demand across digital transformation, cloud, and AI-driven solutions.

- Maintains EBITDA margins of 23-25%, highlighting operational efficiency and cost optimization.

- PAT has grown at an 11% CAGR over the last five years, driven by a high-value service mix and margin discipline.

- The company is almost debt-free, ensuring financial flexibility and resilience.

- Infosys has delivered ROE above 30% for the last two years, showcasing strong capital efficiency.

- Maintains a healthy dividend payout of 63.3%, reinforcing its commitment to shareholder returns.

- Consistently secures multi-billion-dollar contracts in digital transformation, driving long-term revenue visibility.

- Investing heavily in AI, automation, and reskilling initiatives to strengthen its competitive edge.

Recent financial performance of Infosys for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (Rs Cr.) | 38821.00 | 40986.00 | 41764.00 | 1.90% | 7.58% |

| EBITDA (Rs Cr.) | 9137.00 | 9809.00 | 10115.00 | 3.12% | 10.70% |

| EBITDA Margin (%) | 23.54% | 23.93% | 24.22% | 29 bps | 68 bps |

| PAT (Rs Cr.) | 6113.00 | 6516.00 | 6822.00 | 4.70% | 11.60% |

| PAT Margin (%) | 15.75% | 15.90% | 16.33% | 43 bps | 58 bps |

| Adjusted EPS (Rs) | 14.75 | 15.70 | 16.42 | 4.59% | 11.32% |

Infosys financial update (Q3 FY25)

- Revenue grew ~2% QoQ, with constant currency (cc) growth of 6.1% YoY and ~2% QoQ, supported by broad-based vertical and regional growth.

- Net profit increased 4.7% YoY, reflecting a stable pricing environment and improved demand.

- EBITDA margin expanded by 68 bps YoY and 29 bps QoQ, aided by currency movements and cost optimization despite furloughs and fewer working days.

- Large deal wins totaled $2.5 billion, with 63% net new deals, surpassing Q2’s $2.4 billion.

- Headcount increased, reflecting confidence in future growth.

Segment performance

- Manufacturing grew ~11% YoY, EURS 9%, Hi-Tech 8%, Financial Services & Life Sciences 6% each, Communication 4%, Others 3%, while Retail remained flat (0.1%).

- Revenue contribution: Financial Services 27.8%, Manufacturing 15.5%, Retail 13.8%, EURS 13.5%, Communication 11.2%, Hi-Tech 8%, Life Sciences 7.9%, Others ~2%.

Geographical performance

- Revenue contribution: North America 58.4%, Europe 29.8%, ROW 8.7%, India 3.1%.

- Growth (YoY in cc terms): India 40%, Europe 12%, North America 4.8%, while ROW declined 11%.

Client metrics

- 12 new clients added in the $1M+ category (total 997), 6 reductions in the $10M+ band (total 301), 3 new clients in $50M+ band (total 89), and $100M+ band remained flat at 41.

- Revenue contribution: Top 5 clients 12.7%, Top 10 clients 19.9%, Top 25 clients 34.2%.

Outlook

- Revenue growth guidance was revised to 4.5%-5% for FY25 (previously 3.75%-4.5%).

- Operating margin guidance maintained at 20%-22%.

- Management remains optimistic on deal pipeline and closures, aiming to improve margins through lower subcontractor costs, higher utilization, and cost efficiencies

Company valuation insights – Infosys

Infosys is currently trading at a TTM P/E of 25.73, which is at a discount to the industry average of 28.32, suggesting relative valuation comfort. Over the past year, the stock has delivered a 4.3% return, outperforming the Nifty 50’s 0.3% gain.

Infosys has maintained a stable deal pipeline, with large deal signings continuing to grow, even as short-cycle deals remained flat QoQ.

Despite an upward revision in revenue guidance, Q4FY25 could witness some softness due to seasonality, fewer working days, and wage hikes, which are being phased over Q4 and Q1FY26.

However, the company expects to offset cost pressures through efficiency measures, pricing improvements, and reductions in third-party expenses.

Applying a 27x P/E multiple on the FY26 EPS estimate of ₹71.94, we arrive at a target price of ₹1,940, implying a 15% upside potential over the next 12 months. Given its attractive valuation relative to peers, stable earnings outlook, and strong growth prospects, Infosys presents a compelling opportunity in the IT services space.

Major risk factors affecting Infosys

- Global Economic Slowdown – A recession or slowdown in major markets like the US and Europe can impact IT spending.

- Rupee Appreciation – Since Infosys earns a significant portion of its revenue in USD, a stronger rupee can reduce profitability.

- Intense Competition – Stiff competition from TCS, Accenture, and other global IT firms could put pricing pressure on Infosys.

- Regulatory Risks – Changes in visa regulations and outsourcing policies in key markets could impact business operations.

- Attrition Rate – High employee turnover in the IT sector can lead to increased costs and project delays.

Technical analysis of Infosys share

On the weekly chart, Infosys has formed a double-top pattern and is currently trading near its neckline. A breakdown below this level could trigger a bearish move toward the next support at ₹1,620. However, if the price rebounds from the neckline, forming a triple top, it could see an upside move toward the target price of ₹1,940, with ₹1,980 acting as the next resistance level

On the daily chart, the stock is hovering around its support at ₹1,680. A breakdown below this level could confirm further downside, while a successful bounce could lead to a reversal toward ₹1,940 in the near term.

The Relative Strength Index (RSI) at 31.5 is near the oversold territory, indicating a potential buying opportunity if a reversal is confirmed. However, the relative strength against the benchmark index has decreased by -0.02 over the last three days, currently at -0.08, signalling continued underperformance compared to the broader market.

The MACD is negative, and with the price trading below all key moving averages, the technical setup remains weak, indicating potential short-term volatility.

- RSI: 31.5 (Near Oversold)

- ADX: 38.11 (Trending)

- Resistance: ₹1,980

- Support: ₹1,620

Infosys stock recommendation

Current Stance: Buy with a target price of ₹1,940 (12-month horizon); near-term volatility is likely, but long-term fundamentals remain strong.

Why Buy Now?

Attractive valuation – Infosys trades at a discount to the industry P/E, presenting an appealing investment opportunity.

Strong growth drivers – Positioned to benefit from rising enterprise spending in digital transformation, AI, and cloud, with a solid presence in BFSI, manufacturing, and retail.

Resilient pipeline & Cost optimisation – Large deal wins, improving discretionary spending, and efficiency measures support revenue visibility and margin stability.

AI & Automation investments – Strategic focus on automation and AI-driven solutions to mitigate cost pressures and enhance profitability.

Portfolio Fit

Infosys' strong global footprint, disciplined execution, and continued investment in high-growth technologies make it a compelling long-term bet. With steady earnings visibility, improving margins, and a robust growth trajectory, the stock is well-suited for investors seeking consistent compounding in the IT services space. Given its discounted valuation relative to peers, Infosys offers an attractive risk-reward profile for long-term investors.

If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebInfosys: Budget 2025-26 opportunities

- Digital & IT Infrastructure Push: Increased government spending on digital transformation, AI, and cloud adoption could drive demand for Infosys’ IT services, especially in smart governance and public sector projects.

- Incentives for AI & Emerging Technologies: Policy support for AI, machine learning, and automation under India’s tech-driven growth agenda could create opportunities for Infosys in AI-driven solutions and consulting services.

- Boost to BFSI & Fintech: Reforms in banking, insurance, and fintech, including digital lending and payments modernization, could expand Infosys’ revenue potential in its largest vertical, BFSI.

- PLI & Make in India for Electronics & IT Services: Support for domestic IT services and product development under the Production-Linked Incentive (PLI) scheme could enhance Infosys’ offshore capabilities and global competitiveness.

Global Capability Centers (GCCs) & IT Export Growth: Policies promoting India as a hub for GCCs and easing compliance for IT exporters could strengthen Infosys’ outsourcing business and global client engagements.