Stock overview

| Ticker | ITC |

| Sector | FMCG, Agri, Paper and Packaging |

| Market Cap | ₹ 5,40,000 Cr |

| CMP (Current Market Price) | ₹ 410 |

| 52-Week High/Low | ₹ 528/ ₹ 399 |

| P/E Ratio | 26.7x |

| Dividend Yield | 3.2% |

| Beta | 0.85 (Moderately volatile stock) |

About ITC

ITC stands as a diversified powerhouse, balancing strong cash flows from its cigarette business with rapid growth in FMCG, hotels, and agri-exports. With consistent earnings and a solid dividend yield, is ITC a must-have in your portfolio? Let’s find out.

Key drivers of growth:

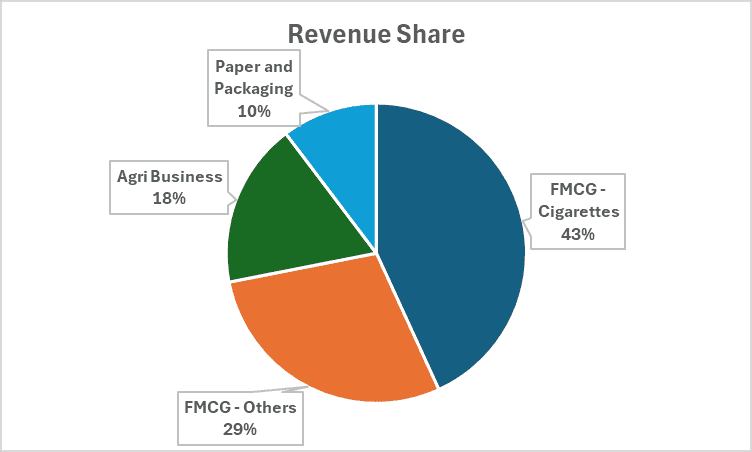

1. FMCG growth & Market leadership

- ITC’s FMCG business contributes ~70% to revenue (Revenue from Hotels is excluded as it is not a demerged entity) with strong brands in packaged foods, personal care, and stationery.

- Margin expansion in FMCG driven by operating efficiencies and premiumization.

- Recent launches in the health & wellness segment catering to changing consumer preferences.

2. Cigarette business

- ITC maintains a ~75% market share in India’s legal cigarette market.

- Despite regulatory headwinds, steady pricing power and brand loyalty keep margins high.

- No tax hikes in Budget 2025 likely to keep the sales and profitability momentum sustained

3. Agri & Paperboard segments

- ITC’s agri division benefits from growing global food demand, especially in wheat and spices.

- Paperboards & packaging segment sees robust demand from e-commerce and sustainability trends.

Here’s a detailed breakdown of ITC revenue sources in Q3 FY 2025 :

Recent Financial Performance (Q3 FY25)

| Metric | Q3 FY 25 | Q3 FY 24 | YoY Growth |

| Revenue | ₹ 18,953 cr | ₹ 17,483 cr | +8% |

| EBITDA | ₹ 6,197 cr | ₹ 6,024 cr | +3% |

| PAT | ₹ 5,638 cr | ₹ 5,572 cr | +1% |

| ARPU | ₹ 245 | ₹ 208 | +18% |

Highlights:

- Revenue growth of 8% YoY, driven by growth in cigarette and the agro business

- Dividend payout remains strong, making ITC a stable dividend play.

- FMCG Cigarettes – Strong growth of 8% YoY in Revenue, driven by volumes- Premium segment & new innovations continue to gain robust traction

- FMCG Others – Revenue up 4% YoY amidst muted demand conditions. Atta, Spices, Snacks, Frozen Snacks, Dairy, Premium Personal Wash, Homecare & Agarbatti drove growth

- Agri Business ̶ Leaf & Value Added Agri products (Coffee & Spices) were the key growth drivers

- Paperboards, Paper & Packaging – Performance reflects the impact of low priced Chinese & Indonesian supplies in global markets (including India), muted domestic demand & subdued realisations

Key Competitor analysis

| Metric | ITC | Godfrey Phillips | VST Industries |

| P/E Ratio | 26.7x | 30.1x | 23.1x |

| Market Cap (cr) | ₹ 5,40,000 | ₹ 28,000 | ₹ 5,000 |

| Revenue (Q3) | ₹ 18,953 cr | ₹ 1,380 cr | ₹ 370 cr |

| Dividend yield | 3.2% | 1.02% | 4.1% |

Comments :

- ITC is a behemoth in the cigarette space : commanding a very high market share of 75%-80%

- ITC commands a higher P/E than the industry owing to the fact that it has diversified revenue streams with high growth potential.

- Subdued demand and cost pressure likely to pose near term challenges for ITC.

Valuation insights

When we value a company like ITC, we’re asking two questions:

- Is it cheap or expensive compared to how it’s been in the past—or to other companies?

- How much money could it make in the future, and what does that mean for its stock price now?

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of ITC based on expected future cash flows:

- Intrinsic Value Estimate: ₹500 per share

- Upside Potential: 21%

- Assumptions :

- WACC: 9.8%

- Cost of Equity: 11.5%

- Cost of Debt: 7.2% (Post-tax)

Key risks to watch

- Regulatory Risks: Higher cigarette taxes or stricter advertising laws may impact sales.

- FMCG Competition: Intense rivalry from HUL, Nestlé, and regional brands.

- Global Agri Market Volatility: Fluctuations in commodity prices can affect export margins.

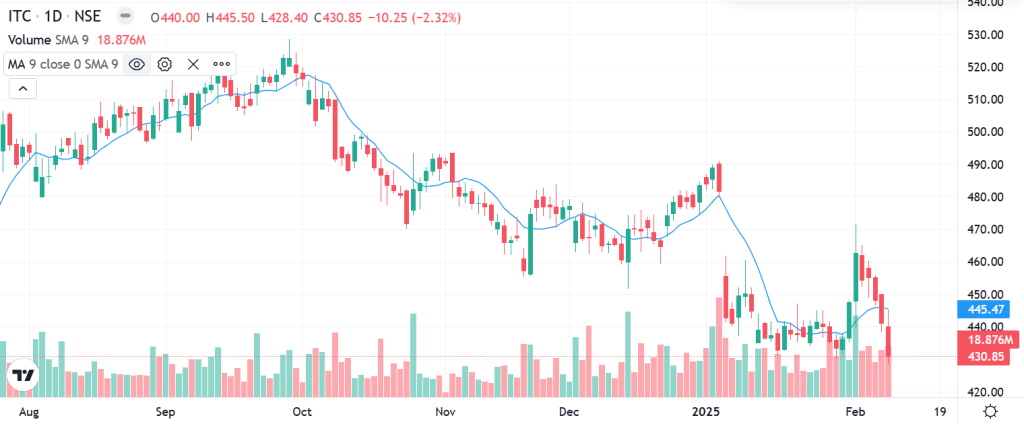

Technical outlook on ITC share

- Resistance Level: ₹470 (Recent high)

- Support Level: ₹435 (200-day moving average)

- RSI (Relative Strength Index): 58 (Neutral, with slight bullish bias)

- Trading Volume: Consistently high, indicating institutional interest.

ITC stock recommendation

Current Stance: BUY with a 12-month target of ₹500.

Rationale:

FMCG growth acceleration

Stable cigarette business cash flows

Resilient dividend yield & valuation comfort

Risk-Reward Profile: Low-to-moderate risk with consistent cash flow generation.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

ITC remains a well-diversified consumer business, offering a mix of growth, stability, and strong dividends. With healthy earnings growth, improving margins, and sector tailwinds, ITC continues to be a solid long-term investment. Investors can accumulate at ₹430 levels for steady returns.