In a market swayed by trends, metals often shine in cycles. But every once in a while, a player comes along that proves its mettle – literally. Enter Jindal Stainless Ltd. (JSL) – a company that has evolved from being a commodity play to a structural long-term story. If you’re exploring India’s manufacturing momentum, domestic capex cycle, and export resilience, JSL might just be the name you want on your radar.

But does JSL offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | JSL |

| Industry/Sector | Metals & Mining (Iron & Steel) |

| Market Cap (₹ Cr.) | 45,760 |

| Free Float (% of Market Cap) | 39.26% |

| 52 W High/Low | 848.00 / 496.60 |

| P/E | 19.07 (Vs Industry P/E of 30.02) |

| EPS (TTM) | 29.32 |

About Jindal Stainless

Jindal Stainless Ltd. is India’s largest manufacturer of stainless steel, and among the top 10 globally (excluding China). It’s part of the $35 billion OP Jindal Group and has a legacy of over four decades. Headquartered in Haryana, the company primarily produces austenitic, ferritic, and duplex grades of stainless steel, catering to both domestic and international markets.

Following a recent merger with Jindal Stainless (Hisar) and successful debt reduction, the company now operates as a leaner and more integrated stainless steel giant.

Key business segments

JSL operates primarily in the following key business segments:

- Automotive & Transport: Supplies stainless steel for EV parts, exhaust systems, and railway coaches.

- Architecture, Building & Construction (ABC): Used in cladding, roofing, and public infrastructure projects.

- Consumer Durables & White Goods: Provides steel for appliances like refrigerators, washing machines, and kitchenware.

- Process Industry & Heavy Engineering: Serves the petrochemical, pharma, and food industries with specialised steel.

- Exports: Exports ~30% of output to Europe, Americas, and the Middle East with a focus on value-added products.

Primary growth factors for Jindal Stainless

Jindal Stainless key growth drivers:

- Rising infrastructure and railway capex: Increased government spending on metro projects, Vande Bharat trains, and smart cities drives stainless steel demand.

- Import substitution and policy support: Anti-dumping duties and preference for domestic sourcing boost JSL’s market share.

- Diversification across sectors: Expanding presence in EVs, white goods, and construction reduces cyclicality and opens new revenue streams.

- Green steel & ESG focus: Investments in clean energy and carbon-efficient processes position JSL ahead of global sustainability norms.

- Backward integration & efficiency: Focus on scrap recycling, logistics, and raw material integration improves cost control and margins.

- Rising exports: Growing demand from Europe, the Middle East, and Asia supports volume growth and geographic diversification.

Detailed competition analysis for Jindal Stainless

Key financial metrics – FY 24;

| Company | Revenue(₹ Cr.) | Realisation / Tonne (Rs / MT) | EBITDA / Tonne (Rs / Tonne) | Capacity Utilisation (%) | PAT Margin (%) | P/E (TTM) |

| Jindal Stainless | 38562.47 | 171190 | 17058 | 95.72% | 6.85% | 19.07 |

| JSW Steel | 175006.00 | 56850 | 8314 | 80.85% | 5.23% | 74.76 |

| TATA Steel | 229170.78 | 69492 | 7759 | 88.80% | -2.12% | 62.31 |

| Steel Authority of India | 105378.33 | 55282 | 5393 | 97.73% | 2.49% | 20.84 |

Key insights on Jindal Stainless

- Achieved a strong revenue CAGR of 23% (5Y) and 47% (3Y), driven by robust demand and strategic capacity expansions.

- Maintains healthy EBITDA margins in the range of 10%–12%, supported by scale, operational efficiencies, and value-added products.

- Delivered exceptional profit CAGR of 79% over the last 5 years, showcasing consistent outperformance and margin expansion.

- Strong ROE of 25.5% (3Y average) reflects efficient capital utilisation and a focus on shareholder value.

- Significantly reduced debt-to-equity from 1.44 in FY20 to 0.41 in FY24, highlighting improved financial strength and deleveraging.

- Combined capacity stands at over 1.9 million tonnes per annum post-merger, with modernization enabling higher yield and product innovation.

- On track for carbon-neutral production by 2050, reinforcing its positioning as an ESG-compliant long-term play.

Recent financial performance of Jindal Stainless for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 9127.45 | 9776.83 | 9907.30 | 1.33% | 8.54% |

| EBITDA (₹ Cr.) | 1246.17 | 1186.49 | 1207.54 | 1.77% | -3.10% |

| EBITDA Margin (%) | 13.65% | 12.14% | 12.19% | 5 bps | -146 bps |

| PAT (₹. Cr.) | 678.15 | 609.20 | 668.78 | 9.78% | -1.38% |

| PAT Margin (%) | 7.43% | 6.23% | 6.75% | 52 bps | -68 bps |

| Adjusted EPS (₹) | 8.41 | 7.42 | 7.95 | 7.14% | -5.47% |

Jindal Stainless financial update (Q3 FY25)

Financial performance

- Standalone sales volume rose 14.8% YoY to 5,87,658 MT in Q3 FY25, driven by strong domestic demand. 9M FY25 volumes grew 7.9% YoY to 17,30,428 MT.

- Realisation per tonne stood at ₹1,71,190; EBITDA per tonne at ₹17,058.

- Standalone net debt reduced by ~22% QoQ to ₹3,344 crore, reflecting improved cash flow and financial discipline.

Operational Highlights

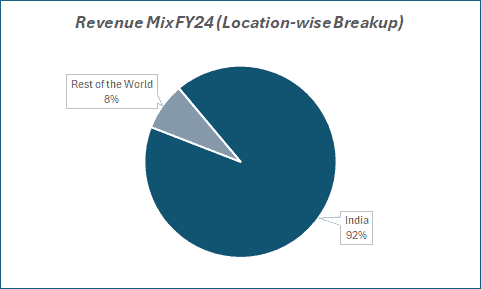

- Revenue mix in Q3 FY25: 92% Domestic and 8% Exports (vs. 88% and 12% in Q3 FY24).

- Export performance was impacted by geopolitical disruptions, weaker EU demand, and rising shipping costs.

- ₹3,800 crore deployed towards acquisitions and capex during 9M FY25, supporting modernisation and capacity expansion.

- US import tariff on Indian stainless steel remains at 25%, posing a short-term challenge.

Outlook

- Aims to increase the share of cold rolled products from 45% to 75% of total melt volume in the coming period.

- Volume growth guidance maintained at ~10% for FY25.

- Net debt target set at ₹5,500 crore by end of FY25, indicating continued deleveraging.

- Expects capacity constraints in the US to open up export opportunities going forward.

Company valuation insights – Jindal Stainless

Jindal Stainless (JSL) currently trades at a TTM P/E of 19.07, well below the industry average of 30.02, indicating relatively attractive valuations. The stock has declined 17.36% over the past year, underperforming the Nifty 50’s 6.55% gain.

However, demand momentum from premium segments such as railways and infrastructure is picking up once again. Unlike carbon steel players, JSL’s EU market exposure remains stable due to unchanged quotas. Additionally, recent US tariffs apply uniformly across all countries, providing a level playing field for JSL to strengthen its position in the American market.

The company is expected to maintain its strong market share in India and the EU while pushing for volume growth in the US. At the current market price, JSL trades at an attractive valuation of 8x FY26E EBITDA of ₹5,995 crore, implying a target price of ₹630, offering a potential upside of 14%. A combination of export stability, renewed domestic traction, and global competitiveness supports a positive long-term outlook.

Major risk factors affecting Jindal Stainless

- Volatility in raw material prices: Nickel and ferrochrome price swings can dent margins.

- Global slowdown: Export-heavy segments may see pressure if US or EU demand weakens.

- Chinese dumping: Any relaxation in import restrictions may reignite pricing wars.

- ESG norms in the EU: The Carbon Border Adjustment Mechanism (CBAM) could pressure exports unless green initiatives accelerate.

Technical analysis of Jindal Stainless share

Jindal Stainless Ltd (JSL) is currently in a corrective Wave 4 phase on the weekly chart, as part of a larger Elliott Wave structure. The formation hints at a potential Wave 5 uptrend, which could trigger a bullish reversal and mark an attractive entry point.

The stock is approaching a 50-SMA crossover; if sustained, this could confirm the beginning of a bullish trend. For now, JSL remains below its key moving averages, but improving price structure offers early signs of recovery.

The MACD remains negative, with the line below the signal line. However, a series of shrinking negative histograms suggests that bullish momentum may be building. The RSI at 43.54 reflects neutral sentiment, while the Relative RSI remains negative over 21-day and 55-day periods, indicating ongoing underperformance against the benchmark.

Notably, the ADX at 29.57 highlights the presence of a strong underlying trend, which could gain traction if price crosses resistance levels.

A decisive move above ₹600 could open up the path to ₹630 and beyond. On the downside, ₹510 serves as a crucial support level.

- RSI: 43.54 (Neutral)

- ADX: 29.57 (Trending)

- MACD: Negative (Bullish crossover awaited)

- Resistance: ₹600

- Support: ₹510

Jindal Stainless stock recommendation

Current Stance: Buy with a target price of ₹630 over a 12-month horizon. JSL’s cost leadership, growing global presence, and strategic positioning in high-growth end-use sectors make it a strong contender in the stainless steel space.

Why buy now?

Sector tailwinds: Benefiting from renewed demand in premium sectors like railways, infrastructure, and mobility, segments witnessing robust policy and capex support.

Global competitiveness: Level playing field in the US due to uniform tariffs across countries enhances export potential; steady quota access to the EU market remains a key advantage.

Resilient operations: The company has maintained profitability despite industry volatility, supported by a flexible cost structure and value-added product mix.

Market positioning: As India’s largest stainless steel producer, JSL is poised to capitalise on both domestic growth and strategic global expansion.

Portfolio Fit

Jindal Stainless offers investors a unique play on infrastructure and industrial capex with a global angle. Its strong fundamentals, improving export competitiveness, and undervalued multiples (TTM P/E of 19.07 vs industry average of 30.02) make it an attractive addition to portfolios focused on cyclical recovery and manufacturing-led growth. With a clear earnings runway and valuation comfort, JSL fits well for investors seeking both re-rating potential and earnings growth.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebJindal Stainless: Budget 2025-26 opportunities

- Infrastructure-led demand: Increased government allocation for railways, smart cities, and urban infrastructure is expected to drive stainless steel consumption across sectors.

- Manufacturing thrust: Higher budgetary support for industrial corridors, domestic manufacturing, and PLI schemes can boost demand from auto, process industries, and capital goods segments.

- Export competitiveness: Continued focus on trade agreements and export incentives will enhance JSL’s access to key global markets, supporting volume growth.

- Sustainability initiatives: Budgetary emphasis on green energy and sustainability (e.g., ethanol blending, hydrogen, solar infrastructure) opens up new avenues for stainless steel in clean tech applications.

- Skill and R&D investment: Government push towards skill development and applied R&D can enhance JSL’s product innovation capabilities, especially in high-end alloy and specialty steel applications.

Final thoughts

JSL is not your average metal stock. It’s a play on India’s infra-led GDP growth, EV transition, and export prowess – all rolled into one. With disciplined capital allocation, improving ESG credentials, and a secular demand trend in its favor, Jindal Stainless could shine bright in both cyclical and structural bull cases.

If you’re building a long-term portfolio with an eye on India’s manufacturing rise, JSL deserves serious consideration.