Kotak Mahindra Bank has been a formidable player in India’s banking landscape, transitioning from a non-banking financial company (NBFC) to one of the most reputed private-sector banks. Investors closely follow Kotak due to its consistent financial performance, conservative lending approach, and focus on high-quality assets. But does it still hold long-term potential?

Let’s dive deep into Kotak Mahindra Bank’s business model, growth drivers, valuation, and risks to assess whether it remains a compelling stock for investors.

Stock Overview

| Ticker | KOTAKBANK |

| Industry/Sector | Financial Services (Private Bank) |

| Market Cap (Rs Cr.) | 3,81,345 |

| Free Float (% of Market Cap) | 73.71% |

| 52 W High/Low | 1994.90 / 1543.85 |

| P/E | 17.18 (Vs Industry P/E of 11.99) |

| EPS (TTM) | 113.32 |

About Kotak Mahindra Bank

Founded in 1985 as Kotak Mahindra Finance Ltd., the bank gained its banking license in 2003, making it one of the few NBFCs to convert into a commercial bank. Today, it is one of India’s leading financial conglomerates, offering a comprehensive suite of financial products and services, including retail and corporate banking, wealth management, asset management, and insurance.

Kotak Mahindra Bank operates a well-diversified business model, catering to various financial needs of individuals and businesses. It is known for its prudent lending policies, robust risk management framework, and customer-centric approach.

The bank holds the 4th largest market share in both deposits and gross advances. Additionally, its securities broking business accounted for an 11.8% market share in FY24, while its asset management division held a 6.5% market share, solidifying its position as a key player in the Indian financial sector.

As of FY24, the bank operates over 1,900 branches, 3,200+ ATMs, and 11 currency chests across India, marking significant growth from ~1,700 branches and ~2,700 ATMs in FY23.

With a well-distributed presence—31% in the West, 31% in the North, 30% in the South, and 8% in the East—the bank continues to expand its reach. Its customer base has also grown substantially, rising from 3.27 crore in FY22 to 5 crore in FY24, reflecting its strong market presence and customer trust.

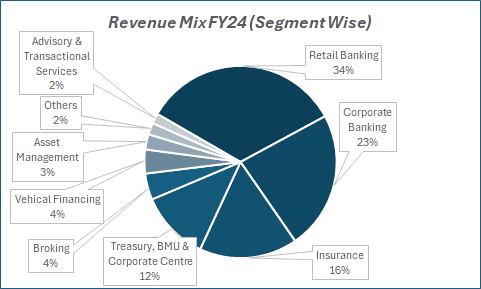

Key business segments

Kotak Mahindra Bank operates across multiple financial segments:

- Retail Banking: Offers savings accounts, loans, credit cards, and digital banking solutions. The bank is aggressively expanding its digital footprint to enhance customer experience.

- Corporate & Wholesale Banking: Provides working capital loans, term loans, trade finance, and treasury management for businesses.

- Wealth Management & Asset Management: Kotak’s wealth management arm is among the largest in India, catering to HNIs and ultra-HNIs.

- Insurance (Kotak Life & Kotak General Insurance): Offers life and general insurance products with a growing customer base.

- Investment Banking & Capital Markets: One of the leaders in M&A advisory, equity capital markets, and debt capital markets.

- Microfinance & SME Lending: Focuses on small and medium enterprises, a growing segment in India’s economy.

Primary growth factors for Kotak Mahindra Bank

- Digital Banking & Fintech Integration: Kotak is leveraging advanced digital solutions, AI-driven analytics, and fintech partnerships to enhance customer experience and drive growth.

- Strong CASA (Current Account-Savings Account) Ratio: With a CASA ratio exceeding 40%, Kotak benefits from a lower cost of funds, boosting its net interest margin (NIM).

- Loan Book Diversification: The bank is strategically expanding its loan portfolio across retail, SME, and corporate segments while maintaining asset quality.

- Rural & SME Banking Focus: Kotak is increasing its penetration in rural and SME sectors, aligning with India’s financial inclusion agenda.

Detailed competition analysis for Kotak Mahindra Bank

Key Financial Metrics – FY 24;

| Company | NII(Rs Cr.) | OperatingIncome(Rs Cr.) | Operating Margin (%) | PAT(Rs Cr.) | PAT Margin (%) | P/E(TTM) |

| Kotak Mahindra Bank | 33669.39 | 25835.85 | 76.73% | 17976.83 | 19.07% | 17.18 |

| HDFC Bank | 129510.47 | 101586.88 | 78.44% | 65446.50 | 16.04% | 18.69 |

| ICICI Bank | 85407.76 | 64146.77 | 75.11% | 45006.74 | 19.07% | 17.53 |

| Axis Bank | 51368.31 | 39356.07 | 76.62% | 26423.54 | 19.15% | 11.17 |

| Indusind Bank | 20615.92 | 15864.06 | 76.95% | 8976.99 | 16.28% | 11.24 |

Key insights on Kotak Mahindra Bank

- Achieved a 14% revenue CAGR over the past five years, supported by steady loan book expansion and strong fee-based income.

- EBITDA has grown at a 17% CAGR, while PAT has expanded at a 20% CAGR, reflecting strong operational efficiencies and prudent risk management.

- Ranks as the 4th largest bank in India in both deposits and gross advances, underscoring its solid market presence.

- Maintains a well-diversified financial services portfolio, with an 11.8% market share in securities broking and a 6.5% market share in asset management, reinforcing its leadership across multiple segments.

- Consistently maintains Net Interest Margins (NIMs) above 4%, supported by its strong retail banking franchise and CASA growth.

- Strong capital position, with a Capital Adequacy Ratio (CAR) of ~21%, ensuring financial strength and lending capacity.

- Improving asset quality, with gross NPA below 2%, reflecting disciplined risk management and prudent credit underwriting.

Recent financial performance (Q3 FY25)

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| NII (Rs Cr.) | 8509.48 | 9287.99 | 9462.40 | 1.88% | 11.20% |

| Op. Income (Rs Cr.) | 6275.59 | 7537.22 | 7234.25 | -4.02% | 15.28% |

| Op. Margin (%) | 73.75% | 81.15% | 76.45% | -470 bps | 270 bps |

| PAT (Rs Cr.) | 4202.39 | 4997.78 | 4639.63 | -7.17% | 10.40% |

| PAT Margin (%) | 17.45% | 18.59% | 19.38% | 79 bps | 193 bps |

| Adjusted EPS (Rs) | 21.46 | 25.37 | 23.64 | -6.82% | 10.16% |

- Steady NII growth & margins

Kotak Mahindra Bank reported 9.8% YoY growth in standalone net interest income (NII), although it lagged loan growth. Net interest margin (NIM) declined 29 bps YoY but improved 2 bps sequentially to 4.93%, aided by lower funding costs.

- Controlled operating costs & profitability

Operating expenses rose 8.3% YoY and 0.7% QoQ, while the cost-to-income ratio improved by 22 bps QoQ to 47.2%. Standalone net profit increased 10% YoY to ₹3,305 crore in Q3 FY25.

- Elevated provisions & Asset quality

Provisions surged 37.1% YoY, reflecting elevated slippages, though sequential slippages moderated to ₹1,657 crore. GNPA ratio inched up by 1 bps QoQ to 1.5%, while Net NPA declined 2 bps to 0.41%, indicating stable asset quality.

- Healthy Loan growth with mixed performance across segments

Overall loan book expanded 15.1% YoY to ₹4.13 lakh crore, growing 3.6% sequentially.

- Home loans & LAP grew 19% YoY, while business banking surged 23% YoY.

- Personal loans & consumer durables grew a modest 10% YoY, reflecting a cautious stance.

Healthy Loan growth with mixed performance across segments - Deposit growth & CASA trends

Total deposits grew 15.9% YoY and 2.6% QoQ to ₹4.73 lakh crore. However, CASA deposits rose only 2.7% YoY and declined 0.4% QoQ, with the CASA ratio dropping 130 bps QoQ to 42.3%.

- Credit stress & Business growth outlook

The management anticipates credit card stress to normalise within 2-3 quarters while remaining cautious about the microfinance segment. The bank expects overall business growth to be 1.5-2x nominal GDP growth in the medium term.

Company valuation insights – Kotak Mahindra Bank

Kotak Mahindra Bank is currently trading at a P/E ratio of 17.18, significantly above the industry average of 11.99, reflecting its premium valuation driven by robust earnings growth and superior asset quality. The stock has outperformed the Nifty 50, delivering a 13.03% return over the last year, compared to the Nifty 50’s modest gain of 0.79%.

The bank remains well-positioned for sustained growth, backed by:

- Loan book expansion: Kotak is expected to achieve an 18.0% CAGR loan book growth over FY24-27E, supported by rising retail and corporate credit demand.

- Stable asset quality: Gross NPA (GNPA) and Net NPA (NNPA) are projected to decline to 1.09% and 0.26% by FY27E, reflecting improved risk management and disciplined underwriting.

- Resumption of credit card & digital growth: The anticipated reversal of the card issuance ban and a revival in customer onboarding through advanced online and mobile banking channels will act as key catalysts for accelerating retail growth.

- Margin resilience amid rate cuts: Despite pressure on Net Interest Margins (NIMs) due to rising funding costs, Kotak is expected to sustain profitability, leveraging its growing mix of high-yielding assets in a potential rate-cut environment.

- Healthy deposit growth: The bank has witnessed strong CASA and term deposit (TD) growth, ensuring a stable funding base for continued expansion.

We employ a Sum-of-the-Parts (SOTP) valuation for Kotak Mahindra Bank. Applying 2.5x P/BV to its standalone banking business, based on a book value of ₹556, we derive a valuation of approximately ₹1,390 per share. Adding contributions from its subsidiaries – Kotak Securities, Kotak Life Insurance, Kotak AMC, and Kotak General Insurance, we arrive at a target price of ₹2,200, implying an upside potential of 15% from the current price.

Major risk factors affecting Kotak Mahindra Bank

- Regulatory Changes: Banking sector regulations can impact profitability and expansion plans.

- Intensifying Competition: Rising competition from other private banks, fintech players, and NBFCs may pose challenges.

- Economic Slowdown: A slowdown in credit demand or increase in NPAs can affect growth.

- Digital Disruptions: Rapid technological changes require continuous innovation to stay ahead in the digital banking race.

- Leadership Transition: Uday Kotak’s recent transition out of the CEO role raises concerns about leadership continuity and strategic direction.

Technical analysis of Kotak Mahindra Bank share

Kotak Mahindra Bank (KMB) is forming a cup and handle pattern on the daily charts, with the cup already in place. A breakout above ₹1,940, confirming a move beyond its ₹1,920 resistance, could trigger an upward momentum, potentially pushing the stock towards its 52-week high of ₹1,994.90 and beyond.

Simultaneously, a bearish cypher pattern is forming, which could facilitate the formation of the handle in the cup & handle setup. This pattern suggests short-term caution, with a potential handle retest zone and support around ₹1,830 before a decisive breakout.

The Relative Strength Index (RSI) at 46.49 indicates a neutral stance, suggesting that the stock is neither overbought nor oversold. MACD remains highly positive at 21.41, reflecting strong momentum, but the MACD line has just moved below the signal line, signaling potential short-term consolidation.

KMB is trading above all its key moving averages, indicating a strong underlying trend. With the stock recently hitting its 52-week high in February, a sustained move above ₹1,940 could lead to a continued rally towards the target price of ₹2,200.

- RSI: 46.49 (Neutral)

- ADX: 24.24 (Range Bound)

- MACD: 21.41 (Positive, but showing short-term caution)

- Resistance: ₹1,920

- Support: ₹1,830

Kotak Mahindra Bank stock recommendation

Current Stance: Buy with a target price of ₹2,200 (12-month horizon), with near-term catalysts expected to drive performance.

Why Buy Now?

Strong loan growth: Projected 18% CAGR (FY24-27E) driven by retail, SME, and high-yielding unsecured loans.

Resilient asset quality: GNPA/NNPA expected to decline to 1.09%/0.26% by FY27E, showcasing prudent risk management.

Key catalysts ahead: Credit card ban reversal and digital onboarding revival to boost consumer banking growth.

Portfolio Fit

Kotak Mahindra Bank is an ideal choice for investors seeking exposure to India’s high-growth banking sector with a strong focus on profitability and digital banking innovations. The bank’s high-quality loan book, resilient earnings profile, and industry-leading return ratios make it a compelling long-term investment.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebKotak Mahindra Bank: Post-Budget 2025 opportunities

- Credit Growth & MSME Support: Increased government focus on MSME lending and credit guarantee schemes could drive higher loan disbursements and portfolio expansion.

- Retail & Housing Loan Demand: Potential tax benefits for homebuyers and middle-class income support measures may boost mortgage and retail loan demand.

- Digital Banking & Fintech Incentives: Government push for digital transactions, UPI growth, and fintech collaboration could strengthen Kotak’s digital banking initiatives.

- Infrastructure & Capex Spending: Increased public and private investment in infrastructure projects may create new corporate lending opportunities.

Deposit Mobilisation & Interest Rate Trends: Policies promoting financial inclusion and higher disposable income could support CASA (Current Account Savings Account) growth.