Stock overview

| Ticker | MANKIND |

| Sector | Pharmaceuticals |

| Market Cap | ₹ 89,239 Cr |

| CMP (Current Market Price) | ₹ 2,445 |

| 52-Week High/Low | ₹ 3,055/ ₹ 1,901 |

| P/E Ratio | 46.1x |

| Beta | 0,85 (Low volatility) |

About Mankind Pharma

Founded in 1995, Mankind Pharma has rapidly grown into one of India’s top five pharmaceutical companies in terms of domestic market share. The company is known for its extensive portfolio across prescription drugs, over-the-counter (OTC) products, and consumer healthcare brands such as Manforce, Prega News, and Unwanted 72. Its strength lies in affordable pricing, a vast distribution network, and a strong brand presence across India.

Mankind Pharmaceuticals has emerged as a leading force in India’s healthcare industry, known for its strong domestic focus and diverse product portfolio. This report provides a detailed analysis of the company’s Q3 FY25 performance, growth potential, risks, and technical outlook to help investors evaluate its long-term prospects.

Primary growth factors for Mankind Pharma

1. Domestic market leadership

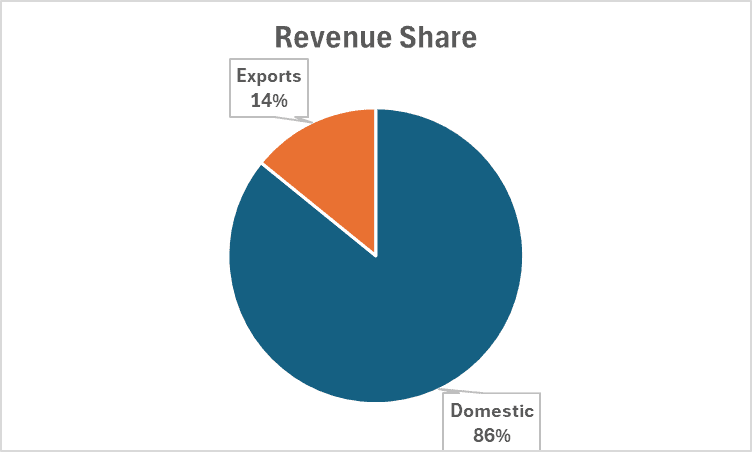

- 80%+ of revenue comes from India, positioning it as one of the largest domestic players.

- Consistent brand recall and affordability fuel prescription growth.

- Here’s the revenue split of Mankind Pharma across Domestic and Export business

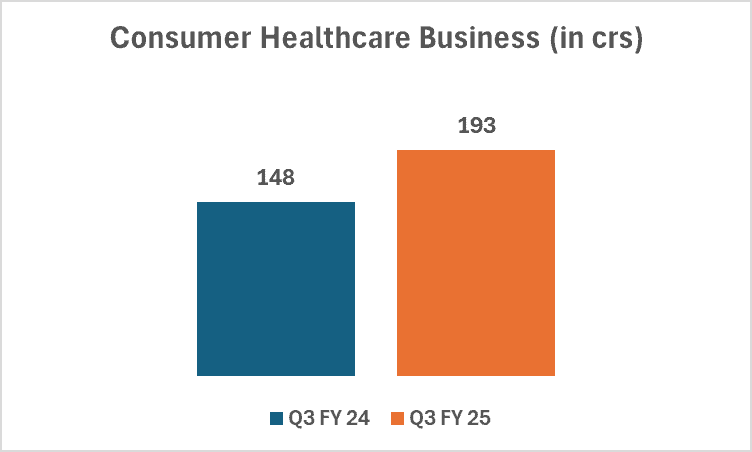

- Consumer healthcare expansion

- Brands like Prega News and Manforce lead in their respective segments with over 60% market share.

- Expanding into nutraceuticals and wellness to capture rising health-conscious consumers.

- Consumer Healthcare business also grew by 30% in Q3 FY 25 on a YoY basis

- New product launches & R&D

- Launched 15+ new drugs in FY25, focusing on cardiology, diabetes, and dermatology.

- 6% of revenue allocated to R&D for developing new formulations.

- International expansion

- Entered Southeast Asia, Africa, and LATAM markets with a growing export portfolio.

- Strategic partnerships with global pharma companies for co-development.

Q3 FY25 Financial Performance

| Metric (in ₹) | Q3 FY 25 | YoY Growth | QoQ Growth |

| Revenue | 3,230 cr | 24% | 5% |

| EBITDA | 833 cr | 36% | -2% |

| PAT | 385 cr | -16% | -42% |

| EPS | 14.2 | 1% | -25% |

- Mankind Pharma reported an impressive 24% growth in Revenue and 36% growth in EBITDA on a YoY basis in Q3 FY25.

- Profit de-grew by 16% vs Last year. There was pressure on overall interest cost and depreciation for the quarter.

- The company looks poised for further revenue growth in the subsequent quarters with improvement in overall profitability as well.

Detailed competition analysis for Mankind Pharma

| Company | Market Cap | Profit | P/E | RoCE |

| Mankind Pharma | 89,239 cr | ₹ 385 cr | 46.1x | 24.6% |

| Sun Pharma | 4,15,300 cr | ₹ 3,167 cr | 35.2x | 17.3% |

| Cipla | 1,21,200 cr | ₹ 1,570 cr | 24.3x | 22.8% |

| Dr Reddy | 97,600 cr | ₹ 1,404 cr | 18.2x | 26.5% |

- Mankind Pharma trades at a steep valuation (P/E 46.1x) vs its peers.

- Mankind’s strong domestic market presence and high margins make it a strong contender in the pharmaceutical industry in spite of a higher valuation.

Company valuation insights: Mankind Pharma

As per Discounted Cash Flow analysis:

It estimates the intrinsic value of Mankind Pharma shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹2,450 per share

- Upside Potential: 13%

- WACC: 10.7%

- Terminal Growth Rate: 3.7%

Major risk factors affecting Mankind Pharma

1. Regulatory risks

- Pharma price controls in India can impact profitability.

- Regulatory scrutiny in export markets could delay approvals.

- Intense competition

- Competing with global giants like Sun Pharma, Cipla, and Dr. Reddy’s.

- OTC brands face competition from FMCG players.

- Raw material costs

- Dependence on China for Active Pharmaceutical Ingredients (APIs) poses supply chain risks.

- Fluctuations in raw material prices can impact margins.

Technical analysis of Mankind Pharma

- Resistance: ₹2,250

- Support: ₹2,10

- Momentum: Bullish but consolidating

- RSI (Relative Strength Index): 58 (Neutral)

- 50-Day Moving Average: ₹2,140

- 200-Day Moving Average: ₹1990 (indicating strength)

The stock is trading above key moving averages, indicating a strong uptrend. However, short-term resistance at ₹2,250 could lead to some consolidation before a breakout.

Mankind Pharma stock recommendation by Ketan Mittal

Current Stance: BUY with a 12-month target of ₹2,450.

Rationale:

Outlook: Positive, with moderate upside potential

Recommended Action: Hold or accumulate on dipsIf you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Mankind Pharmaceuticals stands out due to its dominant domestic presence, strong consumer healthcare segment, and steady financial performance. While near-term resistance may cap upside, long-term investors can consider accumulating on dips.