Mahindra & Mahindra (M&M) has been a dominant force in India’s automobile and tractor industry for decades. With a legacy of innovation, strong execution, and a focus on both domestic and global expansion, M&M has positioned itself as a key player in the automotive and farm equipment sectors. However, with evolving market dynamics, increased competition, and macroeconomic fluctuations, does M&M remain a solid investment opportunity?

This deep dive unpacks the key business segments, growth drivers, valuation insights, and risks associated with the stock.

Stock Overview

| Ticker | M&M |

| Industry/Sector | Automobile (Passenger Cars & Utility Vehicles) |

| Market Cap (Rs Cr.) | 3,38,625 |

| Free Float (% of Market Cap) | 71.06% |

| 52 W High/Low | 3270.95 / 1788.80 |

| P/E | 27.39 (Vs Industry P/E of 19.95) |

| EPS (TTM) | 99.62 |

About M&M

Founded in 1945, M&M is a flagship company of the Mahindra Group. It started as a steel trading company but quickly diversified into automobiles and farm equipment. Over the years, the company has built a strong reputation across multiple industries.

Today, M&M is a leader in the Indian tractor market and a formidable player in the SUV segment, with a growing focus on electric mobility and global expansion.

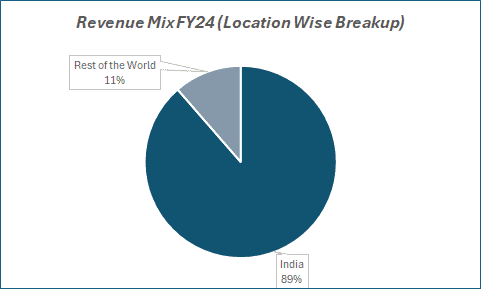

M&M operates 21 manufacturing facilities in India, primarily serving its automotive and farm equipment businesses. The company plans to ramp up its SUV production capacity to 7.7 lakh units in FY25 from the current 5.88 lakh SUVs per annum and further scale it up to 8.64 lakh units by the end of FY26.

In the passenger vehicle segment, M&M holds a domestic retail market share of ~11% in FY24. The company dominates the tractor segment with a ~41% market share, reinforcing its leadership position in Indian agriculture.

Additionally, M&M has maintained its market leadership in the LCV (<3.5T) segment—which is the largest category within the commercial vehicle industry—for a decade, with a 47.6% market share. This segment alone accounts for 56% of India’s total CV industry.

Key business segments

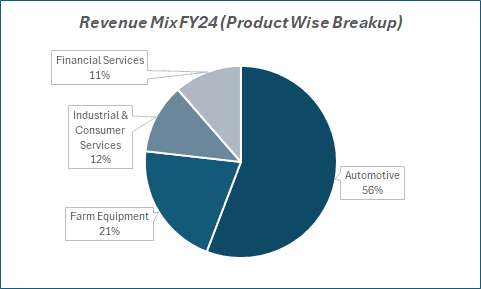

Mahindra & Mahindra Ltd. (M&M) operates across multiple business segments, with a strong presence in diverse industries. The key business segments of M&M include:

- Automotive – Manufacturing and selling SUVs, electric vehicles, commercial vehicles, and two-wheelers.

- Farm Equipment – Producing tractors and agricultural machinery, making M&M a global leader in the tractor industry.

- Information Technology (Tech Mahindra) – Providing IT and digital transformation services worldwide.

- Financial Services (Mahindra Finance) – Offering vehicle loans, insurance, and other financial products.

- Real Estate & Infrastructure (Mahindra Lifespace Developers) – Engaged in residential and commercial real estate projects.

- Hospitality (Mahindra Holidays & Resorts) – Managing vacation ownership and resort services through Club Mahindra.

Primary growth factors for M&M

1. Dominance in the SUV segment:

- M&M has solidified its position in India’s SUV market, with models like the Scorpio, Bolero, XUV700, and the newly introduced Thar Roxx leading sales.

- In 2024, the company surpassed the half-million mark in annual SUV sales for the first time, achieving a 22% year-on-year increase with 528,460 units sold.

2. Financial discipline and strategic focus:

- By divesting loss-making businesses and concentrating on profitable ventures, M&M has enhanced its financial health.

- This strategic approach led to a 67% year-on-year increase in net profit for the first quarter of 2023, driven by robust SUV sales and operational efficiencies.

3. Leadership in the farm equipment sector:

- M&M has maintained its number one position in the farm equipment segment for the 41st consecutive year, holding a market share of 41.6% as of March 31, 2024. This dominance underscores the company’s strong presence in the agricultural machinery market.

4. Expansion into electric vehicles (EVs):

- Recognising the shift towards sustainable mobility, M&M has invested in the electric vehicle market. The company introduced two new electric SUVs—the sporty BE 6e and the luxurious XEV 9e—with driving ranges exceeding 500 km per charge. These models aim to boost M&M’s market share in segments traditionally dominated by competitors.

Detailed competition analysis for M&M

Key Financial Metrics – FY 24;

| Company | Revenue(Rs Cr.) | EBITDA(Rs Cr.) | EBITDA Margin (%) | PAT(Rs Cr.) | PATMargin (%) | P/E(TTM) |

| M&M | 1,39,078 | 24,892 | 17.90% | 11,148 | 8.02% | 27.39 |

| Maruti Suzuki | 1,41,858 | 18,526 | 13.06% | 13,234 | 9.33% | 25.22 |

| TATA Motors | 4,37,928 | 59,538 | 13.60% | 31,107 | 7.10% | 7.51 |

Key Insights on M&M

- 5-year CAGR revenue growth of 7%, with a significant improvement in the last 3 years (3Y CAGR of 23%) and TTM revenue CAGR of 12%.

- EBITDA margins consistently between 16%-19% over the last five years, peaking at 19.21% in FY24.

- Profit CAGR of 17% over the last five years and 10% over the last decade.

- ROE has improved from 6% in FY20 to over 20% in FY24, showcasing better capital efficiency.

- Debt-to-equity reduced from above 2 in FY20 to 1.6 in FY24, strengthening financial stability.

- Maintains a healthy dividend payout of 19.3%, ensuring steady shareholder returns.

- Strong market presence in the SUV and tractor segments, benefiting from rising rural demand and premiumization.

- Investing heavily in electric vehicles (EVs), advanced mobility solutions, and digital transformation for long-term growth.

- Robust order book in SUVs and tractors, providing revenue visibility.

Recent Financial Performance (Q3 FY25)

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (Rs Cr.) | 35,299 | 37,924 | 41,470 | 9.35% | 17.48% |

| EBITDA (Rs Cr.) | 6,224 | 7,133 | 8,231 | 15.39% | 32.25% |

| EBITDA Margin (%) | 17.63% | 18.81% | 19.85% | 104 bps | 222 bps |

| Net Profit (Rs Cr.) | 2,732 | 2,895 | 3,317 | 14.58% | 21.41% |

| Net Profit Margin (%) | 7.74% | 7.63% | 8.00% | 37 bps | 26 bps |

| Adjusted EPS (Rs) | 23.85 | 28.42 | 28.50 | 0.28% | 19.50% |

M&M Financial Update (Q3 FY25)

Automotive

- Revenue grew 21% YoY to ₹23,391 crore in Q3 FY25 and 17.5% YoY to ₹64,922 crore in 9M FY25.

- EBIT stood at ₹2,047 crore for Q3 FY25, with an EBIT margin of 8.8% (9% for 9M FY25).

- Achieved SUV sales of 1.4 lakh units in Q3 FY25 (vs. 1.2 lakh in Q3 FY24).

- Achieved SUV revenue market leadership, increasing market share by 200 bps YoY.

- LCV <3.5T sales hit 67,500 units in Q3 FY25 (vs. 62,900 in Q3 FY24).

- LCV Market Share increased by 230 bps YoY to 51.9% in volume terms.

- In regards to price hikes, they were raised by 0.7% in Dec 2024 and 0.8% in Jan 2025 across various models.

Farm Equipment

- Revenue grew 11% YoY to ₹9,536 crore in Q3 FY25 and 2.8% YoY to ₹27,442 crore in 9M FY25.

- EBIT margin for the tractor segment expanded to 19.5% (vs. 17.3% in Q3 FY24).

- Tractor Market Share increased by 240 bps YoY to 44.2%, driven by product enhancements in Swaraj.

- Exports recorded at ~3,700 tractors sold in international markets during the quarter.

- Farm Machinery revenue stood at ₹249 crore in Q3 FY25 (₹767 crore in 9M FY25), including MITRA’s contribution.

Growth Segments

- Logistics: Secured a major quick-commerce partnership, with a focus on cost and service improvements.

- Hospitality: Achieved 84% occupancy with a 37% rise in average unit realization.

- Real Estate: Acquired 30-acre land in Bhandup (₹12,700 crore GDV); strong collections and planned launches remain on track.

Company valuation insights – M&M

M&M is poised for strong growth, with revenue estimates factoring in a 2%/7%/9% CAGR for FY25E/FY26E/FY27E, driven by a healthy outlook in the Farm Equipment Segment (FES) and automotive business, supported by favorable monsoons and a robust 9M performance.

We value M&M using a Sum-of-the-Parts (SOTP) methodology, incorporating its core automotive business and key subsidiaries. The automotive segment, which remains the growth driver, is valued at ₹2,436 per share, applying a 24x P/E multiple on the FY26E EPS of ₹101.5.

Adding the valuation of M&M’s other key subsidiaries, including its financial services arm, Tech Mahindra, and other listed/unlisted businesses, we arrive at a consolidated target price of ₹3,200, implying an upside potential of 18%.

Key assumptions include sustained growth in the auto segment, stable performance in financial services, and recovery in IT services. Risks include cyclical downturns in autos, regulatory challenges in financial services, and prolonged weakness in IT demand.

Major risk factors affecting M&M

- Supply chain disruptions: Semiconductor shortages and raw material price volatility can impact production and margins.

- EV competition: With Tata Motors and global players aggressively entering the Indian EV market, M&M’s execution needs to be swift.

- Agriculture sector slowdown: Monsoon failures and weak rural demand can negatively affect the tractor segment.

- Global recession risks: A slowdown in international markets can affect exports and Tech Mahindra’s IT business.

- Policy & Regulatory risks: Changes in government policies regarding emissions, taxation, and subsidies could impact business.

Technical analysis of M&M share

On the daily chart, M&M has broken below the ascending channel, indicating a bearish setup. However, the stock is currently consolidating near the lower boundary of the channel. If the price crosses back above ₹2,980 and sustains, it could trigger a reversal, with an upside move toward the target price of ₹3,200. Conversely, failure to reclaim this level may lead to continued weakness.

The Relative Strength Index (RSI) at 43.37 remains in the neutral range, suggesting neither overbought nor oversold conditions. Additionally, relative strength against the benchmark index is negative, indicating underperformance compared to the broader market.

The MACD remains negative, but the MACD line is on the verge of crossing above the signal line, with declining negative histogram bars. This setup suggests a potential shift in momentum, indicating that bearish pressure may be easing, and a reversal could be in sight.

Currently, M&M is trading below all key moving averages, reinforcing short-term weakness. A decisive move above ₹2,980 could signal a bullish breakout, while sustained weakness may push the stock toward lower support levels.

- RSI: 43.37 (Neutral)

- ADX: 15.51 (Range Bound)

- Resistance: ₹2,980

- Support: ₹2,480

M&M stock recommendation

Current Stance: Buy with a target price of ₹3,200 (12-month horizon); near-term fluctuations possible, but long-term growth drivers remain intact.

Why Buy Now?

M&M offers a compelling investment opportunity, supported by strong demand in its core automotive and farm equipment businesses.

The company is benefiting from favourable industry tailwinds, including a robust rural recovery, improved monsoons, and rising demand for SUVs and electric vehicles (EVs).

Additionally, its subsidiaries, including financial services and IT, contribute meaningfully to value creation, further enhancing its long-term prospects.

Portfolio Fit

M&M’s strong market position, consistent earnings growth, and focus on innovation make it a compelling investment choice. The company is well-placed to benefit from India’s expanding automotive and rural economy, offering investors a solid long-term growth opportunity.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebM&M: Budget 2025 – 26 opportunities

- Automotive & EV Incentives: Government initiatives to promote electric mobility, including subsidies for EV adoption and charging infrastructure expansion, could accelerate demand for M&M’s electric SUVs and three-wheelers, strengthening its position in the EV segment.

- Rural & Agri Reforms: Increased budgetary support for rural development, farm mechanization, and credit accessibility for farmers could boost demand for M&M’s tractors and farm equipment, supporting volume growth in its FES segment.

- PLI Scheme & Domestic Manufacturing Push: Expansion of Production-Linked Incentive (PLI) schemes for the auto and auto components sector, along with incentives for localization, could enhance M&M’s cost efficiency and supply chain resilience, reinforcing its leadership in SUVs and commercial vehicles.

- Infrastructure & Logistics Growth: Higher capital outlay for roads, highways, and rural connectivity could drive demand for M&M’s commercial vehicle segment, benefiting from increased construction and logistics activities.

- Sustainable Mobility & Green Energy Focus: Policy incentives for hydrogen, biofuels, and renewable energy adoption could create new opportunities for M&M’s clean energy initiatives, including partnerships in electric mobility and alternative fuel technologies.