The Indian financial markets have seen a massive transformation in the last decade, with asset management firms playing a crucial role in wealth creation. Among these, Nippon Life India Asset Management Limited (NAM-INDIA) stands out as a leading player in the mutual fund industry.

With India’s increasing financial literacy and growing participation in equity markets, understanding NAM-INDIA’s business model, growth drivers, valuation, and risks can provide valuable insights for investors.

Stock overview

| Ticker | NAM-INDIA |

| Industry/Sector | Asset Management |

| Market Cap (₹ Cr.) | 32,143 |

| Free Float (% of Market Cap) | 27.45% |

| 52 W High/Low | 816.25 / 430.00 |

| P/E | 24.47 (Vs Industry P/E of 17.33) |

| EPS (TTM) | 20.99 |

About NAM-INDIA

Nippon Life India Asset Management Limited (NAM India) is the asset manager of Nippon India Mutual Fund (NIMF). The company’s principal activity is to act as an investment manager to Nippon India Mutual Fund (Formerly Reliance Mutual Fund) and to provide Portfolio Management Services (PMS) and advisory services to clients under Securities and Exchange Board of India (SEBI) Regulations. The Company is registered with SEBI under the SEBI (Mutual Funds) Regulations, 1996.

Key business segments

Nippon Life India Asset Management (NAM India) operates primarily in the financial services sector, focusing on asset management and investment solutions. Major business segments in which the company operate:

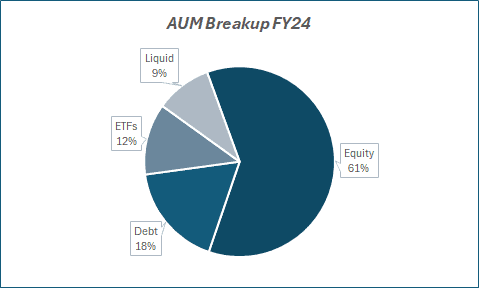

- Mutual Funds: Managing a diverse range of mutual fund schemes under Nippon India Mutual Fund (NIMF), including equity, debt, hybrid, and exchange-traded funds (ETFs).

- Portfolio Management Services (PMS) & Alternative Investment Funds (AIFs): Offering customized investment solutions for high-net-worth individuals (HNIs) and institutional investors.

- International Business: Providing investment opportunities for global investors looking to invest in Indian markets through offshore funds and strategies.

- Retirement & Pension Funds: Managing funds under the National Pension System (NPS) and other retirement solutions.

- ETF & Index Fund Solutions: One of the leading providers of ETFs in India, catering to passive investment strategies.

Primary growth factors for NAM-INDIA

- Focus on Retail and High Net Worth Individual (HNI) segments: The company places significant emphasis on the retail segment, with retail assets under management (AUM) contributing 28% to total AUM, surpassing the industry average of 23%. This focus has been instrumental in expanding its customer base and increasing its market share.

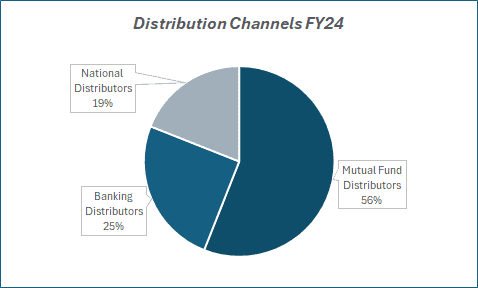

- Digital initiatives and Strategic alliances: NAM India has invested in digital infrastructure, leading to a 28% increase in digital transactions and a 59% growth in new digital Systematic Investment Plan (SIP) registrations. Partnerships with platforms like PhonePe, Paytm, ETMoney, Groww, and Kuvera have enhanced its digital distribution network.

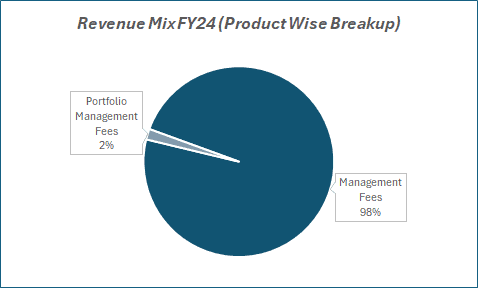

- Diversified revenue streams: While asset management fees constitute a significant portion of revenue, NAM India also generates income from investment advisory services and distribution fees. In FY2022, asset management services accounted for approximately 88.5% of total revenue, with investment advisory services and distribution fees contributing to the remainder.

- Strategic expansion and Market share growth: NAM India has gained market share across various asset classes, including equity, debt, and ETFs. This expansion is attributed to its strategic focus on customer-centric solutions and innovative product offerings.

Detailed competition analysis for NAM-INDIA

Key Financial Metrics – FY 24;

| Company | Revenue(₹ Cr.) | EBITDA(₹ Cr.) | EBITDA Margin (%) | PAT(₹ Cr.) | PATMargin (%) | P/E(TTM) |

| NAM-INDIA | 1,643 | 993 | 60.48% | 1,106 | 67.32% | 24.47 |

| 360 One WAM | 2,507 | 1,291 | 51.49% | 804 | 32.08% | 38.50 |

| Aditya Birla AMC | 1,353 | 761 | 56.24% | 780 | 57.67% | 19.48 |

| UTI AMC | 1,737 | 1,033 | 59.49% | 802 | 46.17% | 14.91 |

| Anand Rathi Wealth | 724 | 304 | 41.94% | 226 | 31.18% | 59.21 |

Key insights on NAM-INDIA

- Financial Performance

In Q1 FY25, NAM India reported a total income of ₹6.36 billion, up from ₹5.61 billion in Q4 FY24. The profit after tax for the same period was ₹3.32 billion, marking a 41% year-over-year increase. The company’s mutual fund quarterly average assets under management (QAAUM) stood at ₹4.84 trillion, reflecting a 54% YoY growth.

- Market Position

NAM India holds a market share of 8.20% in the mutual fund industry, with notable gains across all segments. The equity market share increased by 62 basis points YoY to 6.88%.

- Product Innovation

Recently, NAM India launched the Nippon India Active Momentum Fund, which integrates price momentum and earnings momentum strategies. This fund aims to identify high-quality momentum stocks by analyzing factors such as volatility and market sentiment.

Nippon Life India Asset Management Limited demonstrates strong financial health, a growing market presence, and a commitment to innovative investment solutions. Potential investors should weigh the company’s valuation metrics and growth prospects when considering investment opportunities.

Recent financial performance (Q3 FY25)

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 423.32 | 571.30 | 587.89 | 2.90% | 38.88% |

| EBITDA (₹ Cr.) | 259.16 | 374.36 | 385.69 | 3.03% | 48.82% |

| EBITDA Margin (%) | 61.22% | 65.53% | 65.61% | 8 bps | 439 bps |

| Net Profit (₹ Cr.) | 284.00 | 359.98 | 295.26 | -17.98% | 3.96% |

| Net Profit Margin (%) | 67.09% | 63.01% | 50.22% | -1279 bps | -1687 bps |

| Adjusted EPS (₹) | 4.53 | 5.69 | 4.66 | -18.10% | 2.87% |

NAM India reported a strong quarter, with consolidated revenue rising 38.88% YoY to ₹587.89 crore, primarily driven by robust growth in assets under management (AUM), which increased 36.4% YoY to ₹6.56 lakh crore.

As of December 2024, the company’s mutual fund quarterly average AUM stood at ₹5.7 lakh crore, reflecting a 51% YoY and 4% QoQ growth. Market share expanded to 8.31%, marking a 63 bps YoY and 1 bps QoQ gain, the highest YoY market share increase among asset management companies. Equity AUM market share improved 31 bps YoY and 3 bps QoQ to 6.99%.

SIP inflows continued to rise, reaching ₹0.991 lakh crore in Q3FY25, up 9.7% QoQ from ₹0.903 lakh crore in Q2FY25.

EBITDA grew 48.82% YoY to ₹385.69 crore, with margins improving 439 bps to 65.61%, supported by strong revenue growth. However, other expenses increased 26% YoY due to higher investments in technology and the alternative investment fund (AIF) business.

PAT for Q3FY25 stood at ₹300 crore, reflecting a 4% YoY growth but an 18% QoQ decline, missing estimates by 9%. The decline was primarily due to MTM impact on investments, leading to lower-than-expected other income. However, for 9MFY25, PAT rose 29% YoY to ₹1,000 crore.

Going forward, investments in technology and talent will continue, with management guiding for an expense growth of 15-17% (excluding ESOPs).

Company valuation insights – NAM-INDIA

NAM India is currently trading at a TTM P/E of 24.47, which is significantly higher than the industry average of 17.33, indicating a premium valuation. Over the past year, the stock has delivered a -2% return, slightly underperforming the Nifty 50’s -1.6% decline. Despite this, the company’s robust growth trajectory, expanding market share, and strong investor traction position it well for long-term value creation.

The company continues to strengthen its presence in the asset management space, driven by consistent growth in AUM and increasing equity and SIP market shares. Its expansion into passive investment offerings, including new index funds and a feeder fund in GIFT City, enhances its product diversification and broadens its investor base.

Furthermore, while yields on the equity segment are expected to decline, the pace of contraction is likely to moderate compared to recent years. This will be cushioned by healthy net inflows and an improved commission structure.

The broader outlook for the Indian asset management industry remains strong, supported by low penetration levels compared to developed markets and the ongoing financialization of savings.

As one of the key players in the industry, NAM India stands to benefit from these structural tailwinds. Additionally, the company is projected to deliver a healthy revenue and earnings CAGR of 18% and 16%, respectively, over FY25-27E.

From a valuation perspective, we apply a 25x P/E multiple on our FY26 EPS estimate of ₹24.25, arriving at a target price of ₹610. This implies a potential upside of 20% over the next 12 months, making NAM India an attractive investment opportunity within the asset management space.

Major risk factors affecting NAM-INDIA

As with any financial institution, NAM India is exposed to various risks that could impact its operations and performance. Key risks associated with NAM India include:

- Slower AUM growth & Yield pressure: A sluggish pace in AUM growth, coupled with continued pressure on yields, could weigh on revenue projections and impact overall top-line performance.

- Macroeconomic & Market volatility: Global uncertainties, persistent FII outflows, and a weak INR/USD outlook may dampen investor sentiment, affecting fund flows and overall growth momentum.

- Regulatory risks: The asset management industry operates under a stringent regulatory framework, and any changes in policies or new compliance requirements could pose challenges to earnings visibility and business operations.

Technical analysis of NAM-INDIA share

NAM India is currently trading within a falling channel, indicating a bearish trend. However, if the stock manages to break out from this channel around its support at ₹470, it could trigger an upmove towards its first resistance at ₹545. A decisive breakout above this level could further extend the rally toward its target price of ₹610.

The Relative Strength Benchmark Index remains slightly negative at -0.06, reflecting minor underperformance compared to the broader market. The RSI at 34.11 is approaching the oversold zone, which could present a potential entry opportunity. Meanwhile, the MACD at -29.54 remains negative, but the MACD line has just crossed above the signal line, indicating the possibility of a trend reversal.

From a moving average perspective, NAM India is trading below all its key moving averages, signaling that the broader trend remains weak. However, a breakout from the falling channel at ₹470 could mark a shift in momentum, with a sustained move above ₹545 strengthening the bullish case for a further upside.

- RSI: 34.11 (Approaching Oversold)

- ADX: 33.34 (Trending)

- Resistance: ₹545

- Support: ₹470

NAM-INDIA stock recommendation

Current Stance: Buy with a target price of ₹610 (12-month horizon), short-term volatility expected.

Why Buy Now?

NAM India presents a strong investment opportunity, backed by its consistent AUM growth and expanding market share in the mutual fund industry.

While equity yield compression remains a factor, the impact is expected to moderate, supported by strong net inflows and a rationalised commission structure.

Additionally, the company is projected to deliver a healthy revenue and earnings CAGR of 18% and 16%, respectively, over FY25-27E, reinforcing its growth potential.

Portfolio Fit

NAM India is an attractive addition for investors looking to capitalize on the long-term growth of India's asset management industry. Given its earnings visibility and secular industry trends, NAM India offers a well-balanced risk-reward profile, making it a valuable addition to long-term investment portfolios.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebNAM-INDIA: Budget 2025 – 26 opportunities

- Personal income tax reforms: The government has proposed a ‘Nil tax’ regime for individuals earning up to ₹12 lakh annually. This significant tax relief is expected to increase disposable income for the middle class, potentially leading to higher investments in mutual funds and other financial instruments managed by NAM India.

- Focus on inclusive growth: The budget emphasizes inclusive development, with substantial allocations for agriculture, infrastructure, and technology sectors. Initiatives like the PM Dhan Dhanya Krishi Yojana and national missions for high-yield seeds aim to boost agricultural productivity. Enhanced investment in these sectors may lead to economic growth, offering NAM India opportunities to develop sector-specific funds to attract investors.

- Regulatory changes in investment products: Recent approvals by the SEBI allow asset managers to launch higher-risk investment products, including long-short equity and derivatives-based plans. NAM India can capitalize on this regulatory change by introducing new investment products catering to investors seeking higher returns, thereby expanding its product offerings.