Stock Overview

| Ticker | NTPC |

| Industry/Sector | Power Generation |

| Market Cap (₹ Cr.) | 2,96,330 |

| Free Float (% of Market Cap) | 48.76% |

| 52 W High/Low | 448.45 / 296.85 |

| P/E | 13.69 (Vs Industry P/E of 21.80) |

| EPS (TTM) | 22.67 |

About NTPC

NTPC Ltd. is India’s largest power generation company, playing a crucial role in the country’s energy security. Established in 1975, NTPC primarily focuses on generating and selling electricity to state-owned power distribution companies and industrial consumers. The company is majority-owned by the Government of India and operates through various subsidiaries and joint ventures to expand its presence in renewable energy, coal mining, and power distribution.

The company has expanded from fossil fuels to hydro, nuclear, and renewable energy, reducing its carbon footprint. It has also diversified into consultancy, power trading, professional training, rural electrification, ash utilisation, and coal mining to strengthen its core business.

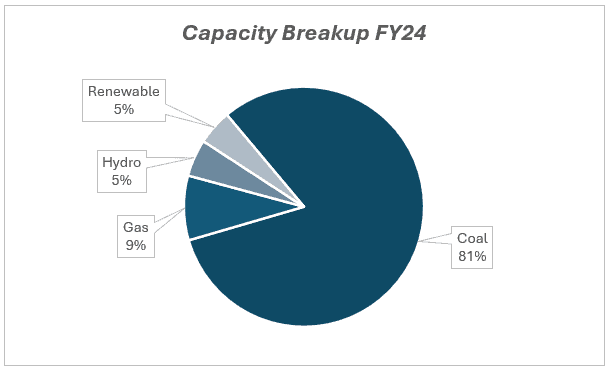

With 89 plants having an installed capacity of 76,048 MW (as of Jun 2024), NTPC contributes approximately 24% of India’s total power generation, ensuring a stable supply of electricity across the nation.

Key business segments

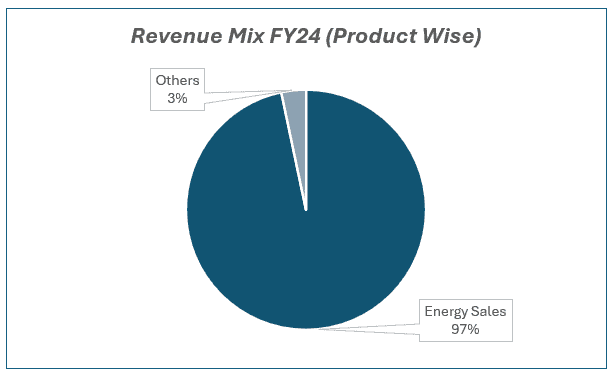

NTPC’s business is diversified across multiple energy generation and allied sectors:

- Thermal Power: The core business segment, contributing over 85% of NTPC’s total capacity. The company operates coal- and gas-based power plants across India.

- Renewable Energy: NTPC is aggressively expanding into solar, wind, and hydropower, aligning with India’s push towards sustainable energy.

- Coal Mining: To ensure a steady supply of coal, NTPC has operationalised captive coal mines.

- Power Distribution & Trading: The company engages in the trading and distribution of electricity to power utilities.

- Green Hydrogen & Battery Storage: NTPC is exploring energy storage solutions and hydrogen-based power generation.

.

Primary growth factors for NTPC

1. Government push for energy security

The Indian government is focusing on reliable power supply, ensuring steady demand for NTPC’s thermal and renewable energy projects.

2. Renewable energy expansion

NTPC aims to achieve 60 GW of renewable capacity by 2032, aligning with India’s green energy goals.

3. Rising power demand

Increasing urbanisation and industrialisation are driving higher electricity consumption, benefiting NTPC’s thermal and renewable segments.

4. Cost optimisation through captive coal mining

Operational coal mines are expected to reduce dependency on expensive coal imports, improving profit margins.

5. Expansion into energy storage & hydrogen

NTPC’s investments in green hydrogen and battery storage will future proof its business and open new revenue streams.

Detailed competition analysis for NTPC

Key Financial Metrics – FY 24;

| Company | Revenue(₹ Cr.) | EBITDA(₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PATMargin (%) | P/E (TTM) |

| NTPC | 178500.9 | 51092.7 | 28.62% | 18696.7 | 10.47% | 13.69 |

| Adani Power | 50351.3 | 18180.7 | 36.11% | 20828.8 | 41.37% | 14.53 |

| Tata Power | 61448.9 | 10877.3 | 17.70% | 3102.5 | 5.05% | 29.92 |

| JSW Energy | 11485.9 | 5381.8 | 46.86% | 1708.1 | 14.87% | 43.98 |

| Torrent Power | 27183.2 | 4559.2 | 16.77% | 1896.0 | 6.97% | 28.83 |

Key insights on NTPC

· NTPC has maintained a steady revenue CAGR of 10-12% over the past five years, driven by capacity additions and improved plant efficiency.

· The company operates with stable EBITDA margins of 25-30%, supported by regulated returns on its power generation assets.

· NTPC’s installed capacity exceeds 73 GW, with an ambitious target to reach 130 GW by 2032, ensuring long-term growth visibility.

· It is aggressively expanding its renewable energy portfolio, aiming for 60 GW of non-fossil fuel capacity by 2032, aligning with India’s energy transition goals.

· NTPC maintains a healthy debt-to-equity ratio of ~1.3x, ensuring financial stability while funding expansion plans.

· The company has a strong dividend-paying track record, with a consistent payout ratio of ~40%, reflecting its shareholder-friendly approach.

Financial Performance of NTPC for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 42820.38 | 44696.30 | 45052.82 | 0.8% | 5.2% |

| EBITDA (₹ Cr.) | 11362.15 | 11655.23 | 13667.12 | 17.3% | 20.3% |

| EBITDA Margin (%) | 26.53% | 26.08% | 30.34% | 426 bps | 381 bps |

| Net Profit (₹ Cr.) | 5155.28 | 5274.59 | 5062.51 | -4.0% | -1.8% |

| Net Profit Margin (%) | 12.04% | 11.80% | 11.24% | -56 bps | -80 bps |

| Adjusted EPS (₹) | 5.32 | 5.44 | 5.22 | -4.0% | -1.9% |

NTPC reported a strong quarter, with consolidated net sales at ₹45,053 crore, up 5% YoY and 1% QoQ. Power generation rose 2% YoY and 3% QoQ to 91.3 BU.

EBITDA grew 20% YoY and 17% QoQ to ₹13,667 crore, with margins improving 380 bps YoY to 30.34%, driven by lower other expenses. PAT stood at ₹5,063 crore, down 1.8% YoY and 4% QoQ.

NTPC is targeting 130+ GW capacity by 2032, requiring a ₹7 lakh crore capex, with 24.6 GW set for commissioning between FY25-FY27. Coal production is expected to reach 40 MTPA in FY25 and 67 MTPA by FY29.

The government’s 80 GW thermal expansion plan includes 25 GW from NTPC, with 17.6 GW under construction and approvals for 8 GW in place.

Company valuation insights – NTPC

NTPC is trading at a P/E ratio of 13.69, significantly lower than the industry average of 21.80, making it an attractive value play compared to private power players. Despite steady price appreciation driven by strong earnings growth and renewable expansion, the stock has underperformed Nifty 50, delivering a -3% return YoY against Nifty 50’s 6.7% gain.

The company’s robust thermal assets ensure strong cash flow visibility, while NGEL’s aggressive renewable expansion is expected to unlock additional value. A rerating potential remains if peak power deficits rise, with renewable energy installation pace being a key monitorable.

NTPC aims to achieve 60 GW of renewable energy capacity by 2032, supported by strategic joint ventures and new capacity developments. The listing of NTPC Green Energy Ltd further strengthens its growth trajectory.

Based on SoTP valuation, the target price stands at ₹380, implying a 25% upside potential.

Major risk factors affecting NTPC

· Potential delays in commissioning both thermal and renewable energy projects, impacting capacity expansion plans.

· Dependence on state Discoms for payments, with financial constraints of Discoms posing a risk to NTPC’s trade receivables.

· Declining plant load factor (PLF) and plant availability factor (PAF) in thermal power plants, impacting operational efficiency and profitability.

Technical Analysis of NTPC share

The stock has crossed below its lower Bollinger Band by 0.5%, signalling a potential near-term downtrend. However, a rebound above the lower Bollinger Band could offer a buying opportunity.

The RSI at 36.71 is nearing the oversold zone, suggesting a potential reversal if momentum stabilizes. Meanwhile, the relative strength against the benchmark has weakened (-0.01), indicating slight underperformance.

The trend remains downward, with strong support at 295 near its 52-week low. If the stock rebounds, the first resistance is at 340, and a breakout above this level could push the price towards 380.

The stock is currently trading below its key moving averages, reinforcing a weak technical setup. A strong reversal above 340 is needed to regain bullish momentum.

- RSI: 36.71 (Range Bound)

- ADX: 26.9 (Strong Trend)

- Resistance: 340

- Support: 295

NTPC stock recommendation

Current Stance: Buy with a target price of ₹380 (12-month horizon), implying a 25% upside potential.

Why to Buy Now?

NTPC’s attractive valuation (P/E of 13.69 vs. industry average of 21.80) makes it a compelling investment. The company’s steady earnings growth, robust cash flow from thermal assets, and aggressive expansion into renewables provide long-term visibility. NTPC plans to add 60 GW of renewable capacity by 2032, with NGEL unlocking further value. The listing of NTPC Green Energy Ltd and increasing peak deficits could drive a potential rerating.

Portfolio Fit

NTPC is a strong addition for long-term, stability-focused investors seeking exposure to India’s power sector growth and energy transition. Its stable dividend yield, government backing, and focus on renewable energy make it an ideal fit for portfolios emphasizing utilities, infrastructure, and clean energy transformation.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebNTPC: Budget 2025 – 26 Opportunities

• Higher Capex Allocation: The ₹11.21 lakh crore capital expenditure outlay will support power sector growth, aiding NTPC’s capacity expansion plans.

• Renewable Energy Push: Increased budgetary support for solar, wind, and green hydrogen projects aligns with NTPC’s strategy to expand its RE portfolio.

• Coal Gasification & Cleaner Energy: Government incentives for coal gasification and cleaner thermal energy provide opportunities for NTPC to modernize existing plants and enhance efficiency.

• State-Level Funding Support: ₹1.5 lakh crore interest-free loans to states may drive new power infrastructure projects, benefiting NTPC’s power generation and distribution business.

• FDI in Power Sector: The continued push for FDI in infrastructure, including power generation and transmission, could accelerate NTPC’s partnerships and funding for large-scale projects.