Stock overview

| Ticker | SUNPHARMA |

| Sector | Pharmaceuticals |

| Market Cap | ₹ 3,94,000 Cr |

| CMP (Current Market Price) | ₹ 1,642 |

| 52-Week High/Low | ₹ 1,960/ ₹ 1,377 |

| P/E Ratio | 33.4x |

| Beta | 0.7 (Low volatility) |

About Sun Pharma

Sun Pharmaceutical Industries Ltd is engaged in the business of manufacturing, developing and marketing a wide range of branded and generic formulations and Active Pharma Ingredients (APIs). The company and its subsidiaries has various manufacturing facilities spread across the world with trading and other incidental and related activities extending to global markets It is the largest pharmaceutical company in India.

Primary Growth Factors for Sun Pharma

1. Market leadership & Global reach

- Sun Pharma is India’s largest pharmaceutical company and ranks among the top 10 global generics players.

- Strong presence in over 100 countries, with a growing footprint in the US, Europe, and emerging markets.

- Leading positions in dermatology, ophthalmology, and speciality therapies.

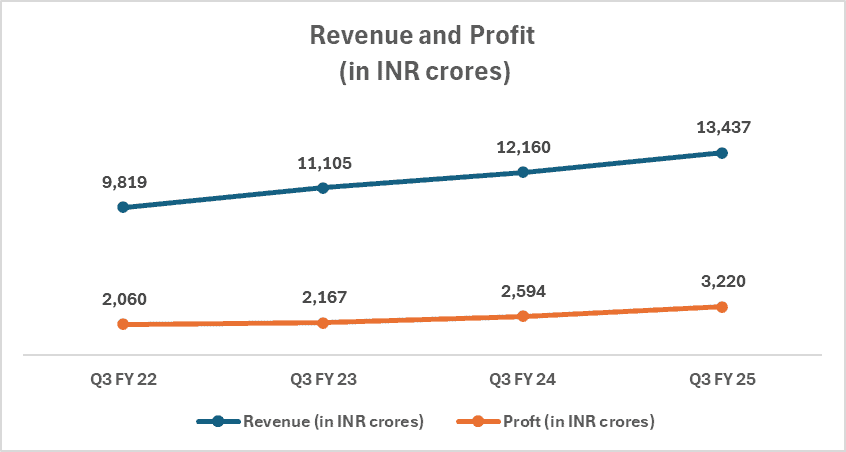

2. Strong Q3 FY25 financial performance

- Revenue: ₹13,436 crore (+10.5% YoY, on an increasing trend YoY for the last 4 years)

- Profit: ₹3,220 crore (+24.1% YoY, on an increasing trend YoY for the last 4 years)

- EBITDA Margin: 29.8% (+120 bps YoY): Indicating strong operational leverage and cost control.

3. Well diversified geographical sales mix

- Sun Pharma’s sales portfolio is well-diversified across India, the US, Emerging Markets and Rest of the World.

- Most of the regions are reporting double-digit growth in terms of revenue which denotes a strong future outlook and relatively lower risk for the future.

- India: 14%

- USA : -1%

- Emerging Markets: 10%

- Rest of the World: 21%

4. Recent strategic acquisitions

- Polaris Biotech (2025): Gaining access to next-gen oncology treatments, enhancing Sun Pharma’s speciality product lineup.

- Taro Pharmaceuticals (2024): Solidifying leadership in the generics dermatology space and expanding US market share.

- Concert Pharmaceuticals (2023): Strengthening Sun Pharma’s dermatology pipeline with innovative treatments for alopecia.

- These acquisitions position Sun Pharma for accelerated growth, boosting its speciality and high-margin product offerings.

Detailed competition analysis for Sun Pharma

| Company | Market Cap | Revenue | P/E | RoCE |

| Sun Pharma | 3,94,000 cr | ₹ 13,436 cr | 33.4x | 17.3% |

| Cipla | 1,19,000 cr | ₹ 7,072 cr | 23.9x | 22.8x |

| Dr Reddy | 96,000 cr | ₹ 8,381 cr | 17.9x | 26.5x |

| Lupin | 87,000 cr | ₹ 5,767 cr | 30.3x | 15.7x |

- Sun Pharma stands out for its higher margins, larger market cap, and stronger global reach.

- Continues to outperform peers in both financial metrics and market expansion.

Company valuation insights – Sun Pharma

From a relative valuation standpoint:

| Company | Sun Pharma | Industry Average |

| P/E | 33.4 x | 28.8 x |

| Price to Book Value | 5.7 x | 3.1 x |

| EV/EBITDA | 23.4 x | 20.5 x |

| Price to Sales | 7.6 x | 6.7x |

- Sun Pharma currently trades at a premium to the overall industry averages.

- At this point, Sun Pharma’s higher valuations are justified by a high market share and strong growth visibility across all revenue segments.

- Any major downside from here on could trigger price correction so investors should keenly watch out for the quarterly performance of the company.

As per discounted cash flow analysis:

Based on the estimates the intrinsic value of Sun Pharma based on expected future cash flows:

- Intrinsic Value Estimate: ₹1,790 per share

- Upside Potential: 10.7%

- WACC: 9.8%

- Terminal Growth Rate: 5%

- Growth drivers:

- New product launches in the US and Europe.

- Expansion in speciality therapies.

- Cost optimizations and operational efficiencies.

Major risk factors affecting Sun Pharma

- Regulatory challenges in the US and other major markets.

- Pricing pressures in the generics segment.

- Currency fluctuations impact international earnings.

Technical analysis of Sun Pharma share

- Trend: Bullish

- Support Levels: ₹1,580 / ₹1,520

- Resistance Levels: ₹1,700 / ₹1,750

- RSI (Relative Strength Index): 62 (Positive momentum, but nearing overbought levels)

- Moving Averages:

- 50-Day MA: ₹1,610

- 200-Day MA: ₹1,490

Sun Pharma is trading above key moving averages, indicating a sustained bullish trend. A breakout above ₹1,700 could signal further upside, while strong support around ₹1,580 provides downside protection.

Sun Pharma stock recommendation

Current Stance: BUY with a 12-month target of ₹1,790.

Rationale:

Market leadership & global reach.

Strong financials and expanding margins.

Deep product pipeline & R&D strength.

Recent acquisitions boosting growth.

Risk-Reward Profile: Moderate risk, high growth potential.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Sun Pharma is a powerhouse in the pharmaceutical industry, with consistent financial strength, global market dominance, and a promising product pipeline. The stock remains undervalued relative to its global peers, with ample room for growth as it continues to innovate and expand worldwide.