A company that plays a crucial role in multiple industries, from construction to automobiles, packaging to furniture, and yet, remains a quiet compounder of wealth. Enter Supreme Industries, a pioneer in India’s plastic processing industry, known for its innovation, diverse product portfolio, and consistent growth. Whether you are an investor eyeing steady compounders or an industry enthusiast tracking market leaders, Supreme Industries presents an intriguing case study.

Let’s break down its business model, growth catalysts, and investment insights.

Stock overview

| Ticker | SUPREMEIND |

| Industry/Sector | Plastic Products (Industrial) |

| Market Cap (₹ Cr.) | 41,836 |

| Free Float (% of Market Cap) | 50.90% |

| 52 W High/Low | 6460.00 / 3270.00 |

| P/E | 41.15 (Vs Industry P/E of 35.61) |

| EPS (TTM) | 80.44 |

About Supreme Industries Ltd.

Supreme Industries Limited, founded in 1942, is a prominent player in India’s plastics industry. It is the largest plastics processor in the country, producing a wide range of plastic products including Moulded Furniture, Storage & Material Handling Products, Films, Industrial Moulded Products, Packaging Products, Composite Plastic Products, Plastic Piping System, and Petrochemicals.

Key business segments

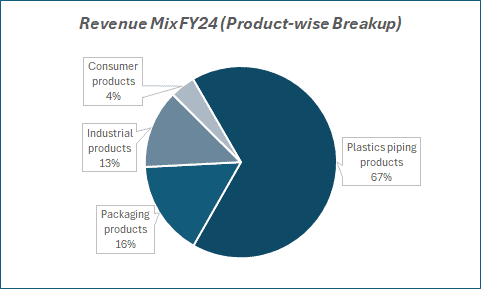

Supreme Industries Ltd. operates primarily in the following key business segments:

- Plastic piping (67%) – Largest segment, includes uPVC, CPVC, HDPE pipes, and fittings.

- Packaging (16%) – Flexible films, protective packaging, and cross-laminated films, driven by demand from dairy and edible oil industries.

- Industrial (13%) – Includes material handling systems, pallets, and composite LPG cylinders, catering to automotive and agriculture sectors.

- Consumer (4%) – Molded plastic furniture; second-largest player with a 30,000 MT capacity.

Primary growth factors for Supreme Industries Ltd.

Supreme Industries Ltd.’s key growth drivers:

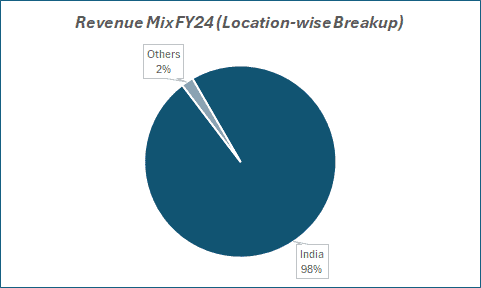

- Diversified portfolio – Operates across plastic piping, consumer packaging, and industrial products, ensuring revenue stability.

- Capacity expansion – Investing in new plants, automation, and logistics to enhance efficiency and reduce costs.

- Govt. Infra Push – Benefits from ‘Har Ghar Jal,’ Smart Cities, and PM Awas Yojana, driving demand for plastic pipes.

- Tier 2 & 3 City Growth – Rising urbanization boosts demand for affordable, durable plastic products.

- Financial Resilience – Despite weak Q3FY24 due to PVC price impact, strong balance sheet and government infra spending to drive FY25 growth.

Detailed competition analysis for Supreme Industries Ltd.

Key financial metrics – FY 24;

| Company | Revenue(₹ Cr.) | EBITDA Margin (%) | PAT Margin (%) | ROE % | ROCE % | P/E (TTM) |

| Supreme Industries | 10134.26 | 15.27% | 9.50% | 22.49% | 29.89% | 41.15 |

| Astral Ltd. | 5641.40 | 16.28% | 9.67% | 18.52% | 25.13% | 69.38 |

| Finolex Industries | 4317.43 | 13.55% | 10.08% | 8.99% | 12.00% | 14.11 |

| Prince Pipes & Fittings | 2568.75 | 11.97% | 7.10% | 12.55% | 16.25% | 39.30 |

Key insights on Supreme Industries Ltd.

- Revenue CAGR of 13% over 5 years and 17% over 3 years, driven by diversified product segments.

- EBITDA margins consistently between 15%-20%, reflecting strong cost control.

- Profit CAGR of 21% over the last 5 years, supported by steady demand.

- Debt-free with a strong balance sheet, ensuring financial stability.

- Healthy dividend payout ratio of 35.1%, showcasing strong cash flow.

- Working capital cycle improved from 38.5 days to 30.3 days, enhancing liquidity.

- Strong return ratios with ROE at 22% and ROCE at 30%, ensuring efficient capital utilization.

Recent financial performance of Supreme Industries Ltd. for Q3 FY25

| Metric | Q3 FY24 | Q2 FY25 | Q3 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2449.10 | 2272.95 | 2509.88 | 10.42% | 2.48% |

| EBITDA (₹ Cr.) | 378.84 | 319.23 | 308.82 | -3.26% | -18.48% |

| EBITDA Margin (%) | 15.47% | 14.04% | 12.30% | -174 bps | -317 bps |

| PAT (₹. Cr.) | 235.35 | 178.79 | 165.01 | -7.71% | -29.89% |

| PAT Margin (%) | 9.61% | 7.87% | 6.57% | -130 bps | -304 bps |

| Adjusted EPS (₹) | 20.16 | 16.26 | 14.72 | -9.47% | -26.98% |

Supreme Industries Ltd. financial update (Q3 FY25)

Financial performance:

- Revenue increased modestly by 2.48% YoY to ₹2,509.88 crore.

- Net profit declined 29.89% YoY to ₹165.01 crore from ₹235.35 crore in Q3 FY24.

Operational highlights:

- Sales volume grew by 3% YoY to 1,62,733 MT, with net product turnover rising to ₹2,488 crore (+2% YoY).

- Value-added product turnover increased by 13% YoY to ₹961 crore (vs. ₹853 crore in Q3 FY24).

- Weak demand in the agri and housing sectors, with agri demand impacted by an extended monsoon.

- Plastic pipe systems growth was affected by adverse PVC resin price movements and subdued infrastructure demand.

Outlook:

- Management expects EBITDA margins of ~13.5%-14% for FY25.

- Planned capex of ₹1,500 crore, with ₹1,000 crore to be funded entirely through internal accruals.

- 9M FY25 capex stood at ₹718 crore.

- Annual capacity at 8,20,000 MT as of December 2024; post-expansion, piping system capacity to reach 9,00,000 MT by FY25-end.

Company valuation insights – Supreme Industries Ltd.

Supreme Industries trades at a TTM P/E of 41.15, above the industry average of 35.61, with a -18.3% 1Y return vs. the Nifty 50’s 3.3%. The company is poised for a gradual demand recovery in the piping segment, supported by increased government spending, strong real estate activity, and infrastructure growth.

With a diversified product portfolio, market share gains, and healthy margins, Supreme Industries maintains a strong long-term outlook. A debt-free balance sheet and improving working capital cycle further enhance its financial strength.

Applying a 36x multiple to FY26E EPS of ₹105, we derive a target price of ₹3,780, implying a 15% upside.

Major risk factors affecting Supreme Industries Ltd

- Raw material volatility: Dependence on crude-based inputs like PVC and polypropylene makes margins vulnerable to price swings.

- Logistics & Demand cyclicality: Delays in transportation and cyclical demand in construction and agriculture can impact sales.

- Competitive pressure: Intense competition from both organized and unorganized players may affect pricing power and market share.

- Regulatory risks: Stricter environmental policies on plastic usage and recycling could increase compliance costs or impact product lines.

Technical analysis of Supreme Industries Ltd. share

Supreme Industries is trading in a descending channel, near its 52-week low and the channel base at ₹3,270, which may act as strong support. The stock is currently below all key moving averages but is approaching its 50-day moving average, a breakout above which could indicate a potential trend reversal.

The MACD remains negative, but the MACD line is above the signal line with positive histograms, signaling a possible rebound. The RSI is at 45.68, indicating a neutral stance, while the relative RSI has improved by 0.04 in the last 3 days, suggesting slight outperformance against its benchmark. The ADX at 27.44 reflects a strong trend.

If the stock sustains above its immediate resistance of ₹3,580, it could move towards the target price of ₹3,780. On the downside, ₹3,270 remains a crucial support level.

- RSI: 45.68 (Neutral)

- ADX: 27.44 (Trending)

- Resistance: ₹3,580

- Support: ₹3,270

Supreme Industries Ltd. stock recommendation

Current Stance: Buy with a target price of ₹3,780 (12-month horizon); Supreme Industries’ strong market positioning, demand recovery in the piping segment, and healthy financials support long-term growth.

Why Buy Now?

Demand revival: Increased government spending on infrastructure and real estate recovery to drive piping segment growth.

Market leadership: Strong brand positioning and continuous market share gains vs. peers.

Margin stability: EBITDA margins remain resilient at ~15-20%, supported by pricing power and operational efficiencies.

Debt-Free growth: Robust balance sheet and improving working capital cycle enhance financial stability.

Value-Added products: Growing contribution from higher-margin value-added products to support profitability.

Portfolio Fit:

Supreme Industries is a market leader in plastic products with a strong track record of profitability, efficient capital allocation, and sustained growth potential. It is an ideal choice for investors seeking exposure to India’s long-term infrastructure and consumption growth themes.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebSupreme Industries Ltd: Budget 2025-26 opportunities

- Jal Jeevan Mission: The government’s continued push for universal water supply coverage under the Jal Jeevan Mission is expected to boost demand for PVC and HDPE pipes, benefiting Supreme Industries’ piping segment.

- Income Tax Relief: Raising the income tax threshold to ₹12 lakh enhances middle-class spending power, driving demand for plastic furniture and consumer goods.

- Manufacturing Sector Growth: The National Manufacturing Mission aims to strengthen domestic production, increasing demand for protective and flexible plastic packaging solutions.

- Infrastructure Development: A ₹11.21 lakh crore capital outlay for infrastructure projects will drive demand for material handling solutions like crates and pallets, supporting logistics and construction sectors.

Final thoughts

Imagine you’re standing in a newly built home. The plumbing? Supreme. The water tank? Supreme. The protective packaging for appliances? Supreme. The industrial components inside your car? Probably Supreme. This silent player is embedded in every aspect of our daily lives, yet remains underappreciated.

With strong financials, a well-diversified business, and long-term growth tailwinds, Supreme Industries is not just another stock – it’s a compounding story in the making.